The weaker-than-expected US payroll numbers on Friday gave precious metals an additional lift and the sector remains the strongest performer so far this January. Gold moved back into its area of resistance of 1,250-1,268 USD/oz, but the failure to break decisively through once the right environment presented itself highlights the continued lukewarm feelings that many have towards the metal which lost 30 percent in value last year.

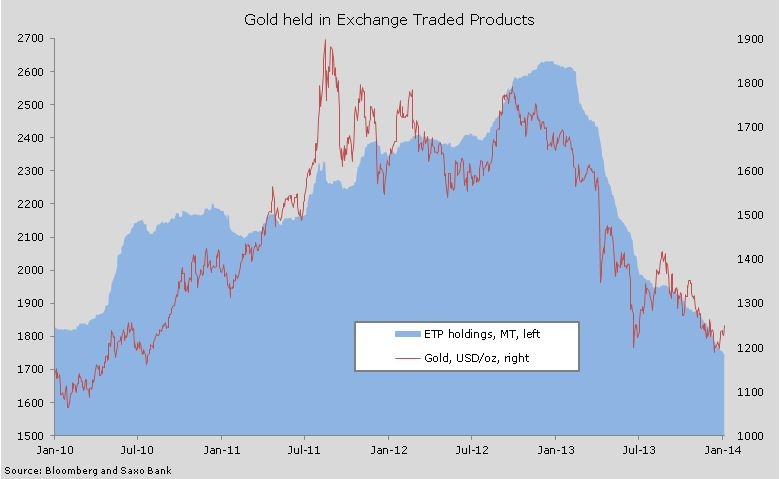

Exchange Traded Product flows remained negative for a ninth consecutive week although last week's reduction of just 9.4 tons were the smallest reduction seen since the week of November 15. Total known holdings, according to Bloomberg, now stands at 1,746.2 metric tons, the lowest reading since October 2009.

So far the rally has primarily been driven by strong physical demand from China ahead of its Lunar New Year celebrations at the end of January and short covering by speculative traders in the futures market. In order for the bulls to gain the upper hand, traders need to see that the market is not just being driven by speculative short covering but also conclude that investor money has begun to flow back into the market. This is the reason that, although relatively small in size, a positive flow into ETPs is needed to give the market the confidence required to take gold higher. Until such time the risk in the market is still that the recent lows can be revisited once Chinese demand begins to ease as Lunar New Year approaches.

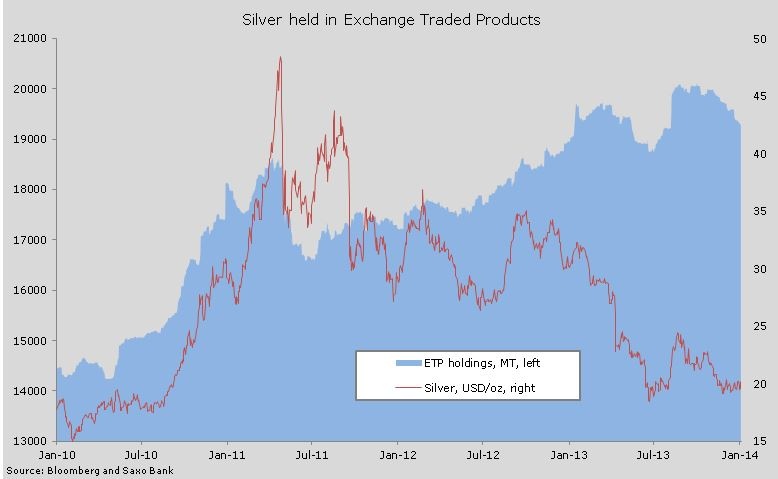

Silver holdings dropped for a third week in a row and has now declined in all but one of the previous nine weeks.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Rally Triggers Additional Reductions In ETP Eoldings

Published 01/13/2014, 06:17 AM

Updated 03/19/2019, 04:00 AM

Gold Rally Triggers Additional Reductions In ETP Eoldings

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.