Sell-Side Analysts Tripping Over Each Other With Bearish Pronouncements

While the debt ceiling farce is playing out, a full court press against gold has become visible in the media (once again), with mainstream sell-side analysts trying to out-bear each other. Never mind that not one of them told people to buy gold when the bull market started – in fact, they were for the most part completely silent until it moved above the $1,500 level, at which time they all turned bullish. Having done their clients the favor of telling them to buy high, they are now apparently quite eager to advise them to sell low.

We have previously remarked that rising gold prices are not in the interest of the fractionally reserved banking cartel, which requires faith in the State’s confetti to remain strong. Since rising gold prices inter alia indicate that this faith is crumbling, both banks and governments have a vested interest in not seeing gold rally.

We are however not necessarily alleging here that the individual analysts making these calls are acting in order to defend these vested interests. Rather, we think most (but not all) of them simply don’t understand the gold market and that their arguments are simply in error. Mind, we have no opinion on whether their price forecasts will or won’t turn out to be correct, we are just saying that they are throwing darts. If they turn out to be right, it will be for the wrong reasons.

We will focus on some reasoning that strikes us as especially misguided. Here is the view from Goldman Sachs, apparently seconded by Credit Suisse:

“Gold, set for its first annual loss in 13 years, is a “slam dunk” sell for next year because the U.S. Economy will extend its recovery after lawmakers resolve stalemates over the nation’s budget and debt ceiling, Goldman Sachs Group Inc.’s Jeffrey Currie said.

The bank has a target for gold prices next year at $1,050 an ounce, Currie, Goldman Sachs’s head of commodities research, said today on a panel in London. The precious metal has tumbled 21 percent this year to $1,322.28 an ounce on speculation that the Federal Reserve would reduce its $85 billion monthly bond-buying program, known as quantitative easing, as the economy recovers.Lawmakers probably will reach an agreement on raising the debt ceiling before the Oct. 17 deadline, Currie said.

“Once we get past this stalemate in Washington, precious metals are a slam dunk sell at that point,” Currie said. “You have to argue that with significant recovery in the U.S., tapering of QE should put downward pressure on gold prices.”

Currie and Ric Deverell, the head of commodities research at Credit Suisse AG, both said on a panel at the Commodities Week conference in London today that selling gold is their top recommendation for trading in raw materials in the next year.”

(emphasis added)

We should perhaps point out the glaringly obvious here because it seems Mr. Currie hasn’t noticed: all that ‘speculation’ about the ‘end of QE’ and even a mere ‘tapering’ has so far turned out to be 100% wrong. It was not possible to make a more incorrect forecast on this issue than Goldman Sachs and other mainstream banks have so far made. We would remind here that the Fed has been mumbling about ‘exit strategies’ since 2009 and has instead vastly increased its ‘QE’ programs. Meanwhile, since ‘QE to infinity’ has so far not helped gold to rally, why should a slight deceleration thereof mean anything?

