In the previous weeks we've been featuring multiple factors that are likely to usher in a sizable gold, silver and mining stocks' moves. Has the very recent downswing been the opening act? The USD Index closed flat on Friday, yet the metals declined across the board. The gold to silver ratio presents us with a highly interesting perspective to say the least. Can you say a meaningful clue of upcoming price action?

Yes, it is one. In the previous weeks we've been featuring multiple factors that are likely to result in lower gold, silver, and mining stock values in the following months. The very recent downswing is likely only the beginning of what's to come. There are even more signals pointing in this direction, though.

On Friday, we commented on the gold to silver ratio chart and in today's analysis we would like to provide you with a quick update.

No, the implications didn't change. We simply noticed something new about this chart and wanted to share it with you. Let's start with a quote from Friday's analysis.

Gold to Silver Ratio Chart Outlook

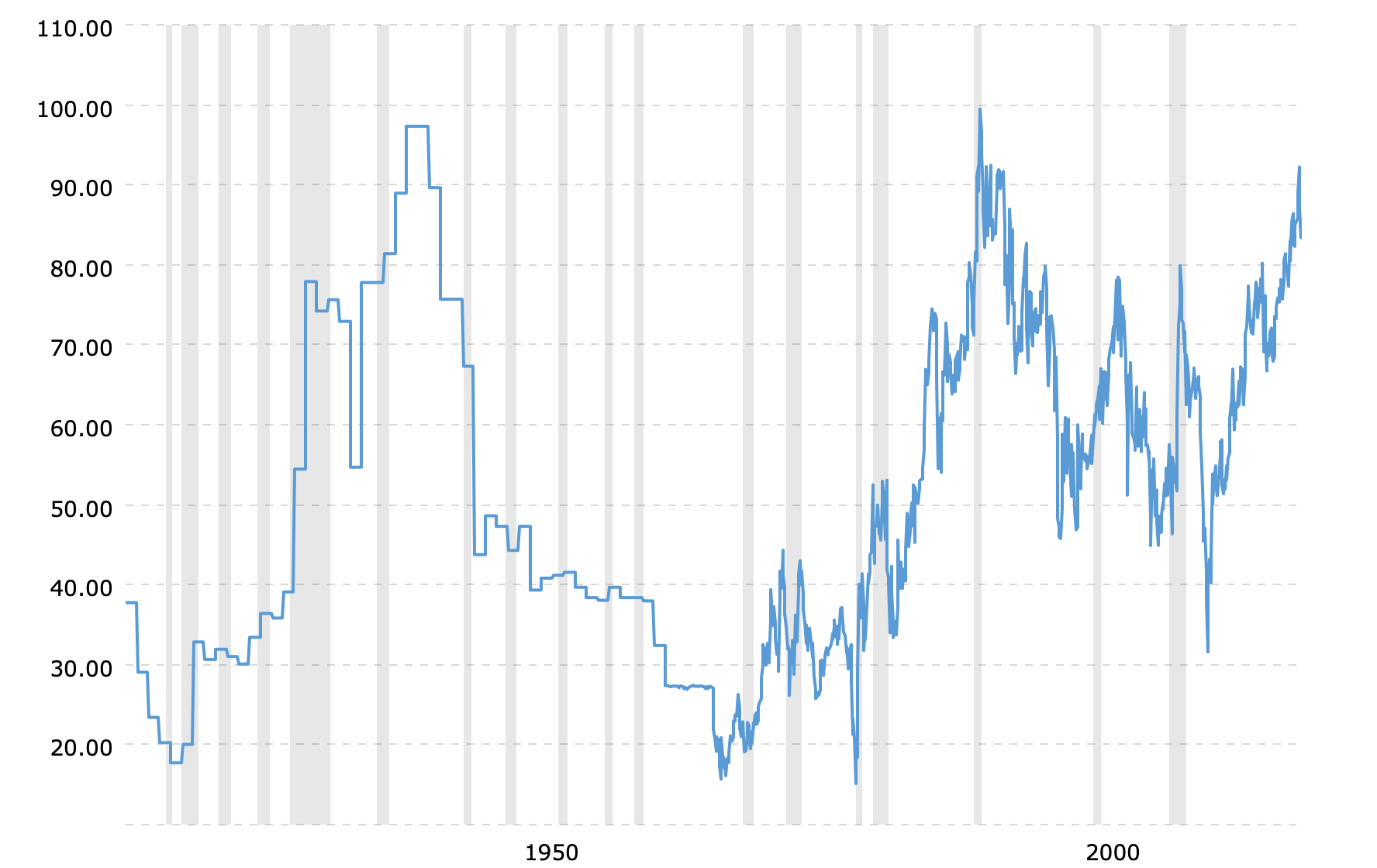

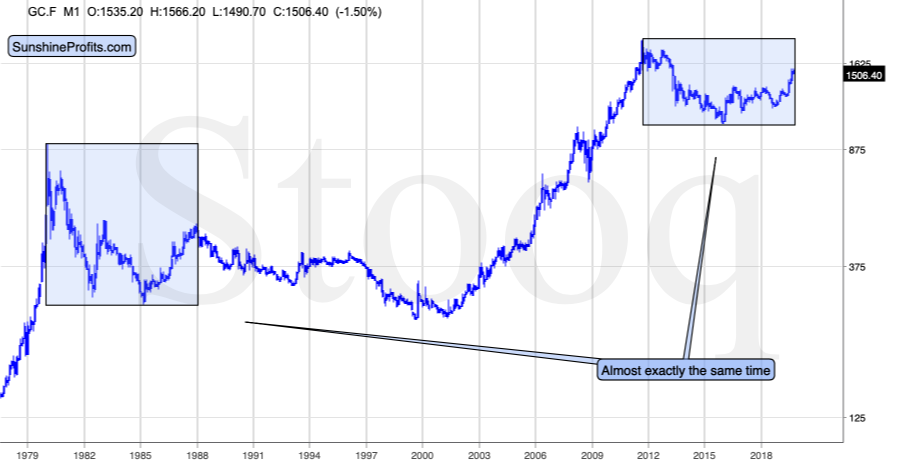

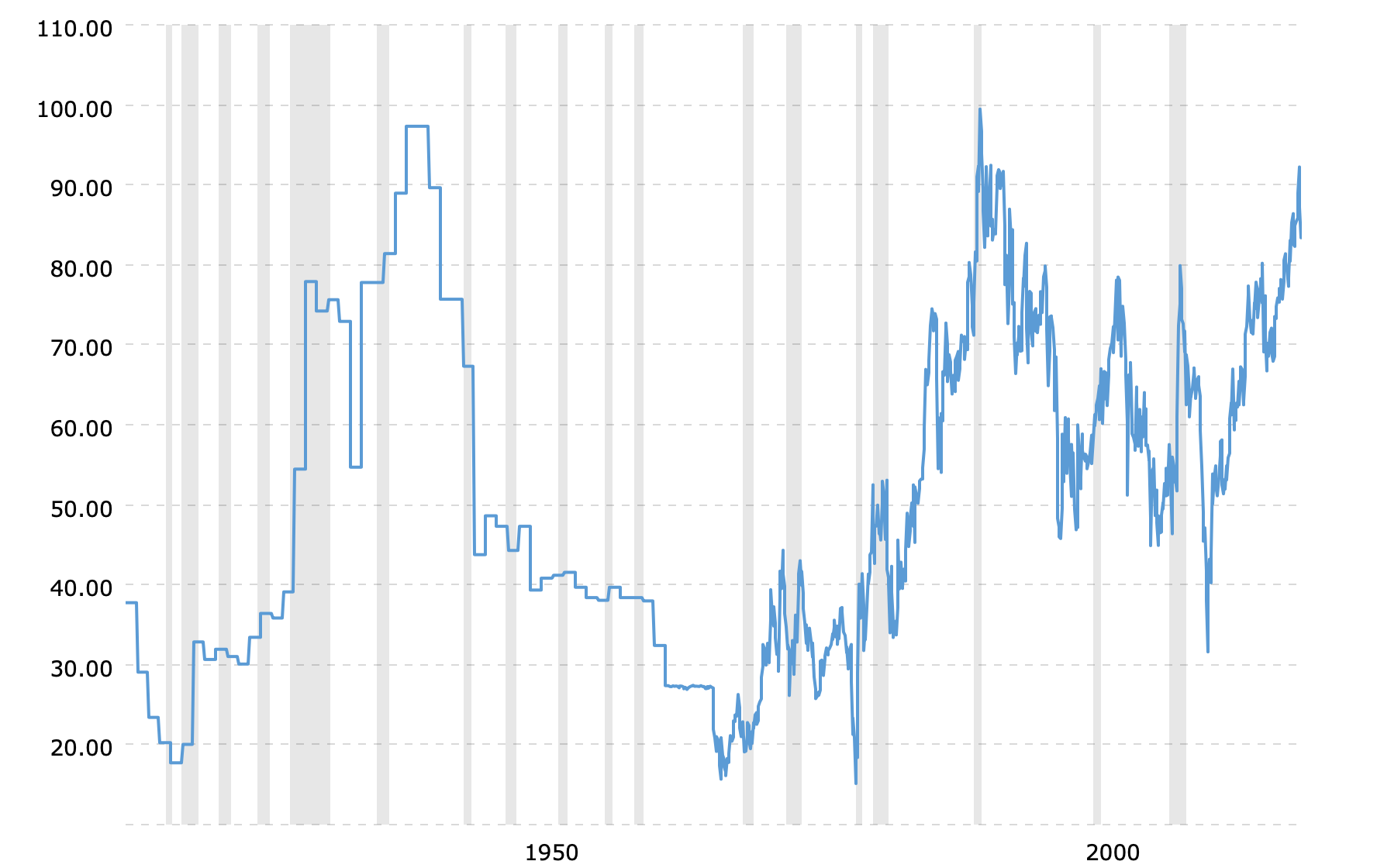

