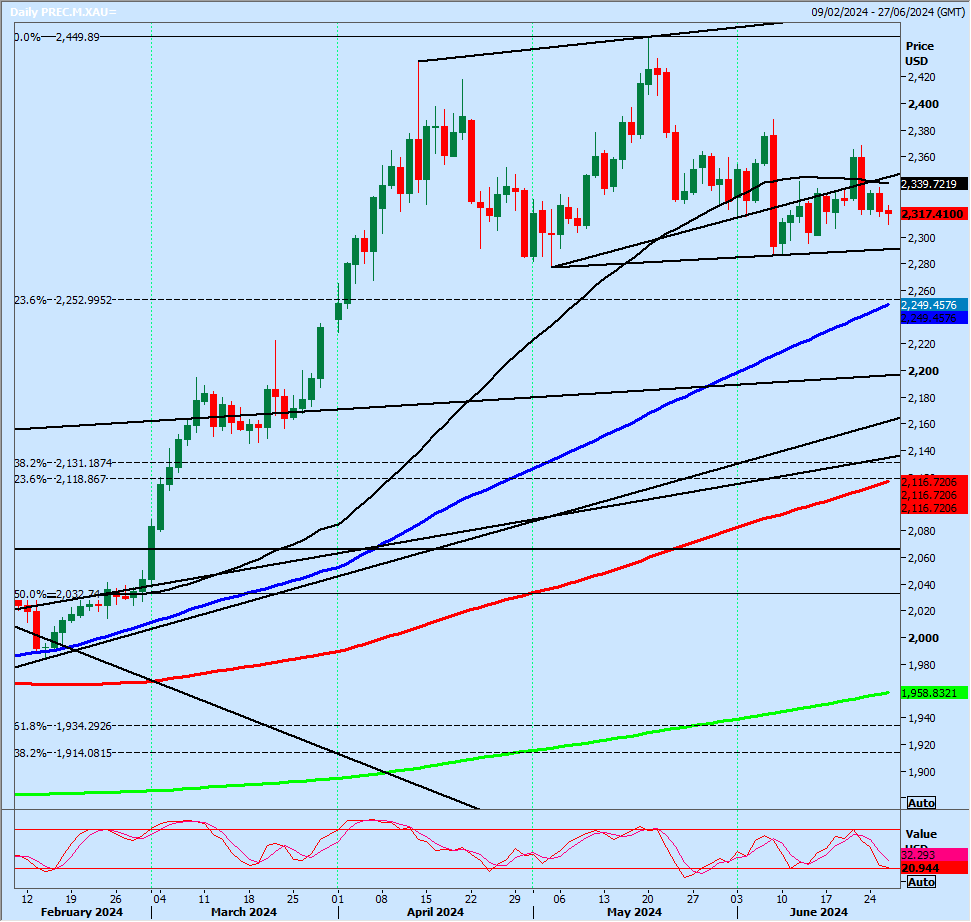

Gold

Gold (XAU/USD) remains stuck in a sideways consolidation with little movement yesterday.

The market moves up one day, and down the next day in a sideways trend for 2 weeks.

However, shorts at resistance at 2335/40 worked perfectly with a high for the day exactly here before prices turned lower to my 3 targets of 2325, 2320, and 2315 for profit taking.

We caught the exact high and low for the day we simply cannot do any better!! - especially in such difficult conditions.

If you want to try selling this level again today, stop above 2345.

A break higher can target 2345/50 and perhaps as far as 2365/70.

A break below 2312 today is likely to signal further losses towards 2307/05 and perhaps as far as 2298/95.

Silver

Silver (XAG/USD) is in a 4-month bull trend and will remain so if we hold on to support at 2915/2895 this week.

If you want to gamble on a long here, stop loss below 2875.

Targets: 2940, 2970, 3000.

However, a break below 2875 could be a sell signal targeting 2850 and 2810/2800.

We should meet resistance at 3010/3030 and shorts need stops above 3040.

Targets: 2970, 2940.

