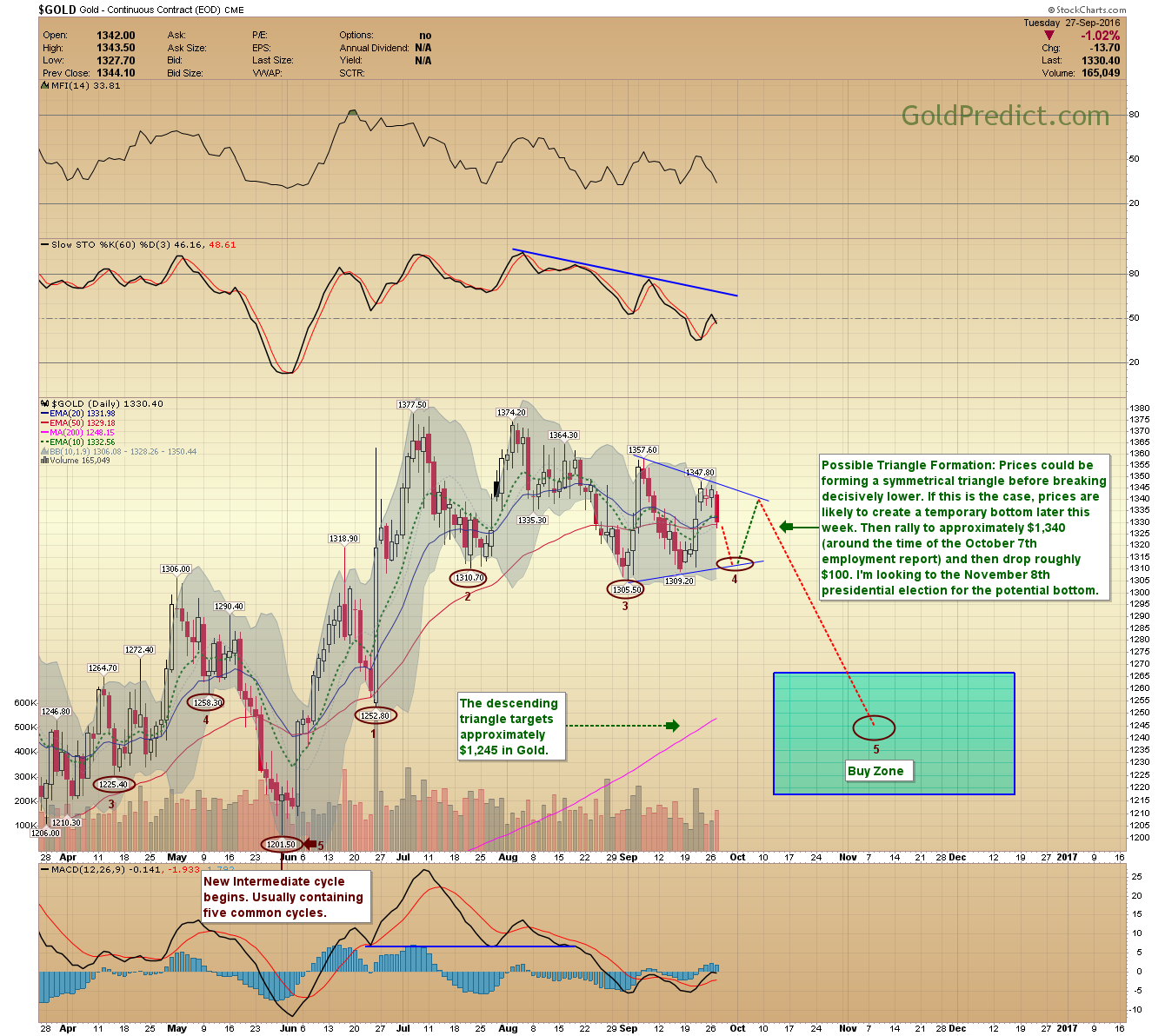

I see potential triangles forming in several of the precious metal charts. Prices will eventually break lower from these consolidations and drop into the next intermediate low. I'm yet to see a low risk shorting opportunity, I'll inform members if one should arrive. This would be just a small position playing the final leg lower into the Buy Zones.

-Gold- Possible Triangle Formation: Prices could be forming a symmetrical triangle before breaking decisively lower. If this is the case, prices are likely to create a temporary bottom later this week. Then rally to approximately $1,340 (around the time of the October 7th employment report) and then drop roughly $100 from there. I'm looking to the November 8th presidential election for a potential bottom. The 5th leg of the intermediate cycle should drop well into the Buy Zone. Preliminary targtes support a run to $1,520 after gold bottoms this fall.

