Spot gold prices soared to a historic peak of $2,167 an ounce, driven by a robust surge in demand from both investors and central banks. This rally is attributed to the combined forces of impending rate cuts, safe haven buying, and an unpredictable economic landscape.

In a context of geopolitical and economic instability, gold has become an attractive option for investors looking for stability. The yellow metal's price jump is largely due to the anticipation of rate cuts by the Federal Reserve in the latter half of the year. This expectation, coupled with gold’s traditional role as a safe haven during turbulent times, has propelled its demand to new heights.

Why Is Gold Rallying Now?

The rally in gold prices can be attributed to a few key factors. Investors are keenly anticipating rate cuts by the Federal Reserve and the ECB, which tends to make income-producing assets like bonds less attractive in comparison to non-yielding assets like gold. Additionally, gold's safe haven appeal becomes particularly attractive amid heightened geopolitical risks, drawing more buyers to it as a form of security. Moreover, there's a belief among some investors that gold serves as a hedge against inflation, holding its value even as consumer prices rise, which further fuels its demand.

Central Banks' Growing Appetite for Gold

January saw a significant addition of 39 tons to the gold reserves globally by central banks, indicating a consistent strong demand for the yellow metal for a third consecutive year. This is especially significant in countries like China, Germany, and Turkey. The rationale behind central banks' boosting their gold reserves appears to be a strategic move to diversify away from the U.S. dollar amid concerns over the U.S. fiscal deficits. By increasing their holdings in gold, these banks aim to mitigate the risks associated with dollar devaluation and uncertainties in the financial system.

The record surge in gold prices underlines the myriad of economic and geopolitical dynamics at play. As gold continues to be sought after by investors and central banks across the globe, its status as a resilient investment seems only to be reinforced amid uncertain times.

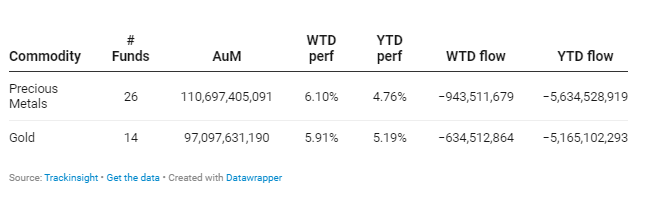

Group Data:

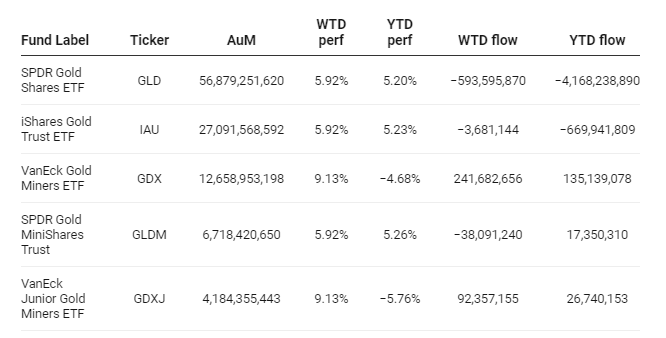

Funds Specific Data: