Gold failed to break out of the current range in either direction despite the Fed raising interest rates for the first time in 9 years. Trading in gold could be choppy as the markets wind down towards the holiday period and the end of the year, but the range will provide some opportunities.

The US Federal Reserve dominated the headlines last week as they raised interest rates by 25 basis points for the first time in 9 years. The move was largely expected, and there was nothing in the accompanying statement to shock the market. The Fed has done well to manage the market's expectations correctly, meaning there were no devastating swings on the day.

The Fed has indicated they will very much take a data driven approach to interest rates in the months ahead. The have made it clear that rate rises will come "in a prudential, gradual manner" which is why gold has not been heavily sold off. Interestingly, Yellen said that wages have yet to show sustained pick up and that some cyclical weakness remains in the labour market, suggesting it may not be as robust as the Fed has previously made it out to be. A strong Unemployment claims at the end of the week indicates the labour market is performing well enough.

This week has seen US GDP and existing home sales figures released. GDP growth remained solid at an annualised rate of 2.0% for the third quarter which is slightly better than the market was expecting. US existing home sales disappointed at 4.8m, down from 5.4m the previous month. The strong GDP result was enough to see gold reject off the top of the range, but the home sales result limited the downside.

The rest of the week will relatively busy with core durable goods orders, consumer sentiment, new home sales and unemployment claims all due. Watch for choppy trading on light volumes as the markets wind down to Christmas and the end of the year.

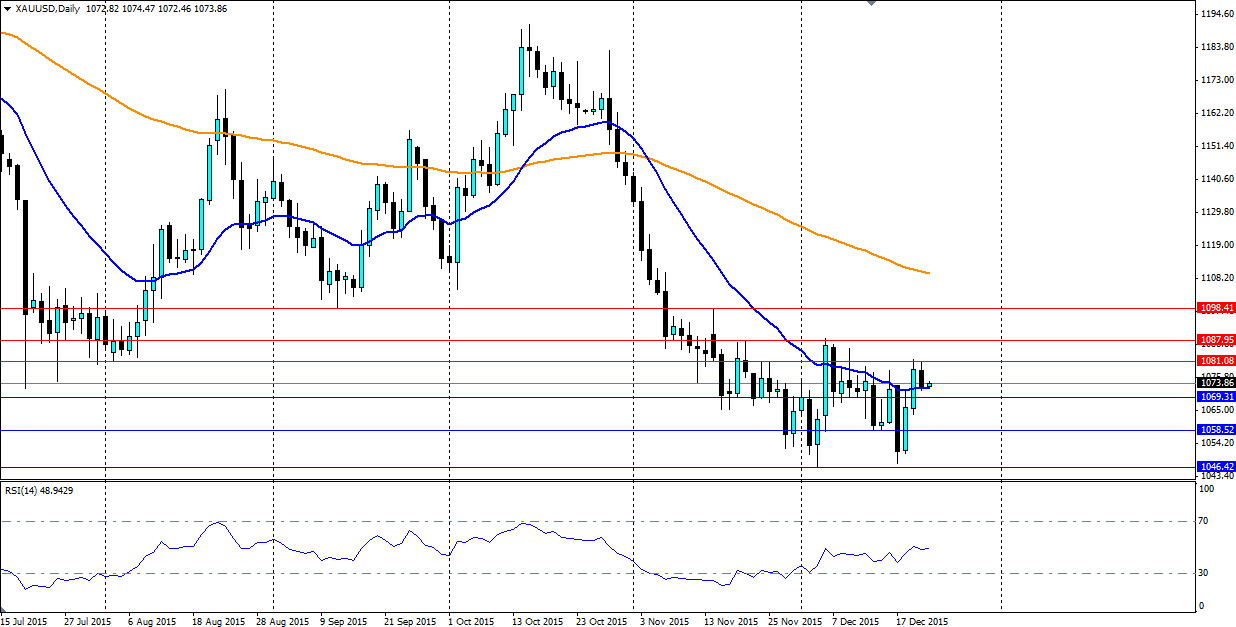

Technicals show gold respecting the range it has found at the bottom of the bearish trend. The range has remained largely intact with tests of both the bottom and the top in recent days. The range will most likely stay in play over the next few weeks as volumes dry up, but the trading could turn choppy. Look for support at 1069.31, 1058.52 and the bottom of the range at 1046.42. Resistance is found at 1081.08, 1087.95 and 1098.41.