-SILVER- Silver may be forming a triangle as well. Prices dropping below $18.46 will signal that the final drop into the Buy Zone is underway.

-VanEck Vectors Gold Miners (NYSE:GDX)- Prices may continue in a triangle formation or just keep falling from here. Sometimes when a triangle is so obvious, it fails to follow the path everyone expects.

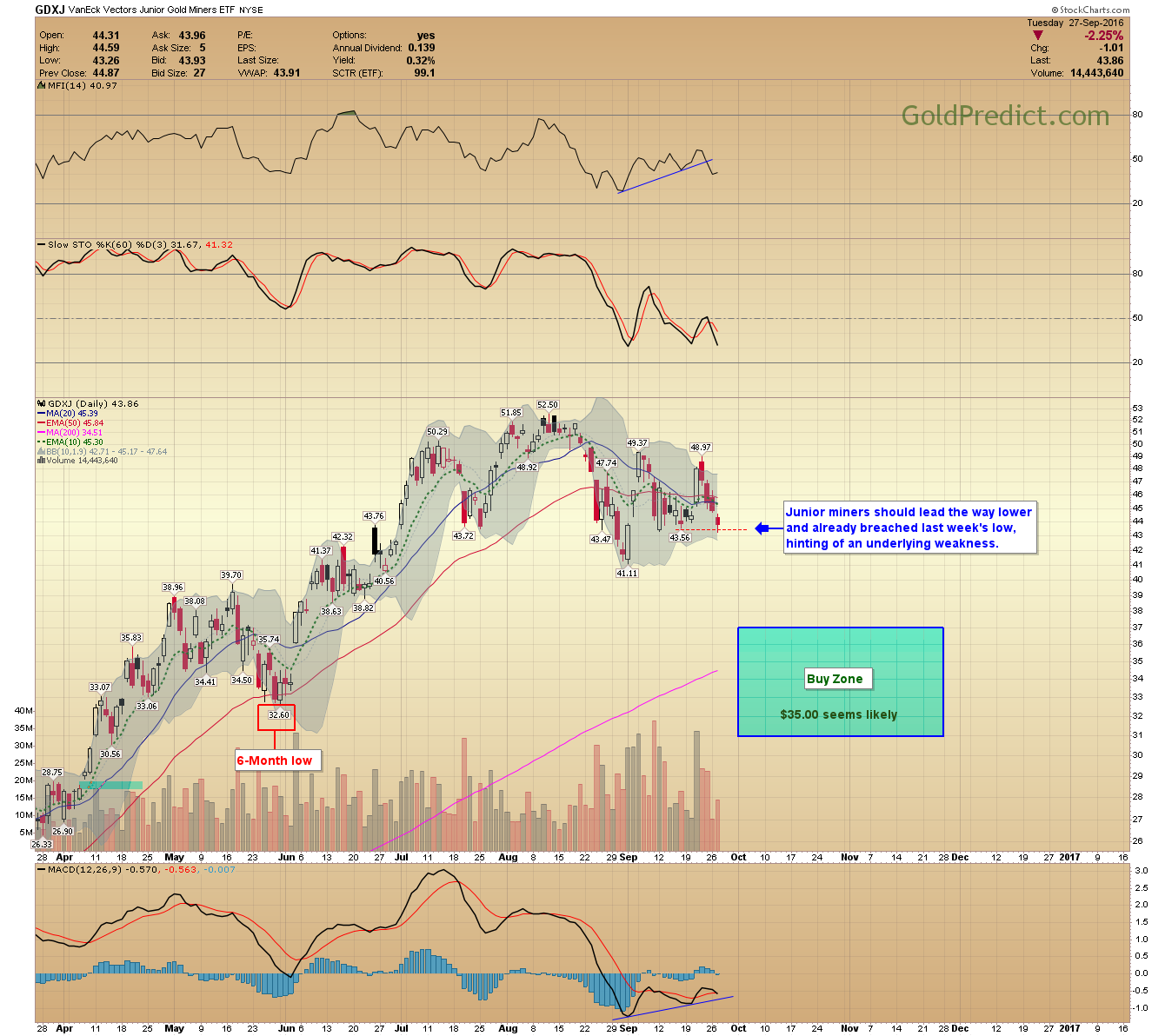

-VanEck Vectors Junior Gold Miners (NYSE:GDXJ)- Junior miners should lead the way lower and already breached last week's low, hinting of an underlying weakness.

