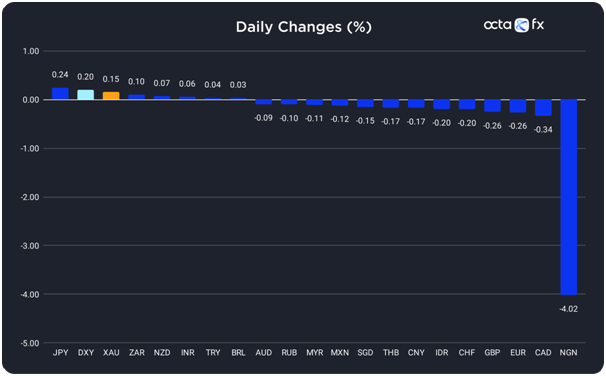

On Thursday, the Japanese yen (JPY) was the best-performing currency among the 20 global currencies we track, while the Nigerian naira (NGN) showed the weakest results. The South African rand (ZAR) was the leader among emerging markets, while the Canadian dollar (CAD) underperformed among majors.

Gold Rose on Thursday But Remained In A Tight Range

Thursday was uneventful, so the gold price was relatively flat, trading in a very tight range from 1,916 to 1,923.

Gold is choppy due to a lack of fresh fundamental news, and it is just trading on technicals favoring the bearish camp at the moment, but some short covering on the dips based on some perceived value buying is keeping it afloat,' said Jim Wyckoff, the senior market analyst at Kitco. The Federal Reserve's (Fed) officials didn't say anything new in their speeches yesterday. Most investors believe there will be no rate hike in September but still acknowledge that further tightening may be required to bring inflation down to the Fed's 2% target. Indeed, yesterday's Jobless Claims data were stronger than expected, pointing to the still tight labor market and suggesting inflation may increase in the future. Fundamentally, it means XAU/USD may continue to move lower.

XAU/USD was rising slightly during the Asian session but continued to trade below the important 1,927 level. Today, the macroeconomic calendar is relatively light. Only the Canadian Employment report at 12:30 p.m. UTC and the speech by the Fed Vice-Chair Michael Barr at 1:00 p.m. UTC might trigger volatility. 'Spot gold may bounce more to 1,935 USD per ounce, as its correction from 1,952 seems over,' said Reuters analyst Wang Tao.

The Canadian Dollar Declined After the US Dollar Strengthened

The Canadian dollar (CAD) lost 0.34% on Thursday as the US dollar rose and set a 6-month high due to the better-than-expected Jobless Claims data.

Yesterday's data showed that Initial Jobless Claims fell unexpectedly to 216,000 last week. These numbers are the lowest since February, suggesting the U.S. economy remains resilient enough to weather more rate hikes. The probability of another rate increase from the Federal Reserve (Fed) this year is around 42%, and the chances may increase if U.S. economic reports continue to be better than expected.

USD/CAD was falling during the Asian session as bulls took profit on their long positions when the pair neared the important 1.37000 resistance level. Today, CAD traders should expect high volatility due to the Canadian Employment report release at 12:30 p.m. UTC. If the figures are better than expected, USD/CAD will likely drop sharply because the pair is in an uptrend. Meanwhile, a weak report may bring USD/CAD towards 1.37000.