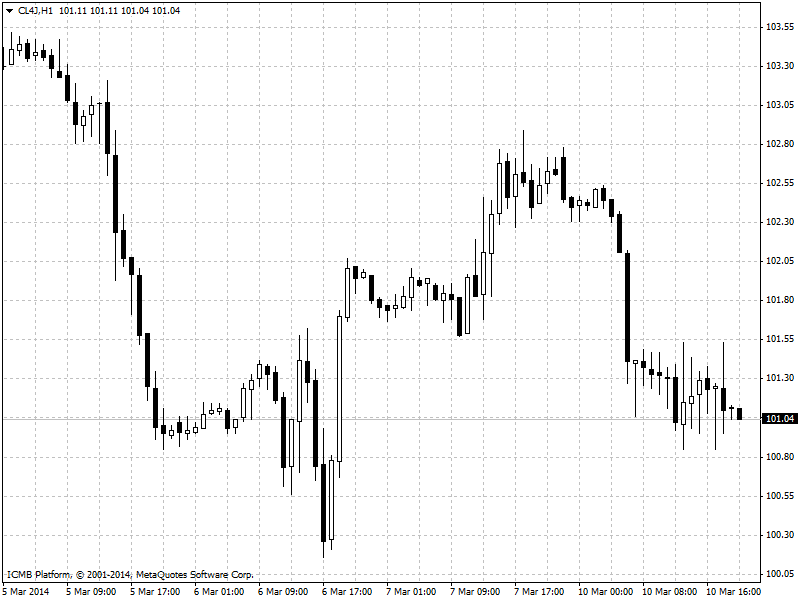

CL

Crude prices took a dive on Monday after poor Chinese trade figures spooked investors with fears emerging-market economies are cooling and will consume less fuel and energy. Weak Chinese trade data bruised oil prices on Monday. Data released over the weekend revealed that Chinese exports fell 18.1% on-year in February, defying expectations for a 6.8% increase, following a rise of 10.6% in January. A separate report showed that the annual rate of inflation in China slowed to 2.0% in February, from 2.5% in January. The numbers confirmed market fears that emerging markets are cooling. China is the world’s second-largest consumer of crude oil. Cushioning losses, however, awere ongoing geopolitical tensions in Ukraine and Libya, which could threaten global supply if escalated.

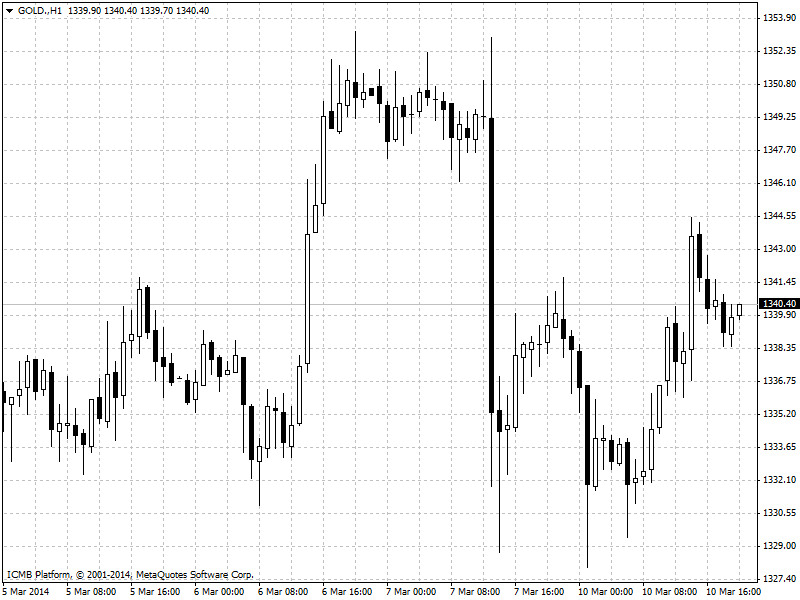

GOLD

Gold prices edged higher on Monday as the ongoing Russian standoff in Ukraine bolstered the yellow metal's appeal as a hedge, though Friday's strong U.S. jobs report and soft Chinese trade figures watered down gains. Gold gains on Ukraine standoff, soft Chinese data weigh Ongoing geopolitical tensions in Ukraine bolstered gold's appeal as a hedge on Monday. Russia remained at odds with the West on how to end the standoff in Ukraine, while U.S. Secretary of State John Kerry declined an invitation to visit Russia for further discussions, which boosted gold prices. Strong U.S. employment numbers and weak Chinese trade figures strengthened the dollar and capped gold's gains, as the two asset classes tend to trade inversely with one another. The Bureau of Labor Statistics reported Friday that the U.S. economy added 175,000 jobs in February, beating expectations for a 149,000 increase. January's figure was revised up to 129,000 from 113,000. The data extended the dollar's gains into Monday, as the Federal Reserve has said it will pay close attention to data when deciding on how quickly it will dismantle its monthly bond-buying program.