Recently, with gold, silver, and gold stocks overbought by almost every technical measurement, almost every gold investor in the West knew there had to be a pause in the action. All that was needed was a catalyst.

The April 12 margin hike announcement for Shanghai gold futures contracts was that catalyst. It capped the rally and the big question for investors is… what’s next?

Some insight into this key matter. After a “flagpole” move higher on the weekly chart, the formation of a bull flag is a reasonable scenario.

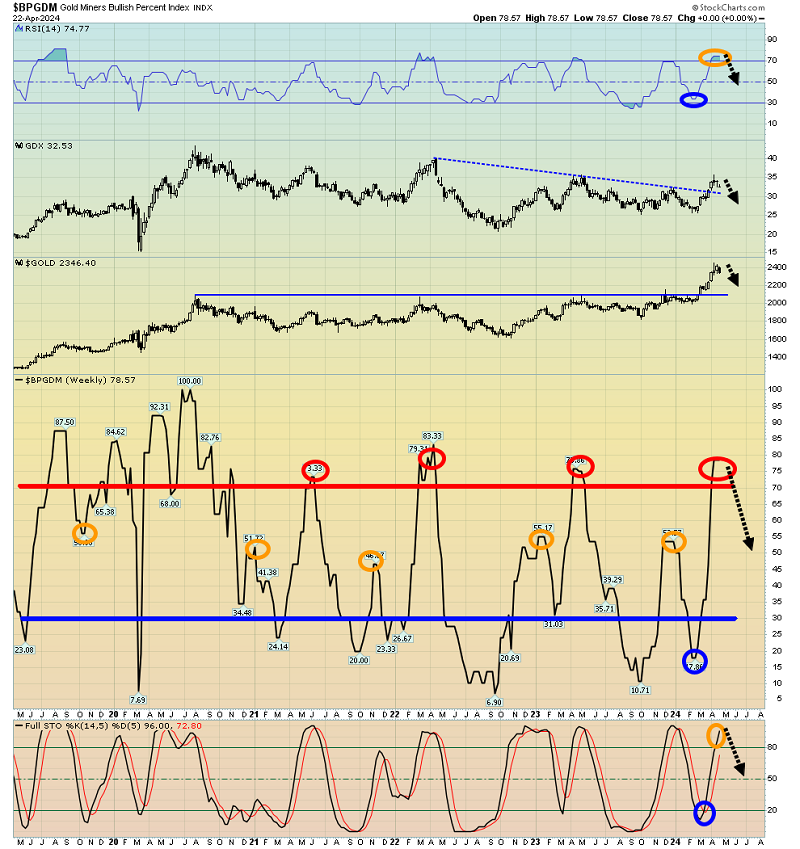

Oscillators like RSI and Stochastics are substantially overbought. When a flag pattern forms, they often pull back the 50 zone… which can act as a launchpad for a fresh momentum-oriented surge.

The weekly sentiment index chart. It’s also overbought, and a gold market bull flag that takes a month or so to form would likely see the BPGDM pull back to its momentum zone of 50.

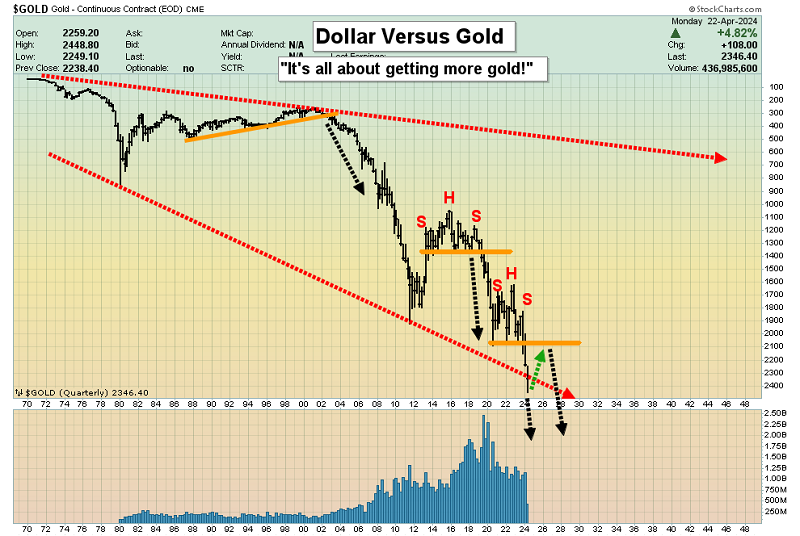

A look at the short-term chart. If a bull flag unfurls on the weekly chart, the most likely zone for it to end is $2220-$2150.