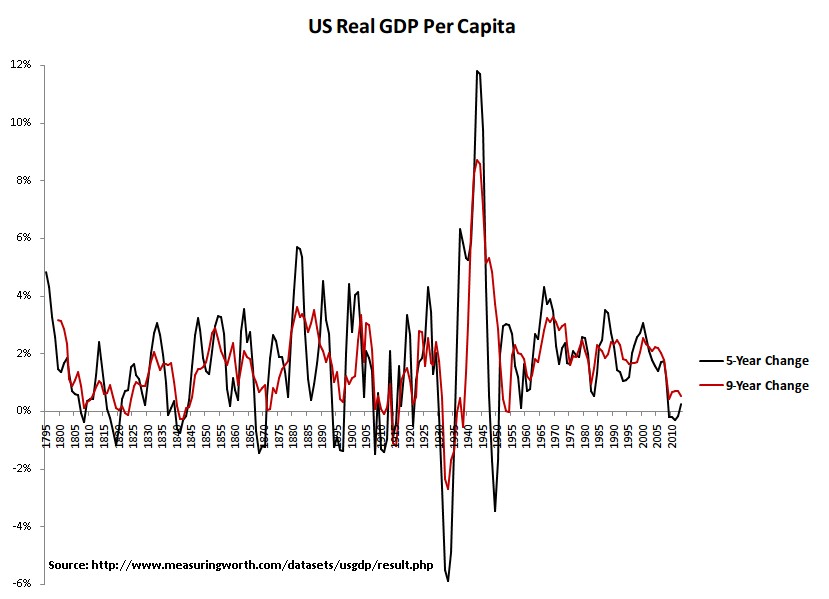

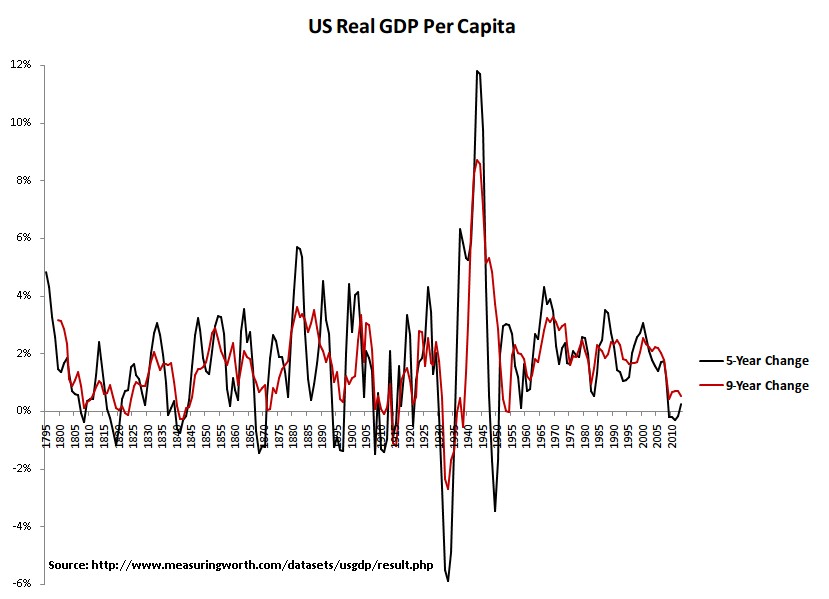

As to the ‘US recovery’ – it remains a sorry sight indeed.

Then there is this idea that all that is holding gold up at present is the ‘debt ceiling’ stalemate. We would note to this that gold has actually not rallied so far on the budget stalemate, precisely because there is a broad consensus (Mr. Currie’s view reflects the consensus thinking) that nothing untoward can possibly happen, that we ‘will soon get past this’ and so forth. Maybe so. As we have noted, these budget impasses have occurred many times in the past and have never amounted to much. It is usually nothing but an exercise in political grandstanding.

However, one must also keep in mind that many members of the tea party faction are acting based on principles and deeply held convictions. So this time, the fight may be of a different nature. However, to forecast that there willeventually be a ‘resolution’ is not exactly a great feat.

One is tempted to ask though why the gold market should be negatively affected by a decision that allows the government to simply continue to spend with both hands. The opposite has historically been the case – gold prices have often tended to follow increases in the debt ceiling.

We cannot deny that gold has been in a cyclical bear market since the 2011 peak and that it remains debatable where and when this bear market will end. However, it appears to us that most of the euro debt crisis related premium has come out of gold’s price and that leaves us with pondering other fundamentals.

Here we see a recent increase in the yield curve spread, vastly overvalued junk bonds (liable to lead to a reversal in credit spread trends), administered interest rates that remain deeply negative in real terms, and the most reckless central bank policies of the entire post WW2 period, so far with very little to show for them.

The embarrassingly weak recovery in aggregated economic data after literally trillions in new money have been thrown at the economy by central bank printing presses and deficit spending tells us only one thing about the true state of the economy: it is horrendous. Capital consumption always looks like ‘good times’ while it is occurring of course, so even if these data were to look better than they do, one could not possibly conclude that a sustainable economic expansion was underway. Let us not forget, the housing bubble was also mistaken for a sustainable expansion by all the usual suspects.

We Can Have it Both Ways

If we look around further, we find that while Mr. Currie thinks gold will decline because there will be a ‘recovery’. JP Morgan’s analysts believe the exact opposite: it will decline because there won’t be a recovery. So according to these worthies there exists no economic environment at all that could be considered bullish for gold.

There is a long list of bears joining GS and Credit Suisse in the article we are linking to above, so one thing that is immediately apparent is that this bearish outlook is currently the consensus. However, we want to look at the argument forwarded by JPM’s analyst because it strikes us as especially misguided:

“The investment case for gold relies on the expectation of rising inflation,” says analysis from investment bank and bullion market-maker J.P.Morgan, “which in turn relies on growth.

