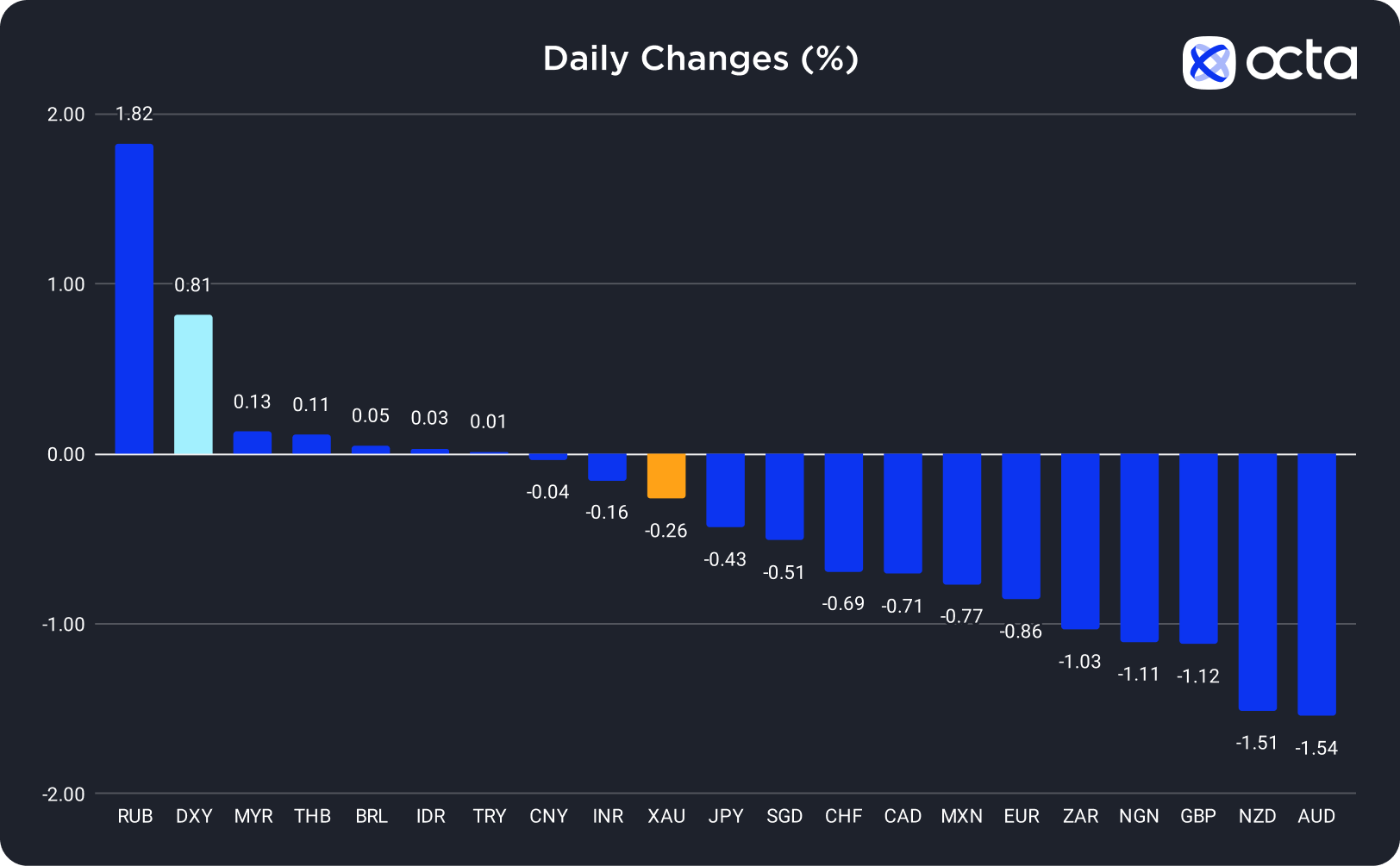

On Thursday, the Russian rouble (RUB) was the best-performing currency among the 20 global currencies we track, while the Australian dollar (AUD) showed the weakest results. The US dollar was the leader among majors, while the Nigerian naira (NGN) underperformed among the emerging markets.

Gold Recovers Sharply After Yesterday's Drop

Gold (XAU) fell sharply on Thursday due to a bigger-than-expected increase in U.S. consumer prices, which fuelled expectations that interest rates would remain elevated for an extended period, pushing both the US dollar and Treasury yields up from their recent troughs.

Gold remains poised for an over 2% increase this week, marking the largest gain since mid-March, as ongoing military confrontations between Israel and the Palestinian Islamist faction Hamas heightened the appeal for safe-haven assets like bullion. U.S. Treasury yields climbed, and the dollar gained ground as worldwide stock markets declined following Thursday's data revealing a rise in U.S. consumer prices for September, driven by an unexpected spike in rental expenses. Market participants believe there's an increased likelihood that the U.S. Federal Reserve (Fed) will implement an additional interest rate increase this year and maintain elevated rates for an extended period into the next year. Indeed, according to the CME FedWatch Tool, the probability of a rate hike in December has increased to 33%.

XAU/USD was rising strongly during the Asian and early European sessions, most likely due to safe-haven flows amid global geopolitical instability. Today, traders should focus on the release of the U.S. Consumer Sentiment report at 2:00 p.m. UTC. Higher-than-expected figures will probably push XAU/USD towards 1,875. However, the short-term bullish trend in gold may continue if the figures come out lower than expected.

"Spot gold is expected to retest a support of 1,869 per ounce, a break below which could open the way towards 1,856-1,863 range", said Reuters analyst Wang Tao.

EUR/USD Dips on Surging U.S. Consumer Prices

The Euro (EUR) plunged by as much as 0.86% on Thursday as the US dollar surged higher following the release of a higher-than-expected U.S. Consumer Price Index (CPI) report for September.

Yesterday, EUR/USD experienced a sharp decline after the U.S. CPI report showed an uptick in inflation and thus pushed the US dollar and Treasury yields higher. In fact, yesterday's decline marked the most significant one-day fall in almost two weeks. Rising inflation in the U.S. is supporting the viewpoint of an extended period of higher interest rates in the U.S. Meanwhile, Joachim Nagel, the Bundesbank President, said that inflation in Germany may have peaked and that he expects it to ease to 2.7% by 2025. Therefore, the divergence between the U.S. and the Eurozone monetary policies continues to favor the US dollar.

EUR/USD recovered somewhat during the Asian and early European sessions but continued to trade below the critical 1.06000 level. Today, traders should focus on the release of the U.S. Consumer Sentiment report at 2:00 p.m. UTC. Lower-than-expected figures may potentially trigger a rally and push EUR/USD towards 1,05800. However, if the report beats expectations, the selloff in the pair may extend towards 1.05000.