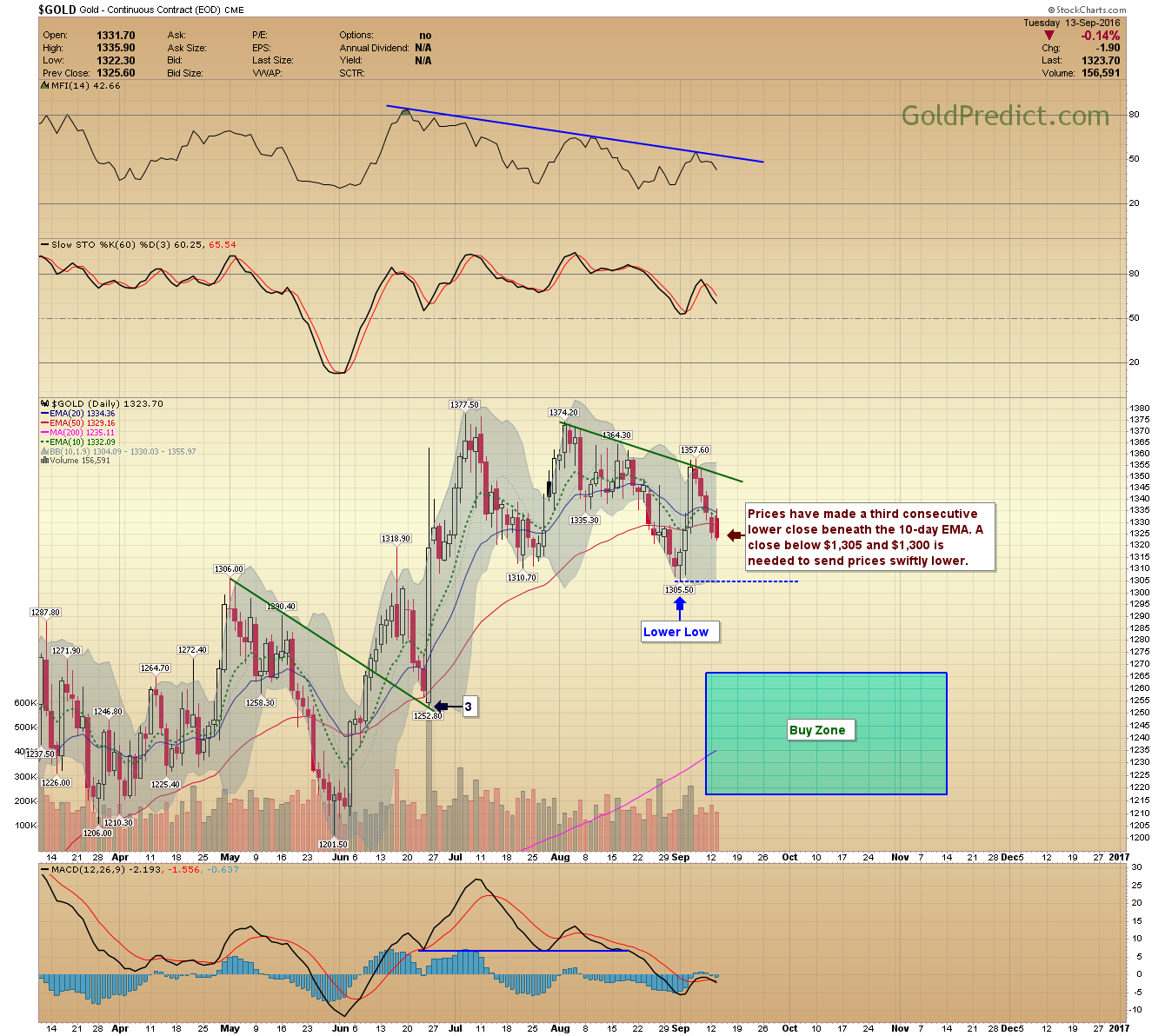

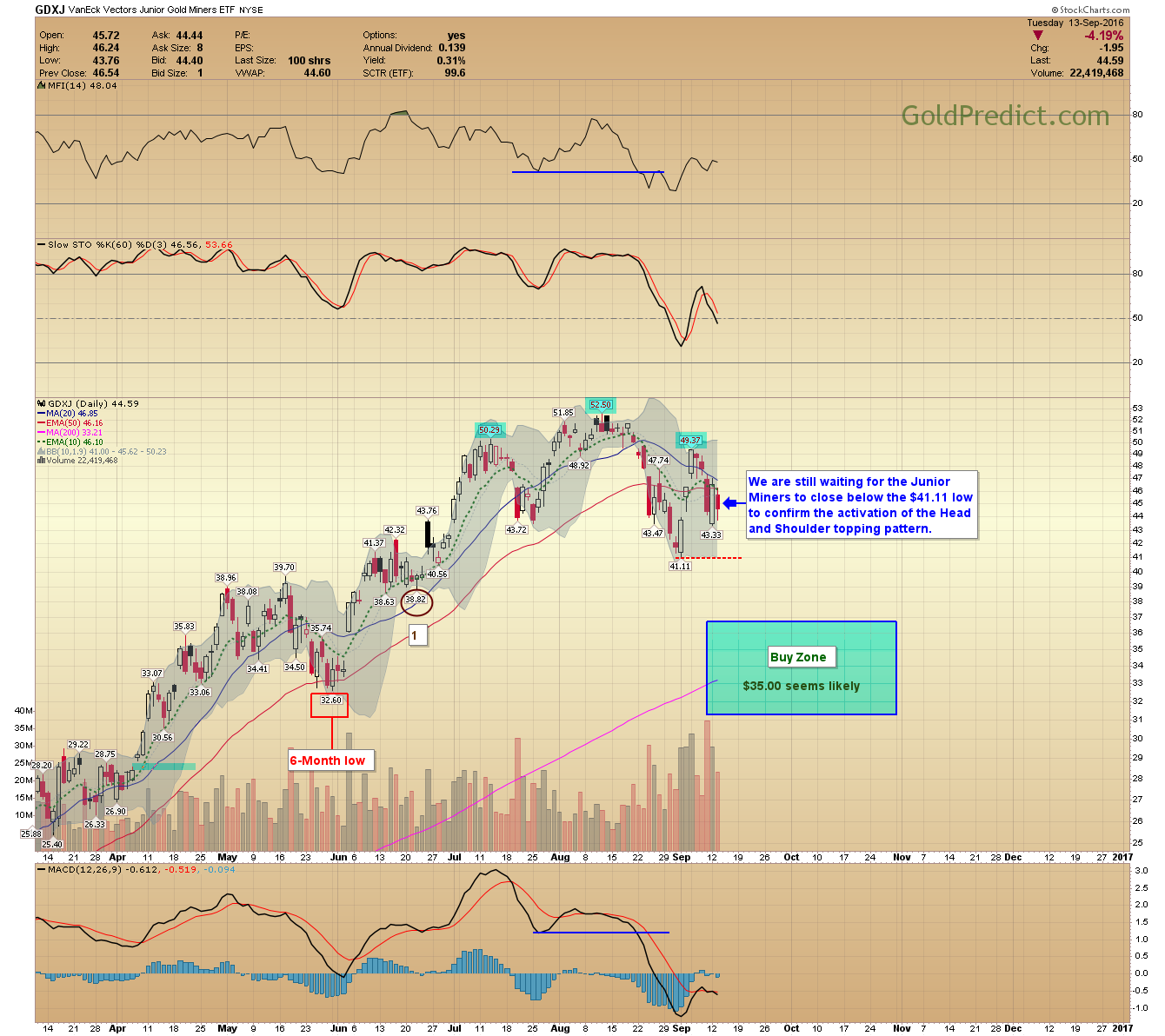

Our Buy Zone analysis is on track. The next signpost we are waiting for is a price break of the recent common cycle lows. When that occurs, I expect selling pressure to intensify, and prices should finally enter the upper portion of the Buy Zones.

Once in the Buy Zones, I will do my best to guide members. Dollar-cost-averaging into positions is a strategy I will personally implement.

US Dollar Index: The dollar climbed back above its 10-day EMA but will need to break out of the converging trendlines for a more sustained move.

Gold: Prices made a third consecutive lower close beneath the 10-day EMA. A close below $1,305 and $1,300 is needed to send prices swiftly lower.

Silver: The 10, 20 and 50-day EMA's have converged, and prices are closing in on the $18.46 low. Once that level breaks, I expect a swift move down to the 200-day MA.

VanEck Vectors Gold Miners (NYSE:GDX): Prices bounced Monday after the sharp selloff on Friday, but they were unable to follow-through higher today. A break of the $25.17 low will bring about the next line of support between $23.00-$22.50; the 200-day MA.

