- Gold (XAU/USD) tested the $3000/oz level but faces resistance, with key support at 2994, 2982, and 2950.

- Increased Gold ETF inflows and significant central bank buying are supporting gold prices amidst economic uncertainty.

- Geopolitical tensions, sluggish retail sales, and the upcoming tariff deadline are contributing to market concerns and gold’s appeal.

Risk assets appear more stable as the new week begins. US Treasury Secretary Scott Bessent reassured investors, saying that equity corrections are normal and beneficial.

However, Gold prices are showing that market participants are still concerned about Geopolitical developments, sluggish retail sales data and the upcoming universal tariff deadline date of April 2. That is not even taking into account the Federal Reserve meeting this week which may lead to a lot of consolidative price action ahead of the event.

Acceptance Above the $3000 Handle is Key

Gold breached the key psychological $3000 level last week before a pullback. The pullback could be largely attributed to some profit-taking as market participants may have been concerned of a deeper pullback.

Looking at the Gold rally over the past 18 months and each time a significant whole number level such as the $2700, $2800 etc have been broken we have seen significant pullbacks. $3000/oz is an even bigger milestone and one could understand the concerns of market participants, especially with a Fed meeting this week.

The chart below shows Gold’s performance against its safe-haven counterparts. That is not to say that a pullback will not materialize, however this may be seen as a chance for would be bulls to get in on the extended rally.

The chart below shows the performance of Gold against its other safe-haven counterparts such as the Swiss Franc, Japanese Yen, US Dollar and US10Y.

Source: LSEG

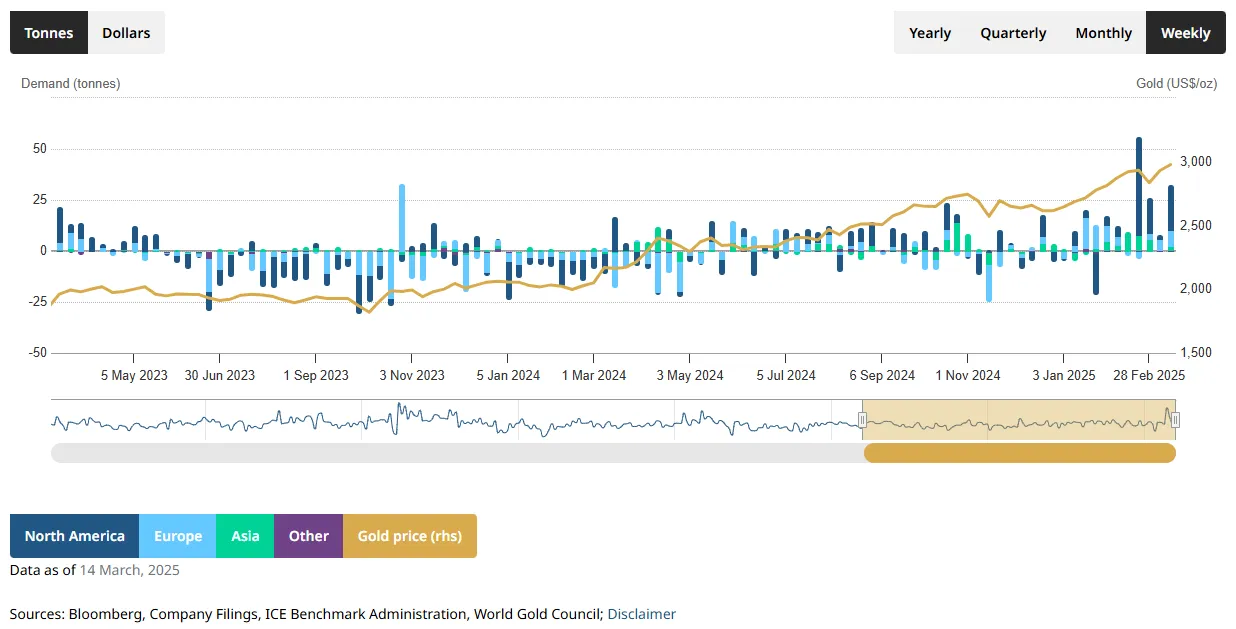

Gold ETF Flows and Central Bank Buying

There has been a significant uptick in Gold ETF (NYSE:GLD) flows over the past few months so much so that it has surpassed Bitcoin as well. Not surprising as Bitcoin prices have declined around 19% over 3 months while Gold has risen around 12 % over the same period.

To put this into perspective, Bitcoin ETFs have seen net outflows of around $3.8 billion since February 24. Gold on the other hand has seen significant inflows since the week starting February 21 with the most recent week ending March 14 seeing inflows of around $1.16B despite the precious metal touching the $3000/oz handle.

Gold exchange-traded fund (ETF) holdings have increased by about 3.88 million ounces this year, reaching nearly 86.7 million ounces, the highest since October 2023. February saw the biggest rise in holdings since March 2022. If this growth continues, it could continue to support gold prices. There is still room for more growth, as the current total is still below the 2020 peak.

Another Sign of the Strong Demand in Play at Present

Source: World Gold Council

Looking at Central Bank demand, since the Russia-Ukraine war began in 2022, central banks have doubled their annual gold purchases from 500 to over 1,000 metric tonnes. Concerns over sanctions, like those placed on Russia, and shifts in currency reserve strategies are driving this trend. Last year, central banks bought 1,045 tonnes, about 20% of global demand, with Poland, India, and Turkey leading in purchases.

Following Trump’s election in November 2024, Comex gold inventories hit record highs, surging over 120% due to tariff fears and profitable price differences. Inventories now stand at 40 million ounces, the highest since 1992, though the pace of inflows has recently slowed.

Final Thoughts

At the moment it’s difficult to see where the downside for Gold is going to come from. As uncertainty reigns over global markets, the stage is set for the precious metal to continue its ascent. Couple that with strong central bank demand, ETF flows and concerns around other safe haven currencies and my point is made for me.

Technical Analysis - Gold (XAU/USD)

From a technical analysis standpoint, this analysis is a follow up from the technicals last week. Read: Will Gold Rally? XAU/USD Price Outlook Amidst Economic Uncertainty

Gold’s price is difficult to decipher at present as we have once again printed a fresh high above the $3000/oz mark.

This makes finding resistance levels particularly difficult given the lack of historical data to go by.

Historically, significant rounded or psychological price levels have often posed challenges for market participants to achieve and sustain acceptance.

For context, It took buyers a year and a half to establish a sustained trend above the $1,000 level. Similarly, the $2,000 level required 3.5 years to break, even with the Federal Reserve’s aggressive monetary policies during the COVID period.

Thus far the $3000/ oz has proved to be the same with Friday’s fall followed by a retest today and a drop once more.

Immediate support levels are identified at 2994 and 2982, with an open run below that range extending down to around the 2950 handle.

On the upside, the all time high will be an area of resistance before the 3025 and 3050 may come into focus now. Once we have a price hold above the 3000 handle we may be able to find more accurate levels.

Gold (XAU/USD) Daily Chart, March 17, 2025

Source: TradingView

Support

- 2994

- 2982

- 2950

Resistance

- 3004

- 3025

- 3050

Most Read: Weekly Market Outlook: Central Banks, US Rates, and Trade War Impact