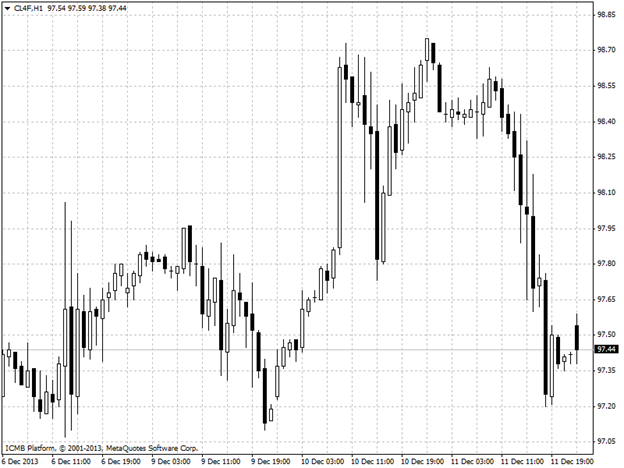

CL

Oil prices took fell on Wednesday after official U.S. data revealed gasoline and diesel inventories rose more than expected despite a drop in crude stockpiles. The U.S. Energy Information Administration said in its weekly report that U.S. crude oil inventories fell by 10.59 million barrels in the week ended Dec. 6, well beyond expectations for a decline of 2.95 million barrels, due in part to a drop in imports. Total U.S. crude oil inventories stood at 375.2 million barrels as of last week. The report also showed that total motor gasoline inventories increased by 6.72 million barrels, compared to expectations for a gain of 1.79 million barrels, which sent crude futures falling. Stockpiles of distillate, which include diesel and heating oil, rose by 4.54 million barrels compared to market calls for a gain of 937,000. The hike in supply of refined fuels offset the otherwise bullish crude numbers and sent the commodity falling on Wednesday.

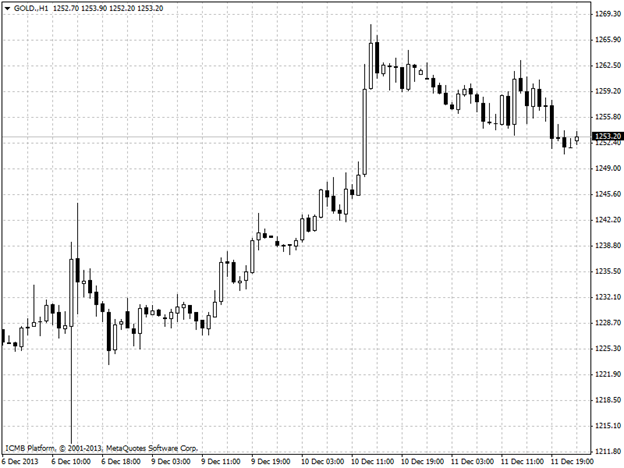

GOLD

Gold prices fell on Wednesday after profit taking wiped out gains stemming from expectations for the Federal Reserve to hold off on announcing plans to taper stimulus measures at a monetary policy meeting next week. Gold prices fell due to uncertainty over the fate of the Fed's $85 billion in monthly bond purchases, which have supported the yellow metal for over a year by driving down interest rates to spur recovery, weakening the dollar in the process. Better-than-expected labor and sentiment data released recently sparked market talk that the Fed may decide to trim asset purchases at its Dec. 17-18 monetary policy meeting, especially after lawmakers agreed on a way out of a budget impasse that could clear up U.S. fiscal uncertainties and spur recovery. Gold rose to levels ripe for profit taking on expectations that the Federal Reserve may opt to wait until 2014 before deciding on the fate of its bond-buying program.