Gold prices slid Monday as a slightly stronger dollar and end of quarter flows weigh on the precious metal. Despite the drop off, Gold remains on course for its best quarter since Q1 of 2016, which recorded gains of 16% +.

Gold continues to find support as safe haven appeal and incoming rate cuts keep bulls interested. However, the drop to start the week could be down to a number of overlapping factors such as profit taking, repositioning and the recent rally in Chinese equities and emerging markets.

The stimulus announced by the PBoC is the gift that keeps on giving where China is concerned. The rally in Chinese equities could be impacting Gold as well, given the higher yield on offer. Gold remains in extremely overbought territory and thus further upside may also prove a challenge.

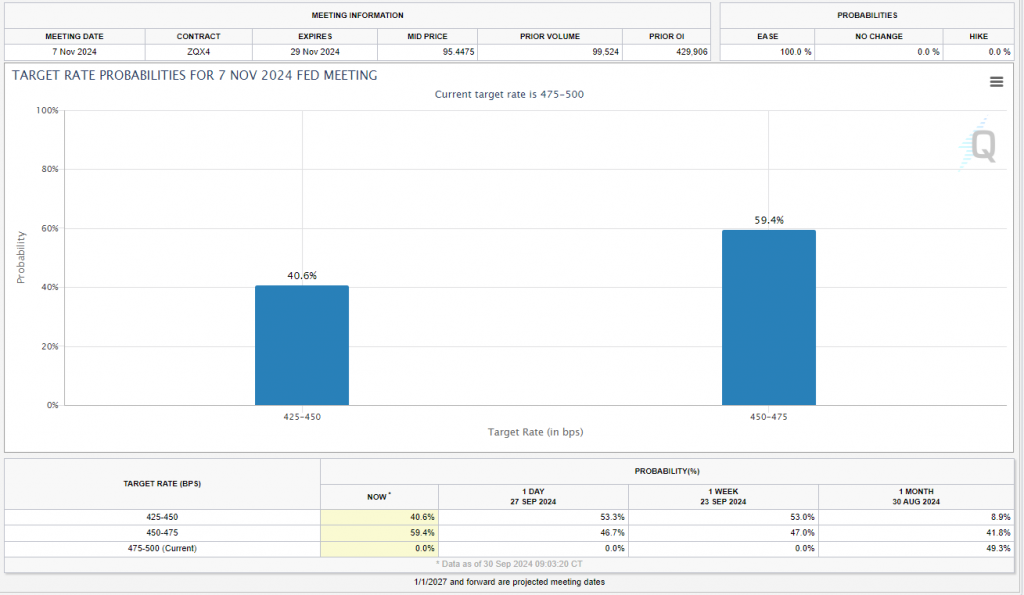

As things stand, markets could continue to range ahead of the jobs data on Friday. Any increase in rate cut expectations could lead to USD weakness. Current expectations have a 50 basis point cut in November at around 40%, down from 53% a day ago and could be partially responsible for the drop in the price of the precious metal.

Source: CME FedWatch Tool (click to enlarge)

Economic Data Ahead

Gold prices face many challenges at the moment, both positive and negative. Safe haven appeal for now appears to be waning yet a weaker US Dollar as we are seeing today does have the potential to keep gold prices on the front foot.

There is a host of US data this week including services data, however the biggest volatility and potential for a change will come on Friday when the US jobs report is released. Signs of improving jobs numbers and a drop in the unemployment rate could push the precious metal lower.

Technical Analysis Gold

From a technical analysis standpoint, gold is tough to read at the minute particularly where areas of resistance is concerned. As we continue to print fresh all time highs it makes it difficult due to the lack of historical price data to analyze.

To put things into perspective, the RSI on the daily, weekly and monthly timeframe are all in overbought territory. However, as we know an instrument can languish weeks and sometimes months in overbought territory on the larger timeframes so this seems to be irrelevant at present.

The psychological 2650 mark is the most immediate area of resistance i would keep an eye on A break beyond that could open up a retest of last weeks and the all-time high print around 2685.50 before the 2700 comes into focus.

Looking at support and the 2625 area has been key over the last couple of days and could still serve as a base for gold prices. This may be a level worth monitoring moving forward.

GOLD (XAU/USD) Four-Hour (H4) Chart, September 30, 2024

Source: TradingView (click to enlarge)

Support

- 2625

- 2600

- 2585

Resistance

- 2650

- 2675

- 3000