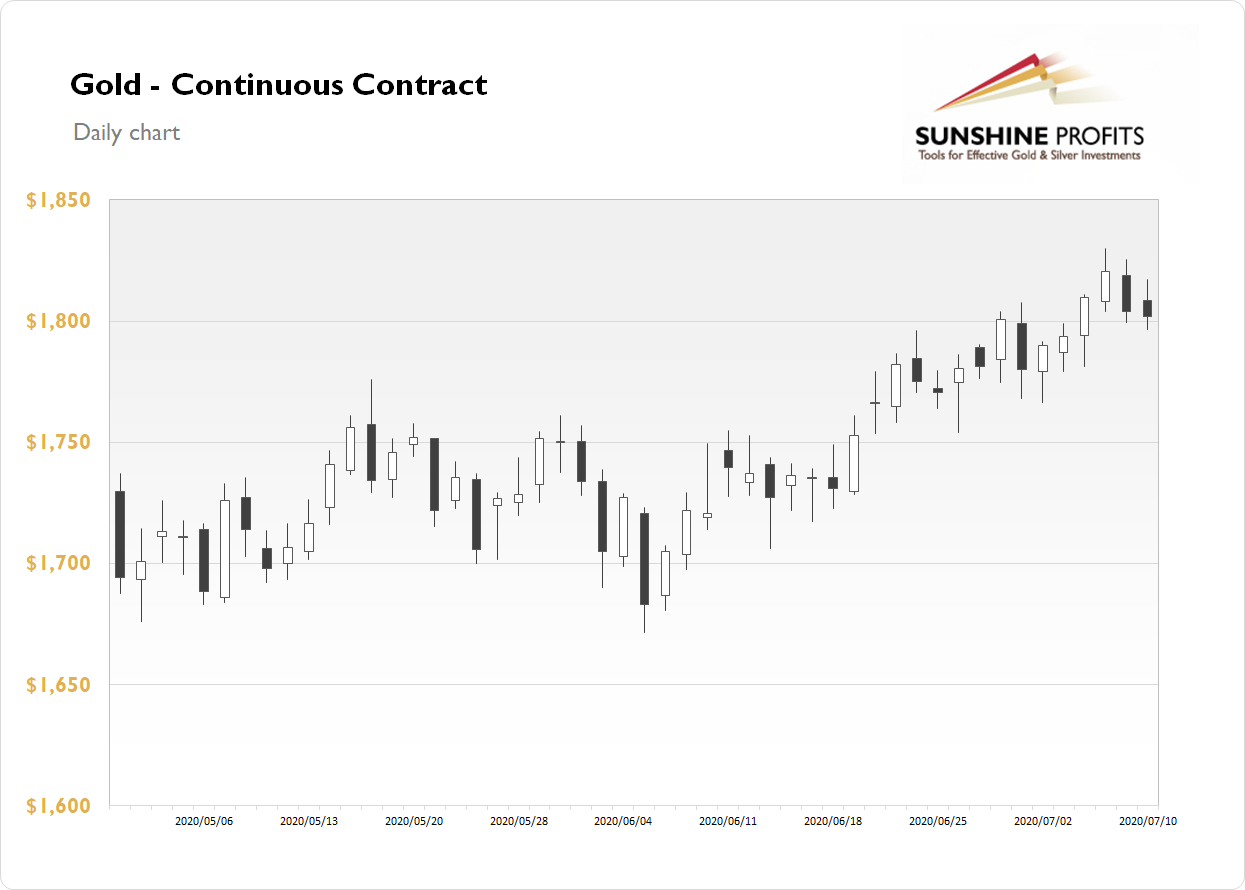

The Gold Futures contract lost 0.11% on Friday, as the market slightly extended its short-term downward correction following Wednesday's advance to a new long-term high of $1,829.80. The recent economic data releases have been better than expected and financial markets went risk-on late last week. Gold broke above medium-term local highs in June, as we can see on the daily chart:

Gold is 0.5% higher this morning, as it is trading along with Friday's daily high. What about the other precious metals? Silver gained 0.48% on Friday and today it is trading 2.5% higher. Platinum lost 0.12% on Friday and today it is 2.1% higher, Palladium gained 1.59% and today it is 1.2% higher. So precious metals are advancing this morning.

Friday's Producer Price Index release has come out negative at -0.2% and it's been lower vs. the expectations of +0.4%. Today we will get a speech from the Fed Member Williams at 11:30 a.m. and economic data from China later in the day.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Monday, July 13

- 11:30 a.m. U.S. - FOMC Member Williams (NYSE:WMB) Speech

- Tentative, China - Trade Balance, USD-Denominated Trade Balance

Tuesday, July 14

- 5:00 a.m. Eurozone - German ZEW Economic Sentiment

- 6:00 a.m. U.S. - NFIB Small Business Index

- 8:30 a.m. U.S. - CPI m/m, Core CPI m/m

- Tentative, Japan - BOJ Outlook Report, Monetary Policy Statement, BOJ Policy Rate

- All Day, Eurozone - French Bank Holiday