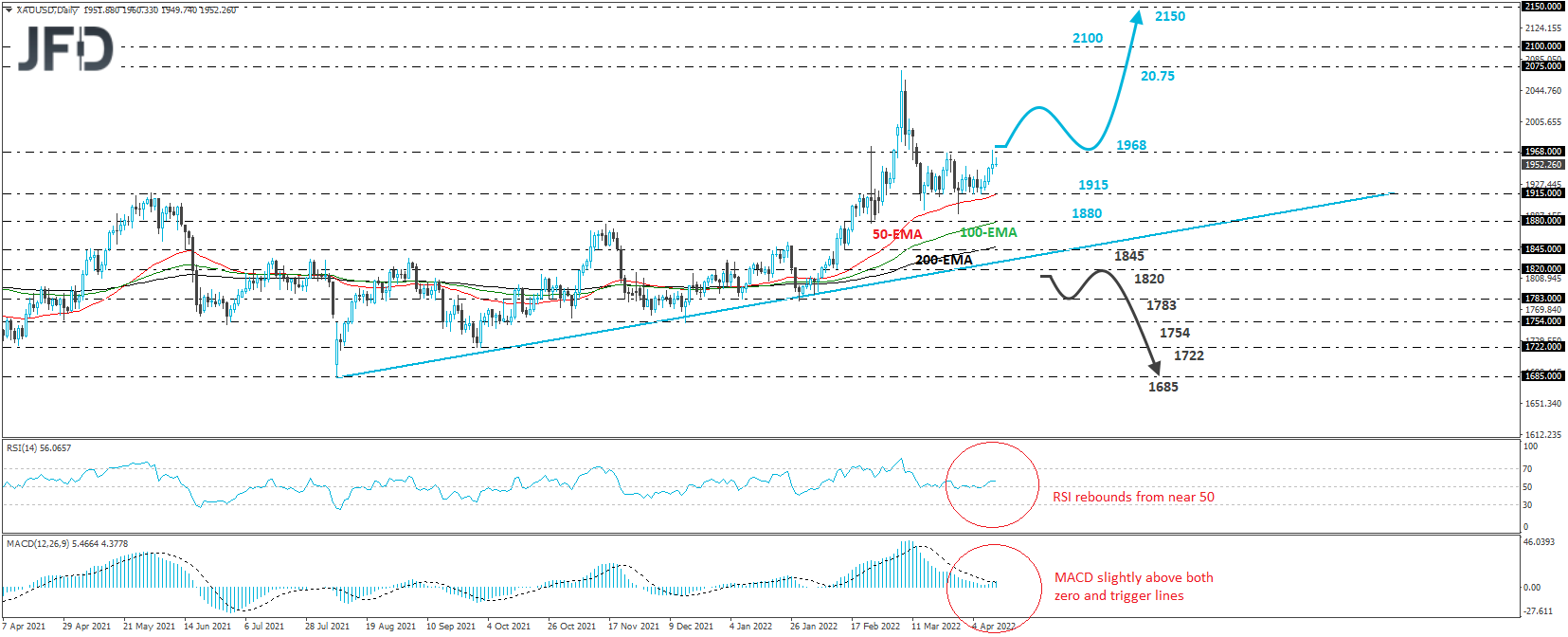

XAU/USD has been in recovery mode since Apr. 6, when it hit support at $1915. That said, the metal met strong resistance in the form of $1968 yesterday, a barrier marked by the peak of Mar. 24. Although gold has been mainly oscillating between those two barriers since Mar. 15, the overall picture still points to a medium-term uptrend, as marked by the upside support line drawn from the low of Aug. 9.

Thus, we see decent chances for the recent recovery to continue above $1968. A clear break above that hurdle could encourage the bulls to climb towards the all-time high of $2075, hit on Aug. 6, 2020, and almost touched on Mar. 8 this year. If they manage to overcome it this time around, we could see them testing the psychological figure of $2100, the break of which could allow extensions towards 2150.

Shifting attention to our daily oscillators, we see that the RSI rebounded from near 50, while the MACD, already slightly above zero, has bottomed and just poked its nose above its trigger line. Both indicators suggest that the yellow metal has started gaining upside speed again, which supports the notion of further advances in the short run.

On the downside, we would like to see an apparent dip below $1820, the low of Feb. 11, before we start examining a bearish reversal. This could confirm the break below the upside line drawn from Aug. 9 and may initially target the $1783 or $1754 levels, marked by the lows of Jan. 28 and Dec. 15, respectively.

If the bears do not want to stop there, we may see them driving towards the low of Sept. 30, at $1722, or the low of Aug. 9, at $1685.