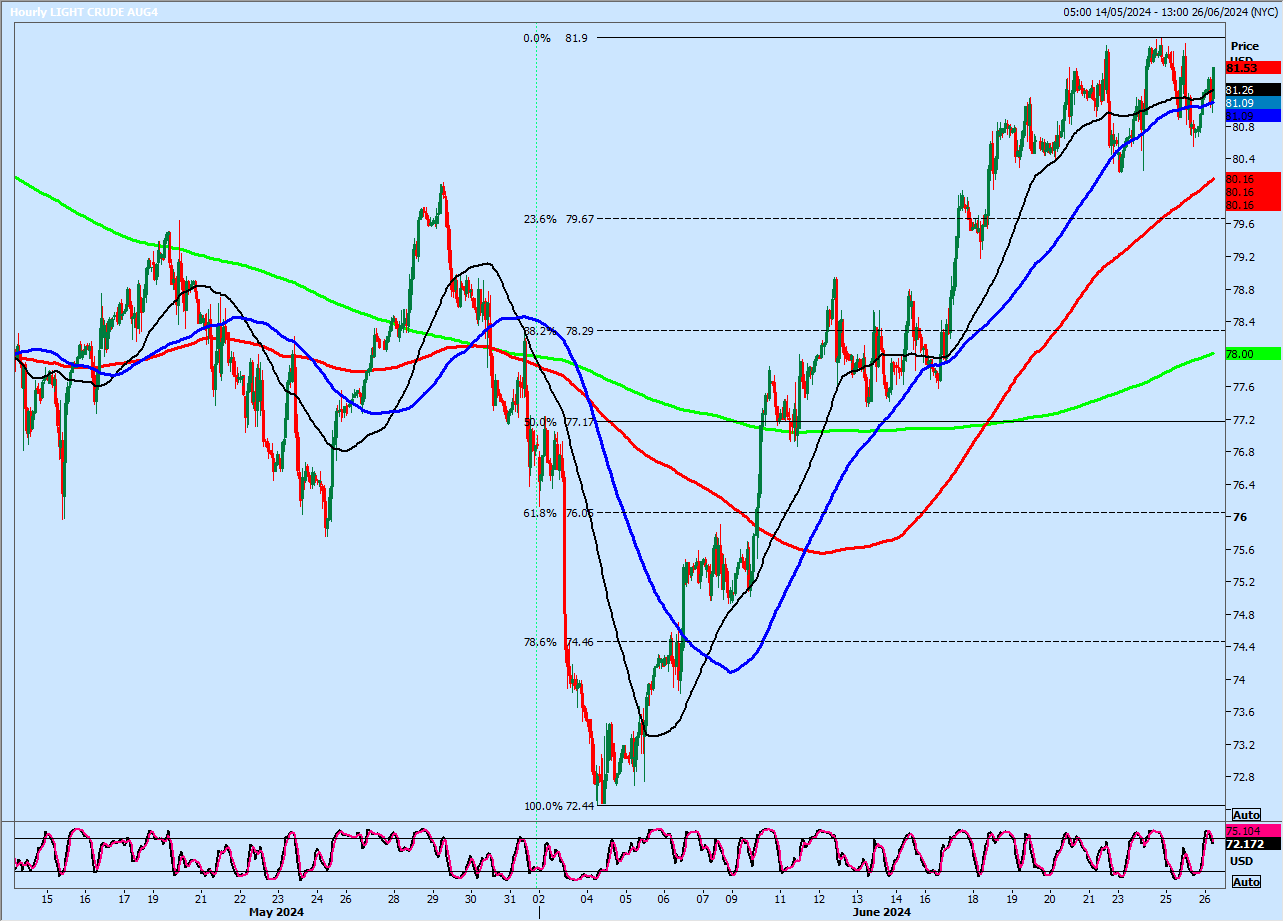

WTI Crude August Future

Last session low and high for the AUGUST contract: 8023 - 8178.

WTI Crude August is up one day, and down the next day in the 4-day sideways trend as we head back towards support at 8030/8000.

Longs need stops below 7940.

Targets: 8080, 8120, 8170

A break lower could be a sell signal targeting 7840/7800.