I suggest buying gold bullion at $2265, but for silver and gold stocks, the zone of focus is $2220-$2150.

It’s possible that gold bottoms here and resumes the rally or range trades between $2432 and $2300, but for actual buying, it’s important that investors choose prices and set-ups that offer the highest odds of success.

In a nutshell, gold (via ETFs, futures, jewellery, coins, bars, etc.) can be bought at $2265, $2220, and $2060, while silver and mining stocks are buys at $2220 and $2060.

Buy size? If gold goes to any of the buy zones, it will be important to monitor the action of the technical oscillators. Their status will help determine the size of the buys.

As noted on the chart, in the big picture, it’s all about getting more gold.

Fiat will have surges against the world’s queen of currency, but investors are far better served by adopting the mindset of three billion Chindians… and making it their mission to get more of the ultimate currency that of course can only be gold.

In the West, investors try to use gold to make “big fiat profits”. Analysts have “long term fiat price targets” and there’s an obsession with defining “new bull & bear markets for gold”.

The bottom line: citizens of the West (even many gold bugs) are obsessed with fiat. This, while the East yawns and gets more gold.

The long-term target for fiat against gold is zero. It all goes off the board over time. In contrast, the long-term target for gold is best defined as one of…

Emotional tranquility and financial peace of mind.

When investors try too hard to make gold into a fiat currency slave, they tend to end up in trouble, a look at the dollar against other finite fiats. The dollar is likely peaking about here. Resistance at 107 is just above the current price.

The important US interest rates chart. Rates are also likely peaking. Why is this big H&S top for rates forming as the Fed fails to reign in core inflation?

Well, the US stock market is likely headed for a summer peak. For decades, I’ve defined the Aug 1-Oct 31 time frame as “crash season” and this year could be particularly bad.

The bottom line: If the stock market crashes going into the US election, the Fed will cut rates… even if inflation stays high.

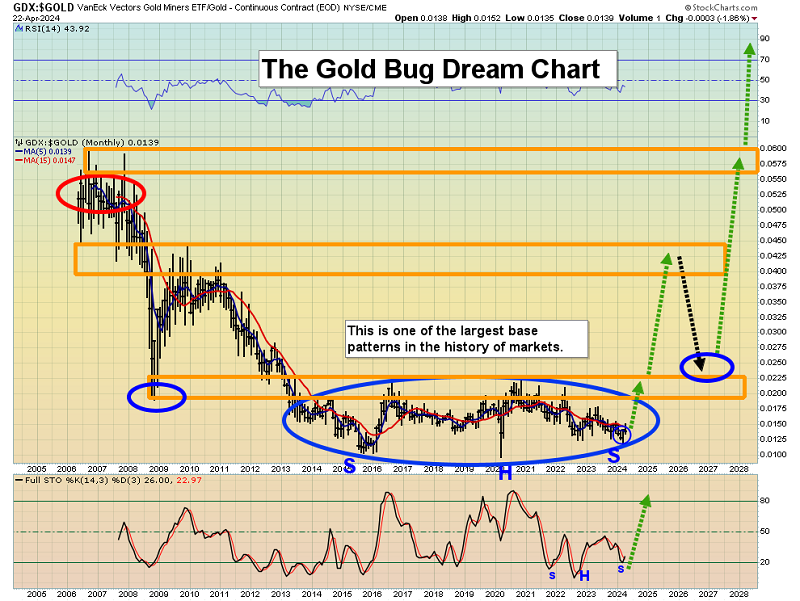

What about the miners? Gold stocks are fabulous tools to make very fast and very large fiat profits, if investors buy them at the key buy zones for gold. Of course, some of that fiat should be converted to gold.

While gold stocks are incredibly overbought on medium-term charts, on the long-term charts versus gold, they are one of the most undervalued sectors of all time… and the huge base pattern in play suggests that a sea change lies dead ahead.

Gold stocks tend to bottom at one of their support zones along with gold, but which one it will be is unknown. That’s why it’s so important to focus on the $2220-$2150 zone for gold. If gold does go there, gold stocks will almost certainly be at support of importance too… and it will time to buy.