“Yet the US shutdown is damaging US growth, both in direct terms through the furlough of 800,000 government employees and through a host of indirect channels.”

(emphasis added)

First of all, allow us to point out that since government merely redistributes resources, a cessation or diminution in government spending cannot possibly be a negative for actual growth. It will show up as such in the statistics of course, but that is mainly an artifact of how these statistics are constructed.

The most glaring error however is the belief that ‘inflation depends on growth’. This is hair-raising nonsense, even keeping in mind that what they mean by ‘inflation’ is only one of its possible effects, namely rising prices of consumer goods.

Just consider what economic growth actually is: it is an increase in the production of goods and services. So according to JPM, when more of something is produced, its price will rise! The ‘stagflation’ of the 1970s should have once and for all laid such debates to rest, but apparently it hasn’t.

In fact, an economy can almost come to a standstill and the money issued by the State can still continue to decline in purchasing power. This was last seen during Zimbabwe’s hyperinflation. Since much of the country’s industry no longer had access to complementary capital goods that needed to be imported, a lot of it simply stopped operating. Growth collapsed, but that did absolutely nothing to arrest the decline in the value of the currency.

Such confusion comes about precisely because the true meaning of the term ‘inflation’ has been lost and replaced with one of its effects.

Lastly we would note to all this that the long term negative effects of the massive monetary inflation since the 2008 crisis have yet to materialize. Once they do, gold prices are likely to soar and it is to be expected that the market will actually discount this to some extent in advance. Whether gold will first fall to $1,000 or rise from where it is now we cannot know (and neither can any of the recently suspiciously overconfident bears, unless they have access to the crystal ball of the Mighty Zoltar). However, we are always intrigued when such a broad consensus develops. It reminds us a bit of the bearish consensus on bonds, which prevailed through the entire second half of their bull market.

