The yellow metal managed to recover this week, trading up off initial weekly lows, to put in a positive week. The move was largely a response to the rally in the US Dollar which traded up to fresh 2018 highs this week on better than expected US CPI before trading back below the level shortly after.

Gold prices have been under pressure recently following a recovery in risk sentiment which saw equity markets posting two consecutive positive weeks following the dramatic declines seen earlier. However, equity markets slumped back this week fuelling a stronger safe-haven bid in gold once again.

Gold prices remain penned in below the 1235.30 resistance level which has now capped price action for three consecutive weeks. For now, there is still the chance of a break higher which would bring the broken bullish trend line from 2015 lows back into focus. To the downside, the 2018 lows at 1158.84 are the first key level to watch with the late 2016 lows of 1122.81 the next level to focus on.

Silver prices tracked the moves seen in gold this week, trading lower initially before recovering as the US Dollar fell back. However, silver prices did initially trade down to fresh year to date lows and their lowest levels since early 2016. Price has been fairly stagnant around current low levels over the last two months, and pressure is certainly still on the downside for now.

Silver prices pierced below the 13.6704 – 13.9612 level support this week to print fresh 2018 lows before recovering back above the level and forming a potential double bottom. However, unless the price makes it back above the 15.1825 – 15.5734 level, the focus will be on the further downside.

The red metal also managed to post a recovery this week on the back of eventual USD weakness. The stronger than expected US CPI has bolstered the market’s expectation that the Fed will raise rates for a fourth time this year at its upcoming December rates meeting. Recent data out of the US has continued to print strongly, and the Fed is widely expected to end the year with a further rate hike, keeping USD bid. Copper has been weighed on by expectations of weaker than expected Chinese data for October, though industrial production surprised to the upside, keeping metals underpinned.

For now, copper prices continue to battle it out around the 2.767 level which has seen volatile but evenly matched order flow. To the downside, we have support at the 2.567 level (2018 low) with the rising trend line from 2016 lows coming in around the same level also and a deeper 2.443 structural level below that. To the topside, the 2.959 level is the main resistance to watch (broken 2015, the range of swing lows over late 2017 / early 2018).

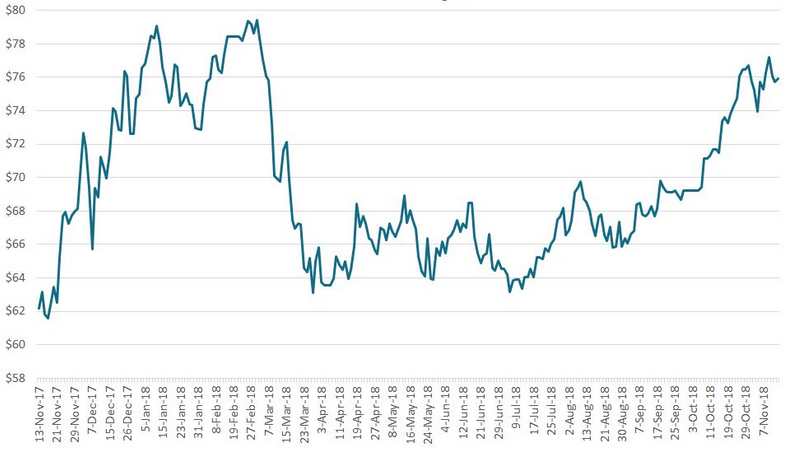

Iron ore prices were softer over the week despite having initially traded up to fresh highs and despite the general recovery seen across the board in the commodities complex also. Better than expected Chinese data (October industrial production printed 5.9%, up from 5.8% prior) and a weaker USD were not enough to keep iron underpinned this week. For now, iron ore prices remain around $76, sitting just below the current 2017 and 2018 highs of $79.

After piercing above the $77 level, iron prices came lower once again this week. However, The recent decline in Iron found support at a retest of the $76 level, and for now, price remains hemmed in between there and highs around $79. For now, the focus remains on further upside. If we see a deeper retracement from here, the mid $72 level is the next key support while below there, the retest of the breakout base around $70 will be the main level.