The gold price crossed the 1,900 price level and touched the highest level in nearly six weeks. There is no doubt that much of the move for the gold price is primarily due to the weakness in the dollar weakness. The ongoing coronavirus situation is sending one clear message; the economic recovery isn’t going to take place overnight. This also means the Fed isn’t going to change its monetary policy anytime soon well. In addition to this, we also have a decision on the second stimulus package. All of these fundamentals are pointing to one particular issue: the coronavirus situation is only becoming worse and will take some time for investors to gain their confidence back.

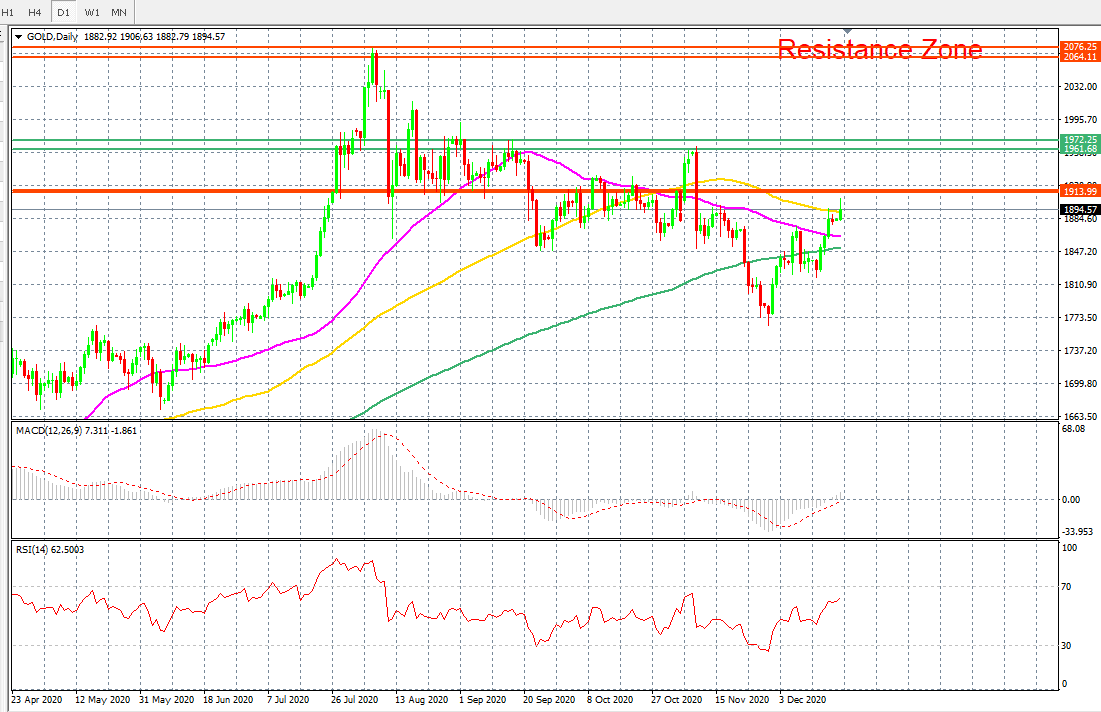

In terms of technical analysis, the price has crossed above the 50, 100 and 200-day SMA on the daily time frame, which is positive for the bull trend. However, the 50-day SMA is still trading below the 100-day SMA, which shows that the bulls are still locking some momentum. If the 50-day SMA moves above the 100-day SMA on the daily time frame, the chances are that the gold price may have another go at the all-time high. Bit for now, the pattern of higher lows and higher highs is in place, which means gold price will continue to move higher.

In terms of support, it is at 1864, and the resistance is at 1961.