VanEck Vectors Junior Gold Miners (NYSE:GDXJ): We are still waiting for the Junior Miners to close below the $41.11 low to confirm an activation of the Head and Shoulder topping pattern.

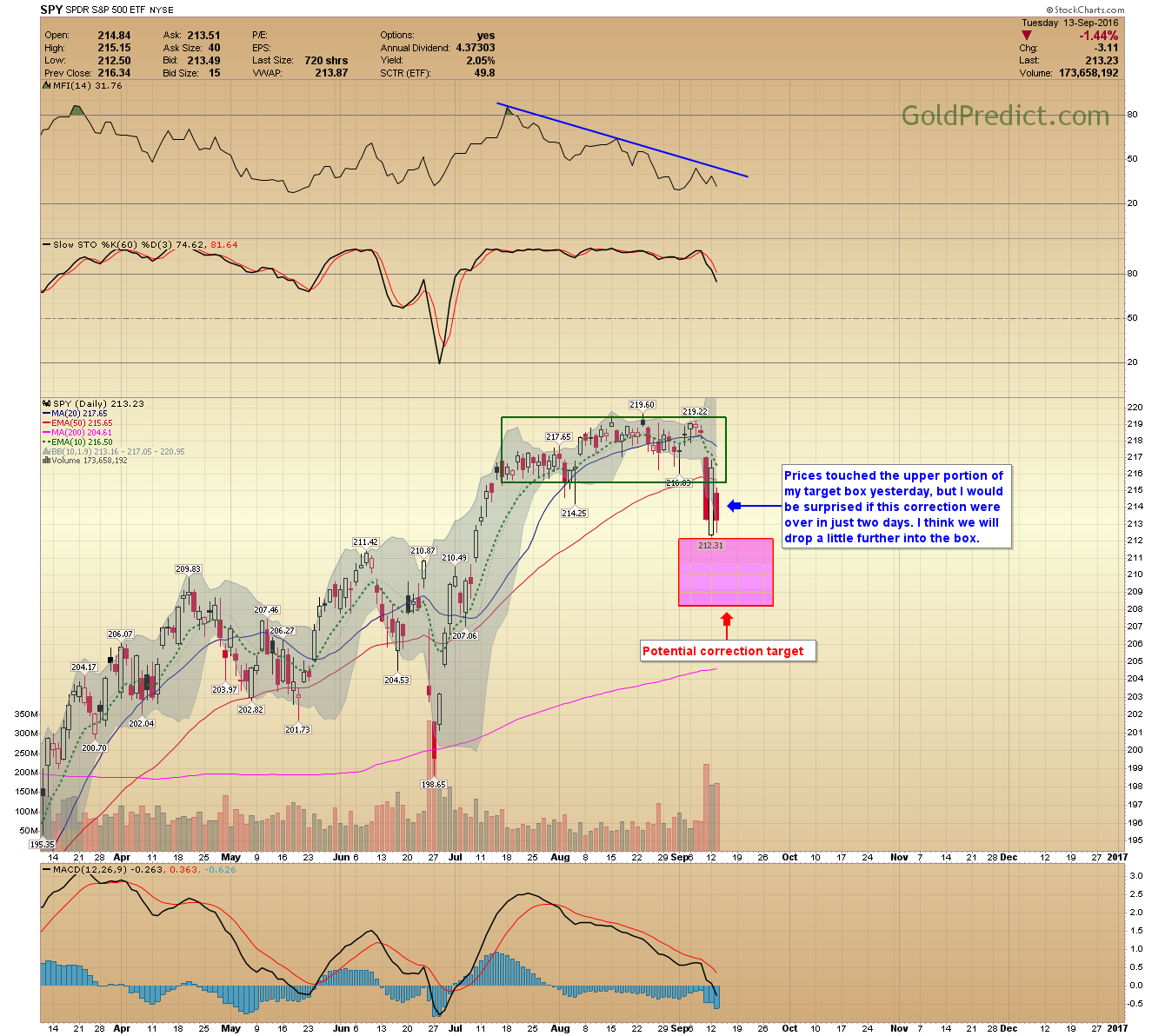

SPDR S&P 500 (NYSE:SPY): Prices touched the upper portion of my target box yesterday, but I would be surprised if this correction were over in just two days. I think we will drop a little deeper into the box.

