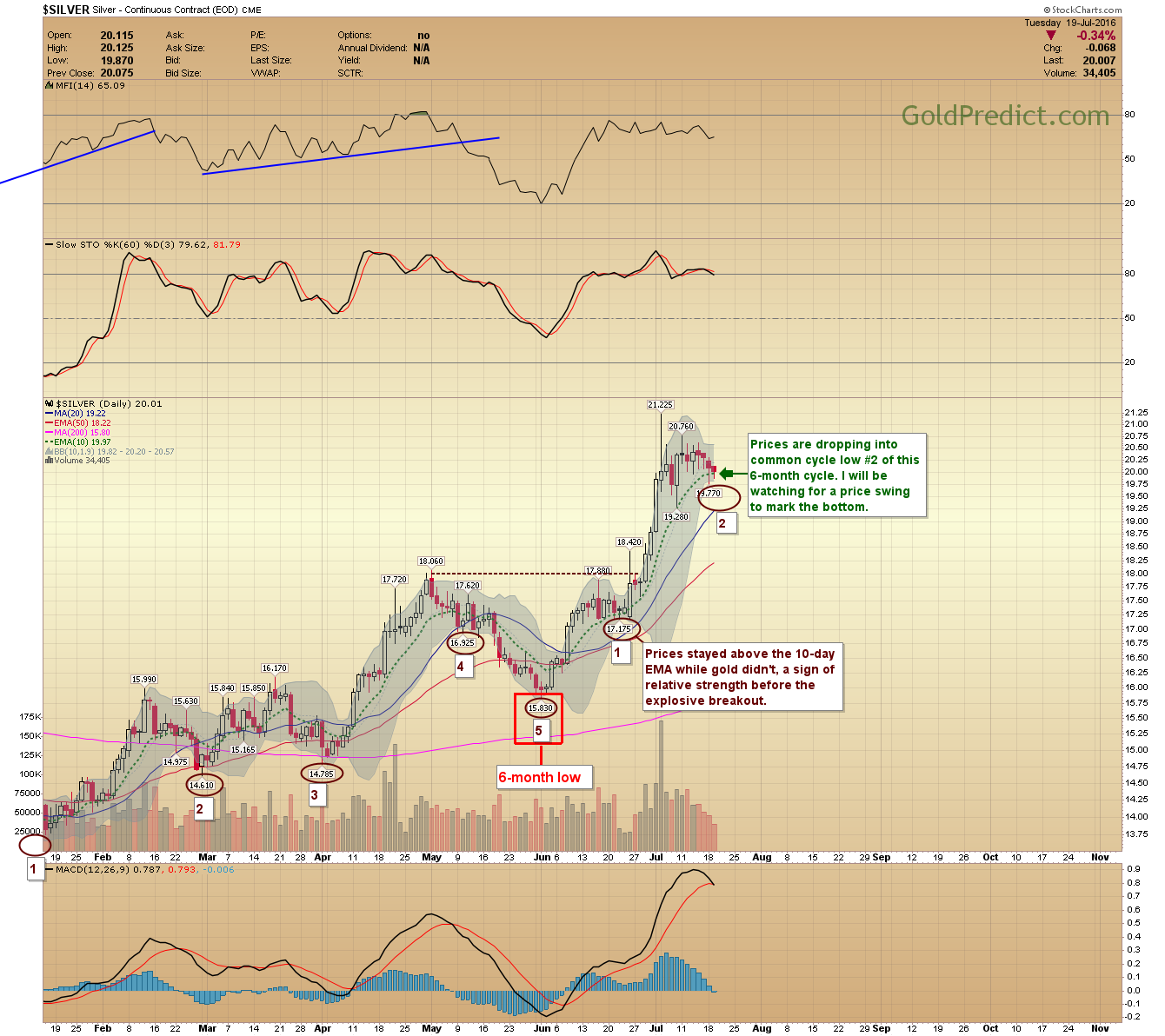

Last week I thought gold and silver were dropping into a quick half-cycle low before turning immediately higher. This correction in gold is taking too long for this to be a simple half-cycle depression. Therefore we are likely forming common low #2 of the current 6-month cycle.

I don't think prices will drop too much further before completing low #2, and I will be watching for a price swing to mark the bottom. I plan on updating members the moment I see signs of a reversal. If you didn't read my article explaining the various gold cycles here is a chart (2009-2010) designating common cycle lows.

-US Dollar Index- The dollar finally broke higher from the Brexit consolidation. However, at 17-days into this cycle prices will likely start dropping into a low relatively soon. We could test the blue trendline before this cycle tops.

-GOLD - I thought this was going to be just a half-cycle low, but I'm pretty sure we are dropping into the 2nd common cycle trough of the larger 6-month cycle. Prices should bottom between the 20-day and 50-day moving averages and then head higher.

-SILVER- Prices are dropping into common cycle low #2 of this 6-month cycle. I will be watching for a price swing to mark the bottom.

-VanEck Vectors Gold Miners (NYSE:GDX)- Miners are consolidating and will turn higher with gold and silver. Worst case scenario, I see miners dropping to the lower trend channel for bottom #2.

-VanEck Vectors Junior Gold Miners (NYSE:GDXJ)- Prices could fall to the 20-day MA to end this correction, but they don't have to.

-WTIC- Nothing new. The moving averages are rolling over, and prices are dropping into an intermediate cycle low.

The price correction in gold, silver and miners should resolve this week.