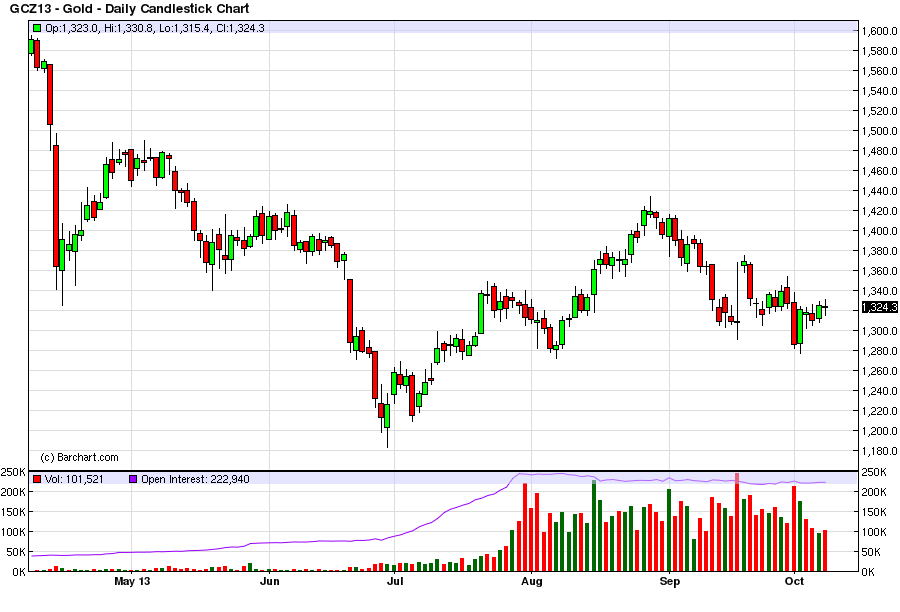

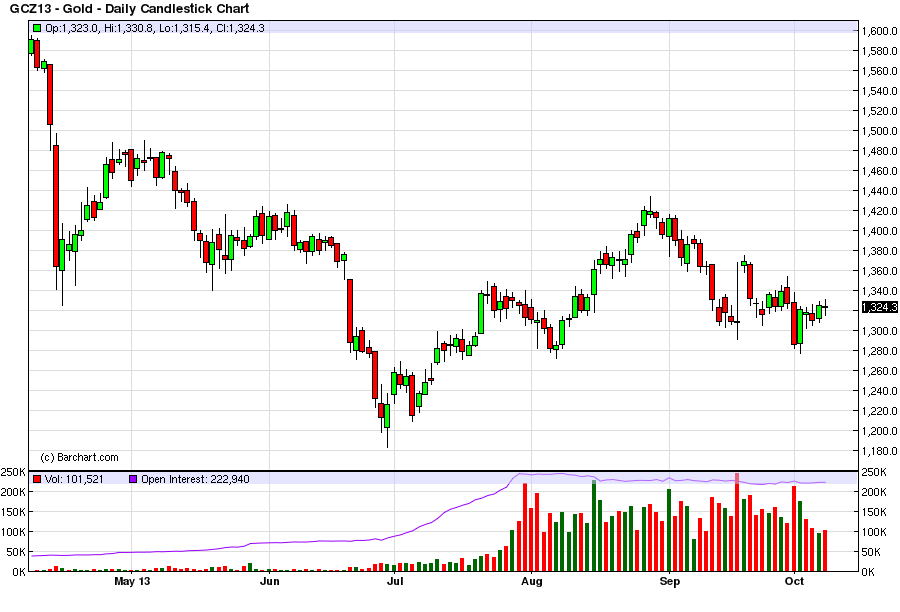

Technically, gold remains in ‘neutral’ territory for now:

Gold, December contract, daily. There is short term support near $1,275, medium term support at around $1,180 and short term resistance at $1,350 and $1,430. Gold therefore remains in neutral territory for now – via BarCharts.

While the debt ceiling farce is playing out, a full court press against gold has become visible in the media (once again), with mainstream sell-side analysts trying to out-bear each other. Never mind that not one of them told people to buy gold when the bull market started – in fact, they were for the most part completely silent until it moved above the $1,500 level, at which time they all turned bullish. Having done their clients the favor of telling them to buy high, they are now apparently quite eager to advise them to sell low.

We have previously remarked that rising gold prices are not in the interest of the fractionally reserved banking cartel, which requires faith in the State’s confetti to remain strong. Since rising gold prices inter alia indicate that this faith is crumbling, both banks and governments have a vested interest in not seeing gold rally.

We are however not necessarily alleging here that the individual analysts making these calls are acting in order to defend these vested interests. Rather, we think most (but not all) of them simply don’t understand the gold market and that their arguments are simply in error. Mind, we have no opinion on whether their price forecasts will or won’t turn out to be correct, we are just saying that they are throwing darts. If they turn out to be right, it will be for the wrong reasons.

We will focus on some reasoning that strikes us as especially misguided. Here is the view from Goldman Sachs, apparently seconded by Credit Suisse:

“Gold, set for its first annual loss in 13 years, is a “slam dunk” sell for next year because the U.S. Economy will extend its recovery after lawmakers resolve stalemates over the nation’s budget and debt ceiling, Goldman Sachs Group Inc.’s Jeffrey Currie said.

The bank has a target for gold prices next year at $1,050 an ounce, Currie, Goldman Sachs’s head of commodities research, said today on a panel in London. The precious metal has tumbled 21 percent this year to $1,322.28 an ounce on speculation that the Federal Reserve would reduce its $85 billion monthly bond-buying program, known as quantitative easing, as the economy recovers.Lawmakers probably will reach an agreement on raising the debt ceiling before the Oct. 17 deadline, Currie said.

“Once we get past this stalemate in Washington, precious metals are a slam dunk sell at that point,” Currie said. “You have to argue that with significant recovery in the U.S., tapering of QE should put downward pressure on gold prices.”

Currie and Ric Deverell, the head of commodities research at Credit Suisse AG, both said on a panel at the Commodities Week conference in London today that selling gold is their top recommendation for trading in raw materials in the next year.”

(emphasis added)

We should perhaps point out the glaringly obvious here because it seems Mr. Currie hasn’t noticed: all that ‘speculation’ about the ‘end of QE’ and even a mere ‘tapering’ has so far turned out to be 100% wrong. It was not possible to make a more incorrect forecast on this issue than Goldman Sachs and other mainstream banks have so far made. We would remind here that the Fed has been mumbling about ‘exit strategies’ since 2009 and has instead vastly increased its ‘QE’ programs. Meanwhile, since ‘QE to infinity’ has so far not helped gold to rally, why should a slight deceleration thereof mean anything?

As to the ‘US recovery’ – it remains a sorry sight indeed.