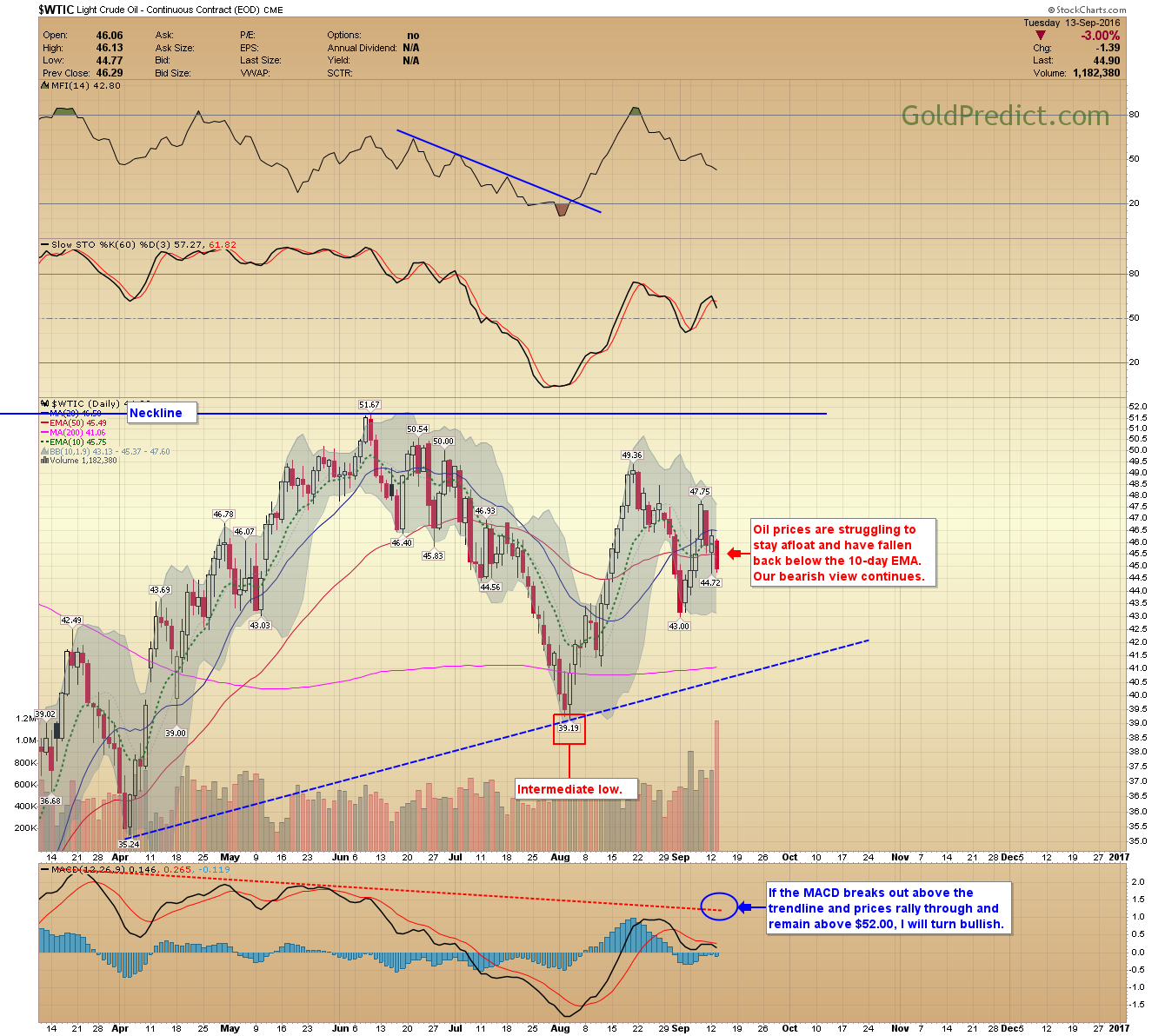

WTIC: Oil prices are struggling to stay afloat and have fallen back below the 10-day EMA. Our bearish view continues.

Only 8-days to the next Fed meeting. I'd be very surprised if they raised interest rates this month. Their comments will set the tone for October precious metal prices.

Volatility is picking up, and the daily market gyrations can easily fool one. It's important not to overtrade in times like this. I choose to wait for prices to reach my Buy Zone targets or trade small, very low-risk trade setups.