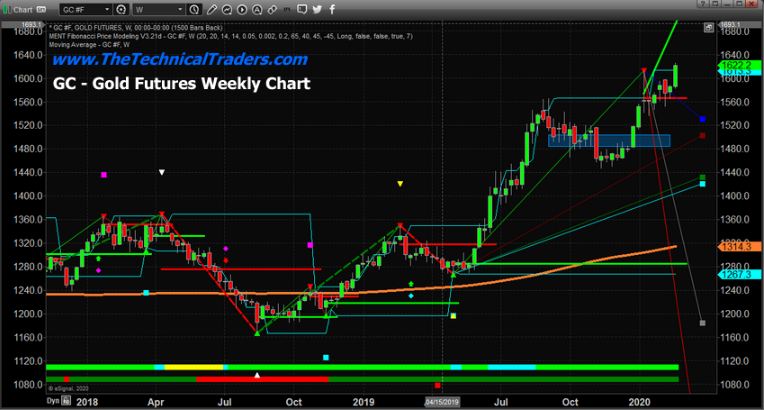

Gold has rallied extensively from its lows near $1560 over the past 2 weeks. At first, this rally didn't catch much attention with traders, but now the rally has reached new highs – above $1613 – and it may try to move above $1750 as metals continue to reflect the fear in global markets.

We've been warning of the real potential in precious metals for many months – actually since early 2018. Our modeling system suggests that gold will rally above $1650 rather quickly, then possibly stall a bit before continuing higher to target the $1750 range.

The one thing traders must consider is the longer-term fear that is building in the markets. Many traders are concerned about the global economy with the coronavirus spreading economic worries throughout Asia, Japan and Europe. We believe this fear will push precious metals continually higher over the next 24 months with a real upside target above $2100 eventually.

Right now, traders need to understand that wave after wave of higher price rotation will continue to happen in gold and silver. If you missed the $1450 and $1550 levels, it's time to find your entry point near $1650 or below that level. Ultimately, real fear has yet to result in a parabolic rally in gold and silver – but it is likely going to happen within the next 24+ months.

Our Fibonacci price modeling system is suggesting that any price rotation below $1550 would be an excellent buying opportunity. These levels really depend on where the current rally ends and what happens in the global markets over the next 60 days.

- February 13, 2020: We said that gold would break above $1650 within 15-30 days

Once fear really enters the markets, we'll see huge sector rotation and a massive price reversion event take place. Historically, Gold and Silver will react to this move, but the parabolic price move in precious metals will come 4 to 6+ months after the reversion event in the global markets. So, from a historical standpoint, any entry-level near current price levels is exceptional.

Trust us, you really don't want to miss this next move in precious metals. Our Fibonacci price modeling system and Adaptive Dynamic Learning modeling system are suggesting price levels above $2400 as an ultimate upside price target for Gold.