Then there is this idea that all that is holding gold up at present is the ‘debt ceiling’ stalemate. We would note to this that gold has actually not rallied so far on the budget stalemate, precisely because there is a broad consensus (Mr. Currie’s view reflects the consensus thinking) that nothing untoward can possibly happen, that we ‘will soon get past this’ and so forth. Maybe so. As we have noted, these budget impasses have occurred many times in the past and have never amounted to much. It is usually nothing but an exercise in political grandstanding.

However, one must also keep in mind that many members of the tea party faction are acting based on principles and deeply held convictions. So this time, the fight may be of a different nature. However, to forecast that there willeventually be a ‘resolution’ is not exactly a great feat.

One is tempted to ask though why the gold market should be negatively affected by a decision that allows the government to simply continue to spend with both hands. The opposite has historically been the case – gold prices have often tended to follow increases in the debt ceiling.

We cannot deny that gold has been in a cyclical bear market since the 2011 peak and that it remains debatable where and when this bear market will end. However, it appears to us that most of the euro debt crisis related premium has come out of gold’s price and that leaves us with pondering other fundamentals.

Here we see a recent increase in the yield curve spread, vastly overvalued junk bonds (liable to lead to a reversal in credit spread trends), administered interest rates that remain deeply negative in real terms, and the most reckless central bank policies of the entire post WW2 period, so far with very little to show for them.

The embarrassingly weak recovery in aggregated economic data after literally trillions in new money have been thrown at the economy by central bank printing presses and deficit spending tells us only one thing about the true state of the economy: it is horrendous. Capital consumption always looks like ‘good times’ while it is occurring of course, so even if these data were to look better than they do, one could not possibly conclude that a sustainable economic expansion was underway. Let us not forget, the housing bubble was also mistaken for a sustainable expansion by all the usual suspects.

We Can Have it Both Ways

If we look around further, we find that while Mr. Currie thinks gold will decline because there will be a ‘recovery’. JP Morgan’s analysts believe the exact opposite: it will decline because there won’t be a recovery. So according to these worthies there exists no economic environment at all that could be considered bullish for gold.

There is a long list of bears joining GS and Credit Suisse in the article we are linking to above, so one thing that is immediately apparent is that this bearish outlook is currently the consensus. However, we want to look at the argument forwarded by JPM’s analyst because it strikes us as especially misguided:

“The investment case for gold relies on the expectation of rising inflation,” says analysis from investment bank and bullion market-maker J.P.Morgan, “which in turn relies on growth.

“Yet the US shutdown is damaging US growth, both in direct terms through the furlough of 800,000 government employees and through a host of indirect channels.”

(emphasis added)

First of all, allow us to point out that since government merely redistributes resources, a cessation or diminution in government spending cannot possibly be a negative for actual growth. It will show up as such in the statistics of course, but that is mainly an artifact of how these statistics are constructed.

The most glaring error however is the belief that ‘inflation depends on growth’. This is hair-raising nonsense, even keeping in mind that what they mean by ‘inflation’ is only one of its possible effects, namely rising prices of consumer goods.

Just consider what economic growth actually is: it is an increase in the production of goods and services. So according to JPM, when more of something is produced, its price will rise! The ‘stagflation’ of the 1970s should have once and for all laid such debates to rest, but apparently it hasn’t.

In fact, an economy can almost come to a standstill and the money issued by the State can still continue to decline in purchasing power. This was last seen during Zimbabwe’s hyperinflation. Since much of the country’s industry no longer had access to complementary capital goods that needed to be imported, a lot of it simply stopped operating. Growth collapsed, but that did absolutely nothing to arrest the decline in the value of the currency.

Such confusion comes about precisely because the true meaning of the term ‘inflation’ has been lost and replaced with one of its effects.

Lastly we would note to all this that the long term negative effects of the massive monetary inflation since the 2008 crisis have yet to materialize. Once they do, gold prices are likely to soar and it is to be expected that the market will actually discount this to some extent in advance. Whether gold will first fall to $1,000 or rise from where it is now we cannot know (and neither can any of the recently suspiciously overconfident bears, unless they have access to the crystal ball of the Mighty Zoltar). However, we are always intrigued when such a broad consensus develops. It reminds us a bit of the bearish consensus on bonds, which prevailed through the entire second half of their bull market.

Technically, gold remains in ‘neutral’ territory for now:

Gold, December contract, daily. There is short term support near $1,275, medium term support at around $1,180 and short term resistance at $1,350 and $1,430. Gold therefore remains in neutral territory for now – via BarCharts.