Markets and stocks remained strong, moving slowly higher for the most part, but doing so very deliberately.

We remain on track for a strong finish to 2014.

Real-time members were treated to an options play that was bought at $1.20 and sold on the way up until the final tranch was let go above $9.

Our other positions are doing well also, and if they aren’t, we sell.

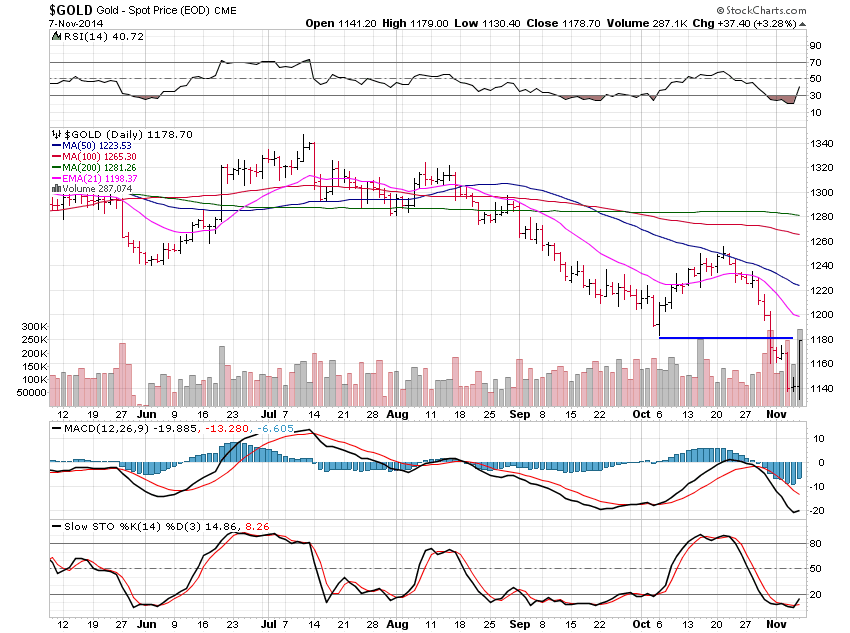

Gold continued to get hit hard along with silver, who finally hit and held the $15 level which is very important.

Gold sliced through lows at the $1,180 area like a hot knife through butter but we saw an extremely positive end to the week as was expected and called for to subscribers by myself.

Gold ended the week pretty flat gaining 0.44%.

Gold sliced under $1,180 and that had the bears calling for much lower prices but they aren’t realistic.

When $1,180 was broken it was not good, there is no doubt, but we have to take a step back and look at the reality of the situation first.

I talk about the most important print being the closing print, and it is.

Daily chart are trumped by weekly charts and weekly charts are trumped by monthly charts.

Basically, longer-term charts carry more weight in terms of the big picture.

When gold really broke, I told subscribers it had to close the week above recent lows near $1,180 or we would be seeing the $1,000 print sooner rather than later.

We were expecting a large Friday and we got it.

While gold didn’t close exactly above the $1,180 level Friday, it is close enough.

Gold has now found at least a temporary low.

We’ve got to see how the action plays out and I’m not calling for a major run higher but the downward momentum does now look to be arrested.

We never saw the real blood in the streets moment I need to see and I still think it is coming, but we should see gold act much better in the weeks and perhaps months ahead.

Silver ended the week off 2.23% and is holding the very important and major support level at $15.

Silver has now found a low for now.

We have to see how it acts going forward but we now have a bit of resistance at 16 and then more at 17.

It’s an easy play from here to 17 if you are interested in making a bit of money but beyond that, I can’t yet say.

I’m happy silver did hold $15 since the next major support level is all the way to $10.

Major support and resistance levels are just that.

They acts as magnets and almost always take time/rest/consolidation to get through.

It is too early to say if this multi-year move lower is now over but the perma-bulls can now rest easy for a while.