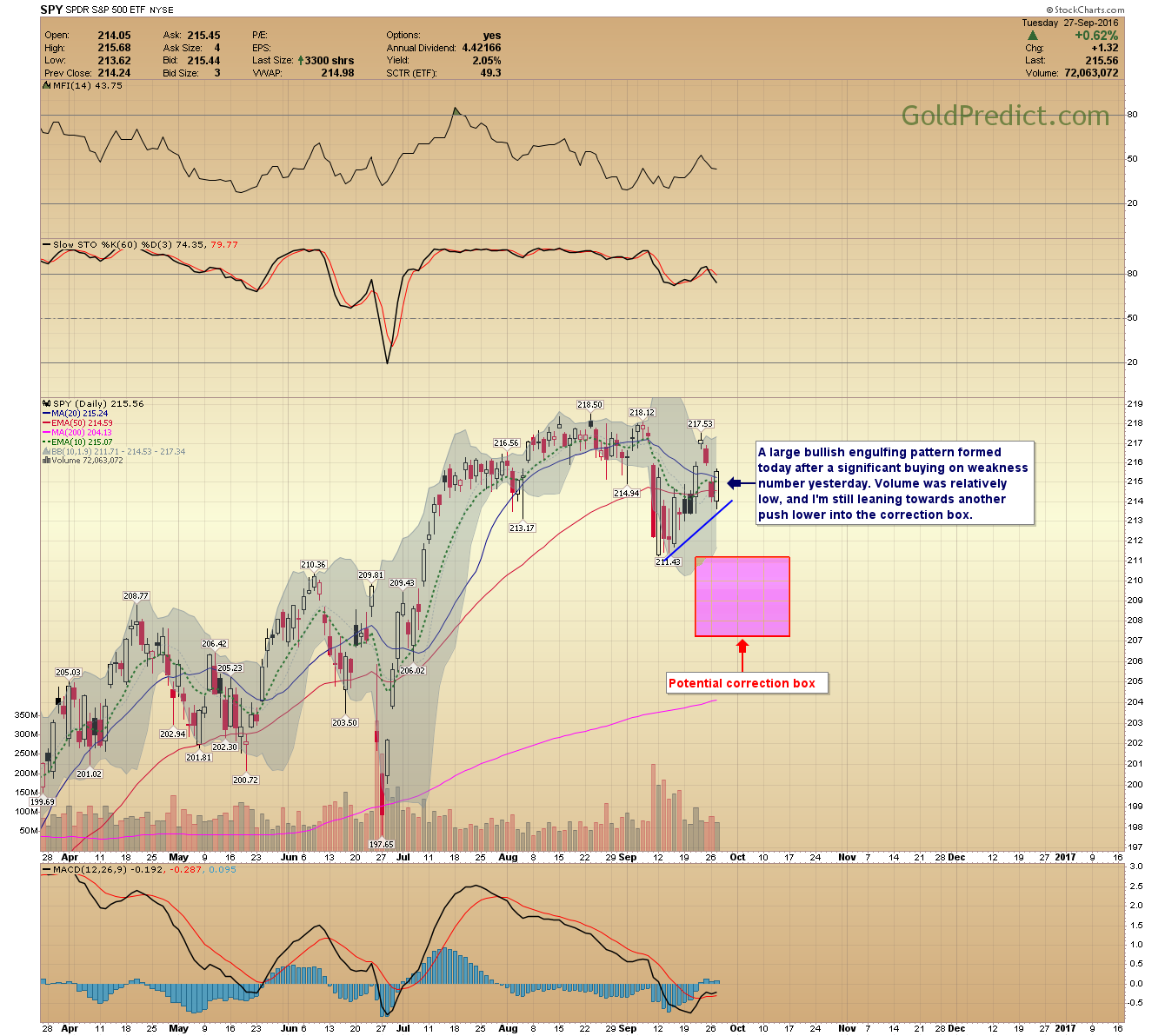

-SPY- A large bullish engulfing pattern formed today after a significant buying on weakness number yesterday. Volume was relatively low, and I'm still leaning towards another push lower into the correction box.

-WTIC- Prices continue to consolidate. It stands to reason they will drop as gold falls into the intermediate low.

The inability for gold prices to maintain the rally after the Fed and BOJ meetings reinforces our Buy Zone Targets.