Gold prices are on an upward trajectory, moving towards 2351.00 USD per troy ounce on Tuesday. This marks a significant rise after days of sideways movement, highlighting the metal's renewed appeal among investors.

This surge in gold prices can be attributed to a localised weakness in the US dollar, which has investors keenly anticipating the release of critical US inflation data later this week. The focus is particularly on the Core PCE indicator set for release on Friday, which is expected to provide further insights into the Federal Reserve's potential interest rate adjustments.

The market's reaction to the upcoming data could be pivotal, as strong movements in gold prices are likely once the Fed's intentions on rates become clearer. To date, discussions on rate adjustments have been vague, leaving investors craving more definitive guidance.

Despite the Fed's recent minutes suggesting a possibility of rate hikes due to persistent inflation, the market sentiment is tilted towards an eventual easing of the Fed's stance, as indicated by the positive direction of short-term futures contracts on gold.

Technical analysis of XAU/USD

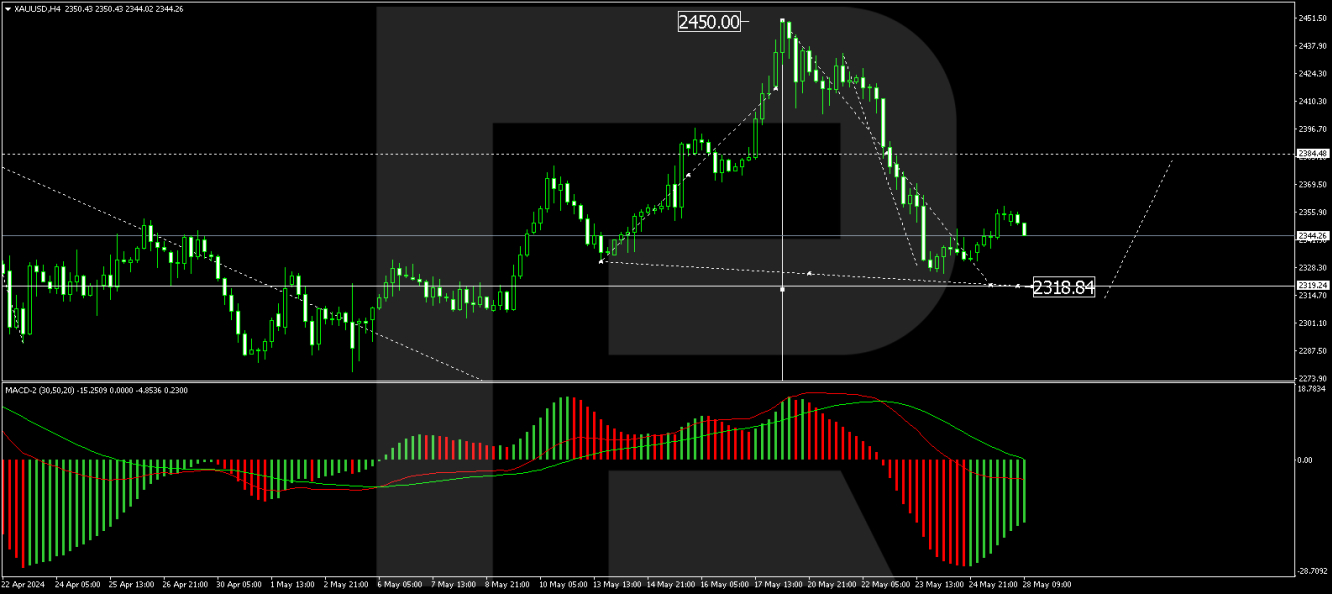

On the H4 chart of XAU/USD, a second downward impulse to the 2340.00 level has been formed. Today, a correction to 2358.50 has been executed. A downside movement to 2341.44 is expected, where a consolidation range may form. If the price breaks upwards from this range, a further correction towards 2384.80 could be considered. Conversely, a downward breakout could open the potential for a decline to 2318.80, the first target of the decline wave. This scenario is technically supported by the MACD indicator, with its signal line below zero and pointing strictly downwards towards new lows.

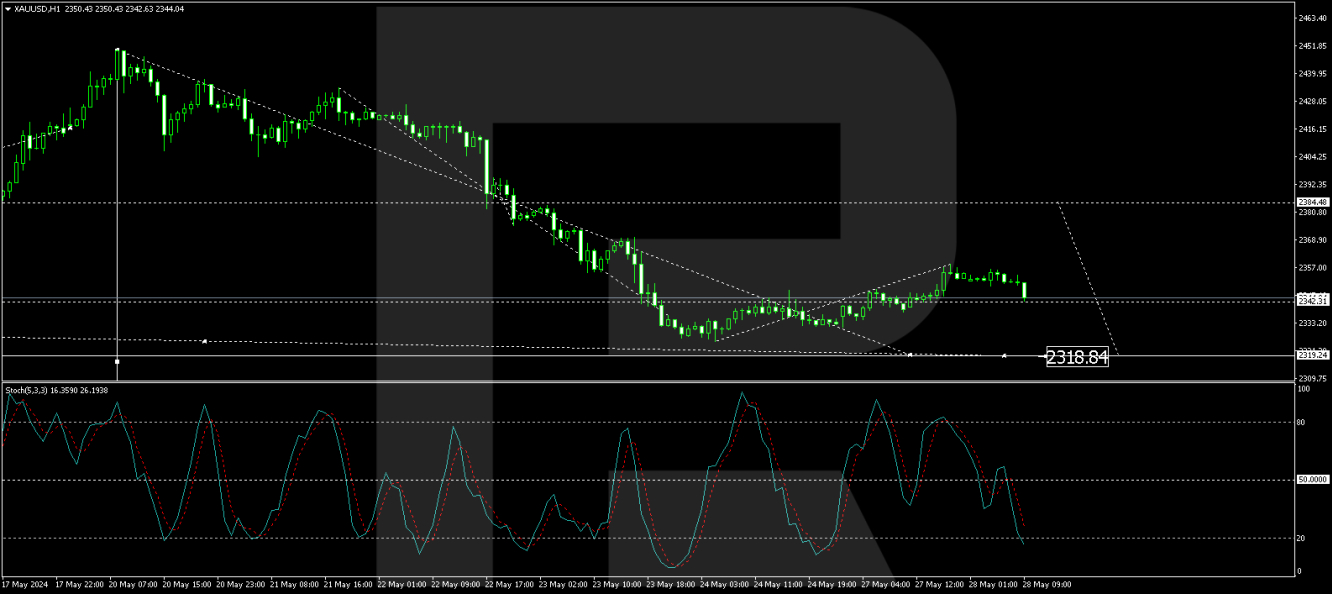

On the H1 chart, a decline to 2325.40 has been executed, followed by the formation of a growth structure to 2342.31. A consolidation range has formed around this level, with a correction wave to 2358.50, starting with an upward exit. Today, a decrease to 2342.31 (testing from above) has been executed. The new consolidation range is practically outlined. A downward breakout from this range could lead to another downward impulse to 2318.85. Further development towards 2384.50 is possible if the price breaks upwards, continuing the correction to 2384.85. Afterwards, a decline along the trend to 2318.85 is likely. This scenario is technically confirmed by the Stochastic oscillator, with its signal line having broken through 50 and continuing its decline to 20.

Summary

Gold prices are rising due to a weaker US dollar and anticipation of key US inflation data. Technical indicators suggest potential corrections and further declines, with significant support and resistance levels to monitor. Investors should closely follow the upcoming data and Fed communications for additional market direction.

By RoboForex Analytical Department

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Prices Edge Towards $2351 Amid Weakening US Dollar

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.