Over 2 years ago, when the gold to silver ratio was trading at about 78, and practically everyone was writing that the ratio moved to a resistance and was about to decline strongly, we wrote an article in which we argued that the 80 level and the most recent highs are not the ultimate long-term resistance and that the real resistance is the 100 level. In the following months, the ratio continued to climb and even soared above 90. It declined sharply after that, which begs the question whether this decline actually changes anything.

Absolutely not, tt doesn't change anything. As we already wrote, no market can move up or down in a straight line and what we saw recently, was just a corrective downswing. It might have appeared to be an important short-term development, but it's not correct to evaluate it in this way. It was a long-term breakout (above the previous highs at about 80) that we saw recently, so one should look at the decline from this point of view. And what does the above very long-term picture tell? That the recent decline is barely visible. The ratio is trading at about 85 at the moment of writing these words, which means that the breakout above the previous highs was just successfully verified.

The implications of the current situation in the gold to silver ratio are bullish for the ratio. And they are bearish for the entire precious metals sector as gold, silver, and mining stocks tend to move - on average, and in the long run - in the opposite way to the ratio's direction.

Once the gold to silver ratio hits 100, it might be a good idea to back up the truck with gold, silver and quality mining stocks, but we're far from this moment at this time.

The thing that we would like to add today is that both massive rallies that ended at about 100 were characterized by a specific development. Namely, there was a visible pullback from the 80 level. We saw the very same thing in 2016. At that time, the corresponding rally in silver seemed like a big rally - perhaps even a game-changer. Yet, the bullish silver forecasts didn't play out as expected - silver is well below its 2016 high. It's even quite visibly below this year's high. The corresponding decline in the gold to silver ratio was a very normal development. What is more, this correction was smaller than the previous ones, suggesting that the uptrend is even stronger this time. The bullish implications for the ratio and the bearish implications for the precious metals sector clearly remain in place.

