I sometimes bristle at the hype that emanates from the precious metals sphere coming in the form of gold bug doctrine, perma-cheerleading, lecturing, and rigid thinking. That is because like it or not, the macro is always shifting and doctrine or not, the macro shifted away from the precious metals in 2012 and only began recovering a gold-positive view in 2018. Since then it’s been a volatile process with incomplete macro fundamentals.

Incomplete, but now turning to the preferred macro that a gold bull would want to see and a stock bull would not want to see. Let’s be clear, “turning” is not “turned”. It is not complete, but our view of transition is being proven out slowly and now, methodically.

I still have a personal question as to whether the forces of bubble-making (now in their 3rd decade by my estimation) can hold ‘er together to and through the presidential election. But we don’t need to have the answer to that question. We need to manage risk and respect market signals and TA.

Gold

Here is the thing; gold to me is an indicator as much as it is a monetary value retainer and risk manager. I disregard views of gold as some kind of play; as a market among other markets. Gold miners are a play; a play on the asset that stands outside of the Keynesian debt/leverage system as the anti-bubble.

When anti-bubble forces become too strong and the ‘bust’ end of the boom/bust cycle ensues, the gold miners should leverage the relative performance of gold to the speculative upside based on positive leverage, just as they have chronically under-performed due to negative leverage during intense bubble phases.

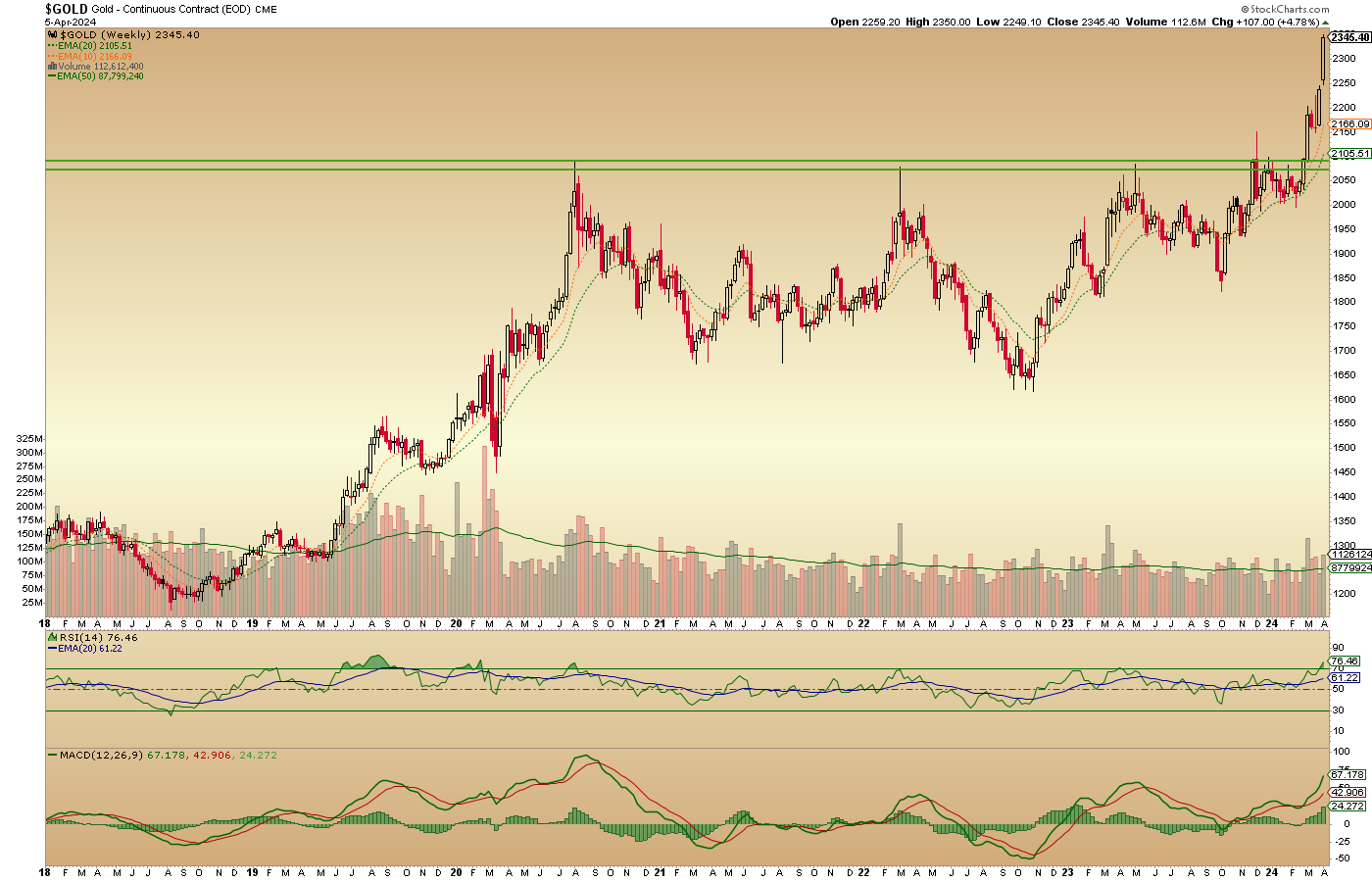

Getting off the idealist views and back to the technical view, gold’s weekly chart is purely bullish. The pattern of this chart targets 2450. This is a purely bullish breakout to blue sky.

The monthly chart advises the target of the large Cup and Handle, which has been fashioned over 10 years of pain and pleasure. The max pleasure point had been the 2020 high, from which the Cup made its higher right side high. After that, the smaller pattern did its thing.

You see weekly and monthly RSI flirting with overbought status (as is the daily), but let’s discuss this for a moment. Traders will watch that stuff. But investors should realize how long gold stayed overbought during the hard-up phases of the previous bull market (2005-2011) and the first-up phase of this bull market (2019-2020). I’ve shaded those instances.

The thing is, an overbought market is a sign of a bullish market. I, who have held the metal since 2002, would not trade it (unlike the miners). But traders would do whatever the hell they will with GLD (NYSE:GLD) and other bullion holders/price trackers. As we’ve been noting for months now, gold is bullish on all time frames, with the daily finally joining the weekly and monthly in that status back in Q4, 2023.