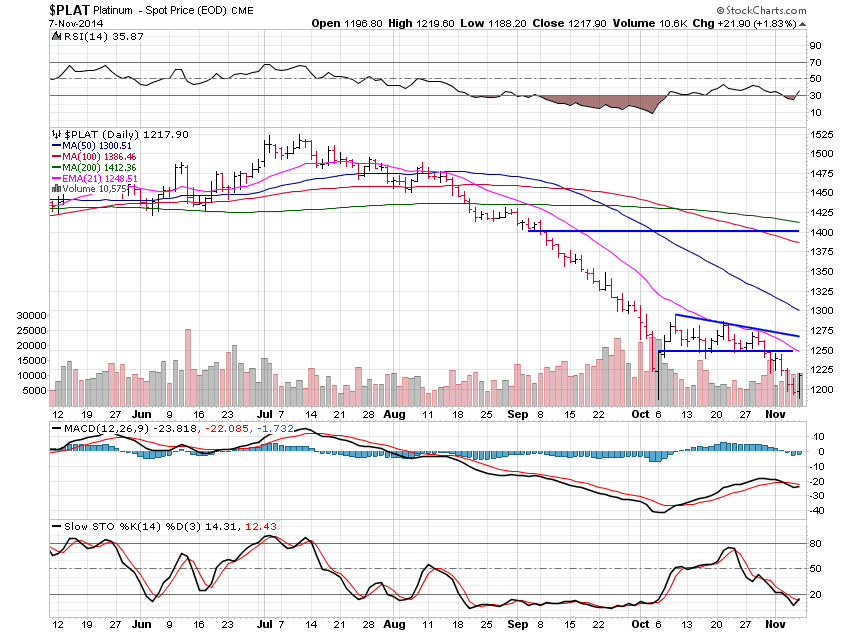

Platinum lost 1.62% this past week but looks good.

Gold and silver hitting lows open the door for platinum to head to $1,400 now.

There is some resistance at $1,250 but nothing major, and platinum should be able to best it within a week or week and a half.

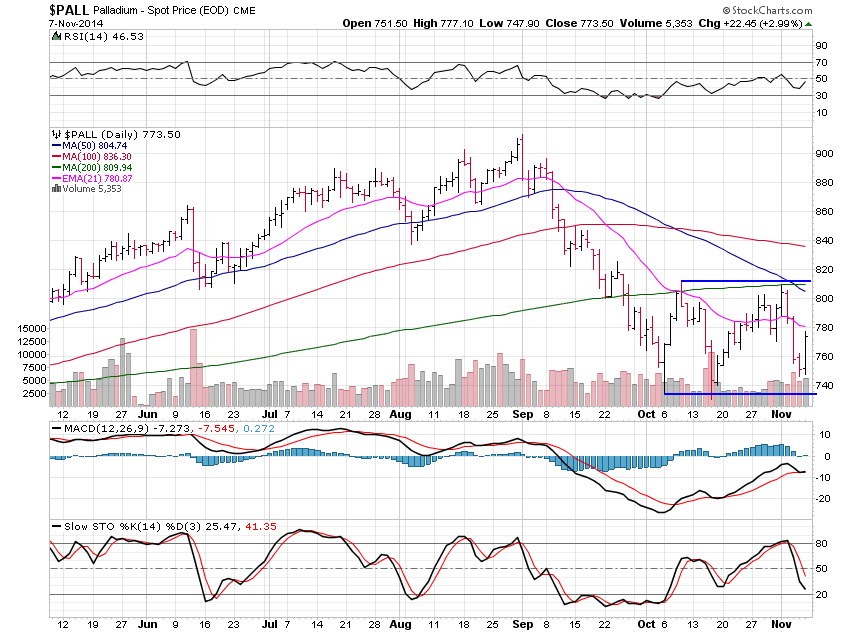

Palladium lost 2.51% on the week as I said was inevitable.

Palladium follows gold and silver, it is that simple.

With the pressure off gold and silver for now, palladium should do quite well.

We’re now looking at a range trade between the $740 and $815 areas but, with gold bottoming for now, this opens the window for palladium to move up to the $880 area.

All in all, a very great week for the metals even though it may not feel like it.

Very, very constructive action that does tell me a low is in place for now.

So, there you have it. While I’ve been calling for lower prices for quite some time, now, I have no problem telling that things have changed and we should see the selling pressure lifted.

Unlike the perma-bulls or bears, I follow the action and tell you so.

Success in markets depends on being objective and realistic, not stuck in your ways.