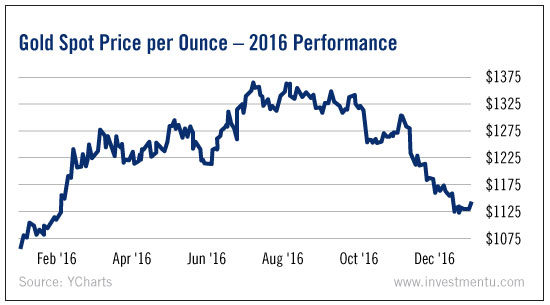

2016 was a strange year for gold. In the first half of the year, a massive bull run brought the price of an ounce near $1,400. But then, in the summer, the bottom fell out on this rally, and the yellow metal finished the year under $1,150. In short, last year was a roller coaster of gold price trends.

Today, analysts are wondering what lies in store for gold in 2017. Will gold recover from its autumn rout? Or was it the beginning of a longer bear market for the shiny stuff?

It’s only mid January now, so it’s far too early to say for sure. But to take a guess at 2017’s biggest gold price trends, we’ve gathered the most insightful takes from the fields of technical analysis, investment banking and economics.

The Technical Analysis Take

We’re not exactly devoted chartists at Investment U. As Alexander Green explained in an article last fall, many technical analysts use their craft as part of a misguided attempt to time the market. But when used to analyze one specific asset, technical analysis can yield some interesting insights.

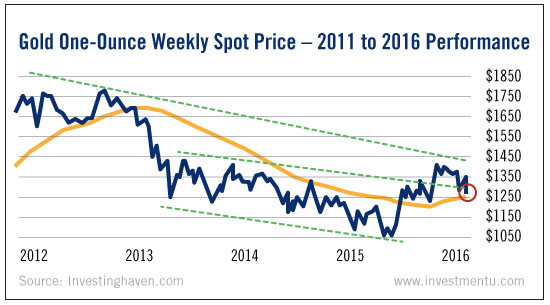

And the news from the charts isn’t great for gold. The price of an ounce has faltered around $1,400 for years now. Every bull market since 2013 has failed to breach this line. What’s more, five-year gold price trends are still sloping downward. Many technical analysts suspect that this long-term bearish trajectory could take gold below $1,000 in 2017.

The Banks’ Take

The banks have been a bit more optimistic about the near future of gold prices. But we wouldn’t call them bullish.

Most of the major investment banks have released their own research about 2017 gold price trends, and their predictions do vary by a few hundred dollars. But in general, the big banks think the price of gold will be stagnant over the next year.

Bank of America (NYSE:BAC) expects a price of around $1,200 per ounce in mid-2017. Credit Suisse (NYSE:CS) and United Bankshares (NASDAQ:UBSI) are a bit more optimistic, forecasting prices around $1,350 throughout 2017. Almost all of the banks feel that the price of an ounce will remain within a couple hundred dollars of where it is now.

The Macroeconomic Take

Gold is a “fear asset.” It tends to rally when people feel uncertain about mainstream financial markets and when other hedges are unappealing. The first half of 2016 is a perfect example. U.S. stocks were off to a bumpy start, and interest rates had just been raised from zero to 25 basis points. Unsurprisingly, gold rallied in this environment of fear and low yields.

Today, neither of those conditions apply. The stock market rallied handsomely in the second half of 2016, and interest rates went up again. Now at the beginning of 2017, people are feeling optimistic about the stock market. And at least for now, most investors believe we’ll see a couple more rate hikes in the next year.

Gold doesn’t like that one bit. There’s a negative correlation between gold prices and interest rates. Both gold and U.S. bonds are hedges used by fearful investors, so they tend to “compete” with each other. And for the same reason, gold tends to underperform during stock market rallies.

It’s important to take these early 2017 predictions with a grain of salt. A lot could happen in the next year. The stock market could reverse course; so could interest rates -- particularly in the event of a downturn. And our new government obviously represents a big unknown.

But barring some kind of economic cataclysm, gold price trends look to be pretty bearish in 2017. Financial markets are doing pretty well, interest rates are rising, and banks and chartists alike are skeptical about the yellow metal’s chances of appreciating next year. There aren’t many good reasons to be a gold bull right now, but there are a few compelling arguments for bearishness.

Gold bulls had a disappointing year after the exciting start of 2016. Based on where we stand now, they could be in for more disappointment in the months ahead.