Gold declined at the beginning of Today Asian trading session, as the dollar traded close to a 5-1/2-year high against a basket of major currencies, but the yellow metal managed to hold above the key level of $1200 per ounce.

The investors are cautiously awaiting the ECB policy decision concerning the monetary stimulus measures, also the U.S. jobless claims data to see if it will push the dollar to rise further.

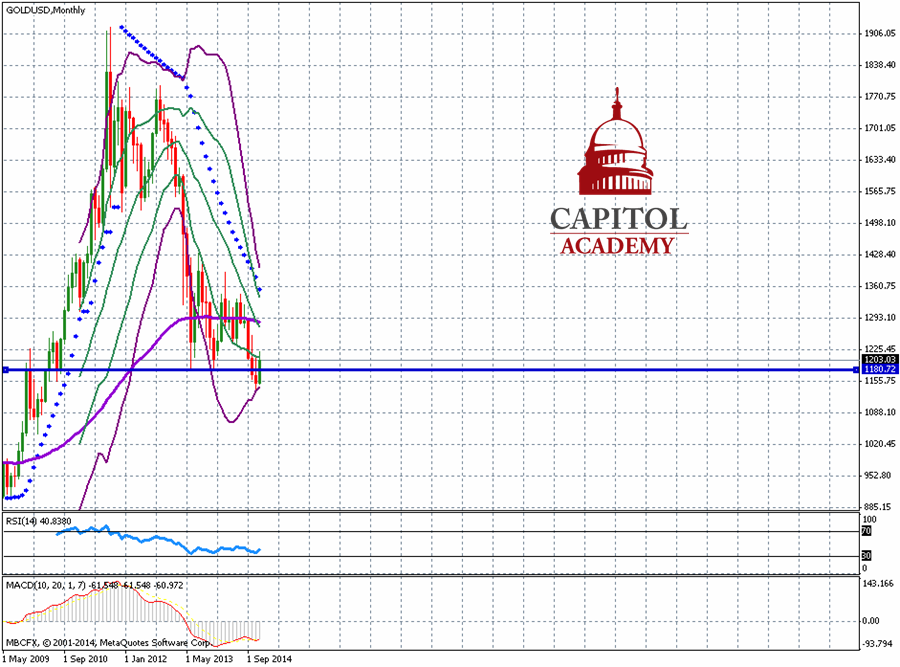

We have mentioned in our previous technical analysis that the Gold is in processes to witness a significant bullish wave above $1204 per ounce, and we also mentioned that the prices was below $1186 and followed by a significant recover of the Gold.

The prices have reached the first 3 expected targets and rose toward $1221 per ounce. And concerning the next trading session, and as we can see on the monthly chart, the gold has faced a barrier around the lower line of the Bollinger band® and is in process to form the 2B Bottom which confirms the upward movement. So the pullback of the prices to trade around $1200 is just a profit taking from the precious buying positions. Then we expect a new bullish wave toward $1214,$1216, then toward the mentioned resistance area of $1223-$1232 per ounce.

As for the key support level, it lays a $1276, and as long as the prices will trade above this level, the Gold will continue its general bullish trend.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Prices Remain Steady Above $1200 Ahead Of The ECB Meeting

Published 12/04/2014, 03:24 AM

Updated 05/14/2017, 06:45 AM

Gold Prices Remain Steady Above $1200 Ahead Of The ECB Meeting

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.