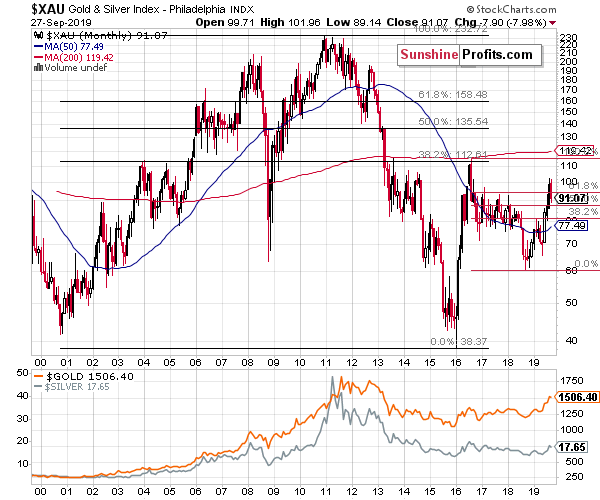

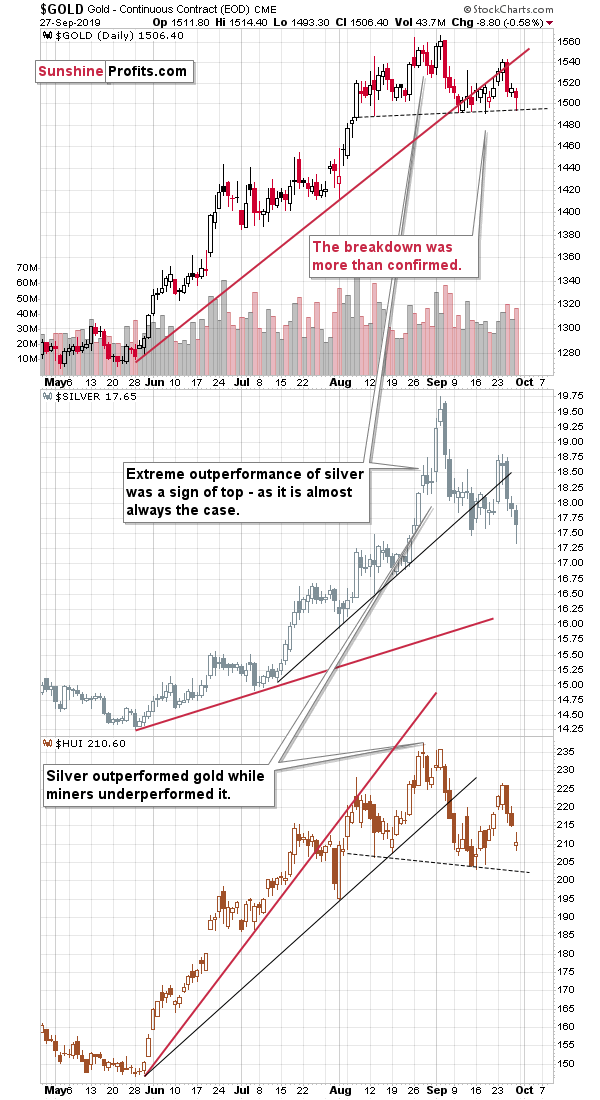

Precious Metals on Friday

The entire trio: gold, silver, and mining stocks declined. Silver even temporarily moved to a new monthly low. The decline was normal and expected. What didn't happen, though, was the breakdown below the neck levels of the head and shoulder patterns in case of gold and the HUI Index. This means that these formations were not yet completed, and we might still see some back and forth movement instead of the continuation of the decline. Completion of the formations will make the next short-term slide very likely.

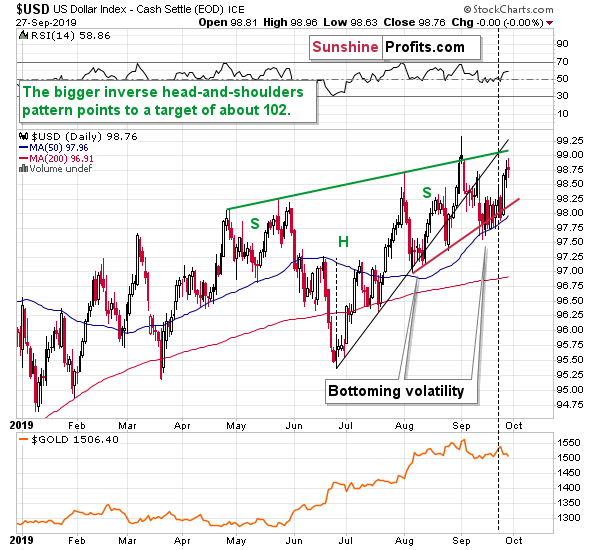

Then again, let's keep in mind that the above-mentioned decline in the precious metals market happened without USD Index's help.

USD Index Went Nowhere on Friday

Despite the intraday movement, the USDX ended the session completely flat. Given the above, it would be normal for the PMs not to decline or rally. And they did decline, so they showed daily weakness, which generally does not bode well for their future performance. The head-and-shoulders formations may have not been completed last week, but the odds are that they will be still completed shortly.