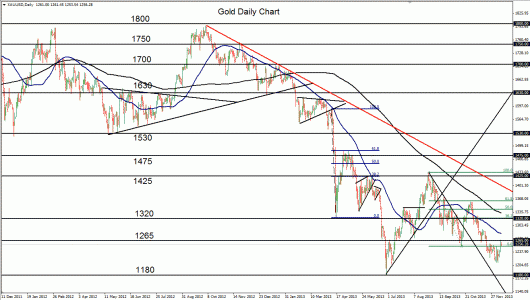

Gold on the daily chart has rebounded modestly back up to the key 1265 resistance area after having established a 5-month, double-tested low at 1211 late last week. Despite this rebound, the precious metal is still showing a significant overall bearish bias, having displayed marked weakness since its 1433 high in late August. From that high, the price of gold dropped down to a low of 1251 in mid-October before pulling back up two weeks later to 1361, which was the 61.8% Fibonacci retracement of the prior bearish leg.

Since that upside pullback, gold has fallen sharply for more than a month on its way toward its major downside objective – the key 1180 level, which was the multi-year low that was last established in late June. Despite the current upside pullback, 1180 remains the primary downside target. A further breakdown below 1180 would confirm a continuation of the sustained bearish trend that has been in place since the October 2012 high near 1800. The current bearish environment is reinforced by the price of gold being well below its 50-day moving average which is, in turn, well below its 200-day moving average. Any strong breakdown below the noted 1180 low could potentially begin to target further downside around the 1000 psychological support level.

From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.