Gold tested $2,000 for the second time this month but found it difficult to stabilize above this key level due to a lack of fundamental drivers and thin trading volumes in the second half of the week. Although next week’s economic calendar will offer high-tier data releases, XAU/USD’s stabilization above $2,000 could depend on a steady decline in the US Treasury bond yields.

Gold price lacked direction this week

Following Monday’s quiet trading, Gold gathered bullish momentum and climbed to its highest level since early November above $2,000 on Tuesday. Although the minutes of the Federal Reserve’s October 31-November 1 policy meeting offered some hawkish remarks, the US Dollar (USD) struggled to find demand as risk flows continued to dominate the financial markets.

“Participants noted that further tightening of monetary policy would be appropriate if incoming information indicated that progress toward the Committee's inflation objective was insufficient,” the Fed said in its publication.

Nevertheless, the market positioning regarding a Fed rate cut as soon as June next year was largely unaffected, considering that the meeting took place before the US Bureau of Labor Statistics reported a noticeable softening in Consumer Price Index (CPI) inflation in October.

The number of first-time applications for unemployment benefits in the US declined to 209,000 in the week ending November 18 from 233,000 in the previous week, the Department of Labor reported on Wednesday. This reading helped the 10-year US Treasury bond yield stage a rebound and caused XAU/USD to retreat back below $2,000 mid-week.

As the market action turned subdued amid thin trading conditions on the US Thanksgiving Day holiday on Thursday, Gold went into a consolidation phase and spent the second half of the week fluctuating in a narrow channel above $1,990.

Gold price could be impacted by US data and Fed commentary next week

The US Bureau of Economic Analysis will release the second estimate of the annualized third-quarter Gross Domestic Product (GDP) growth on Wednesday. A significant downward revision to the initial estimate of 4.9% could weigh on the USD with the immediate reaction and help XAU/USD edge higher.

In the early Asian session on Thursday, NBS Manufacturing and Non-Manufacturing PMI from China will be watched closely by market participants. Signs of improvement in the business activity in China, the world’s biggest consumer of Gold, could support XAU/USD.

Later in the day, Personal Consumption Expenditures (PCE) Price Index data will be featured in the US economic docket. Unless the monthly Core PCE Price Index rises more than 0.5% in October, the market expectation that the Federal Reserve (Fed) will start reducing the policy rate in the second half of 2024 is unlikely to change. Finally, the ISM Manufacturing PMI for November will be released on Friday. An unexpected rebound to above 50 in the headline print could provide a boost to the USD ahead of the weekend.

Investors will continue to pay close attention to comments from Fed officials ahead of the blackout period that will start on December 2. Before the Fed’s blackout period, Chairman Jerome Powell will deliver a speech on Friday. The CME Group (NASDAQ:CME) FedWatch Tool shows that markets are pricing in a 22% chance that the Fed’s policy rate will remain unchanged at 5.25%-5.5% by June next year. In case Fed policymakers push back against the market positioning and try to convince participants that they will not consider rate reductions for a longer period, the USD could find a foothold and make it difficult for XAU/USD to gather bullish momentum.

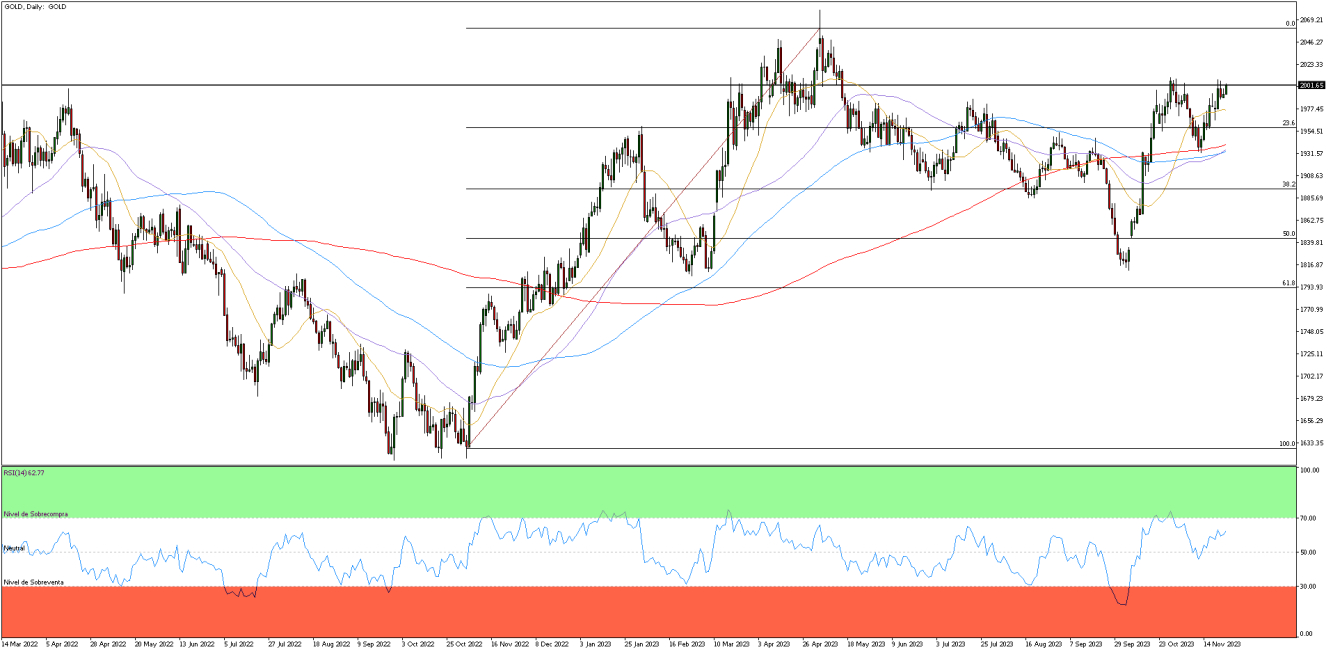

Gold technical outlook

The Relative Strength Index (RSI) indicator on the daily chart turned flat near 60, suggesting that XAU/USD is struggling to gather momentum despite keeping the bullish bias. Key resistance is located at $2,000 (psychological level, static level). Once the pair confirms it as support, technical buyers could take action. In this scenario, $2,010 (static level) and $2,040 (static level) could be set as the next bullish targets.

On the downside, the 20-day Simple Moving Average (SMA) forms dynamic resistance at around $1,980. A daily close below this level could open the door for an extended slide toward $1,950 (Fibonacci 23.6% retracement of the latest uptrend) and $1,940-$1,935 (200-day SMA, 100-day SMA).