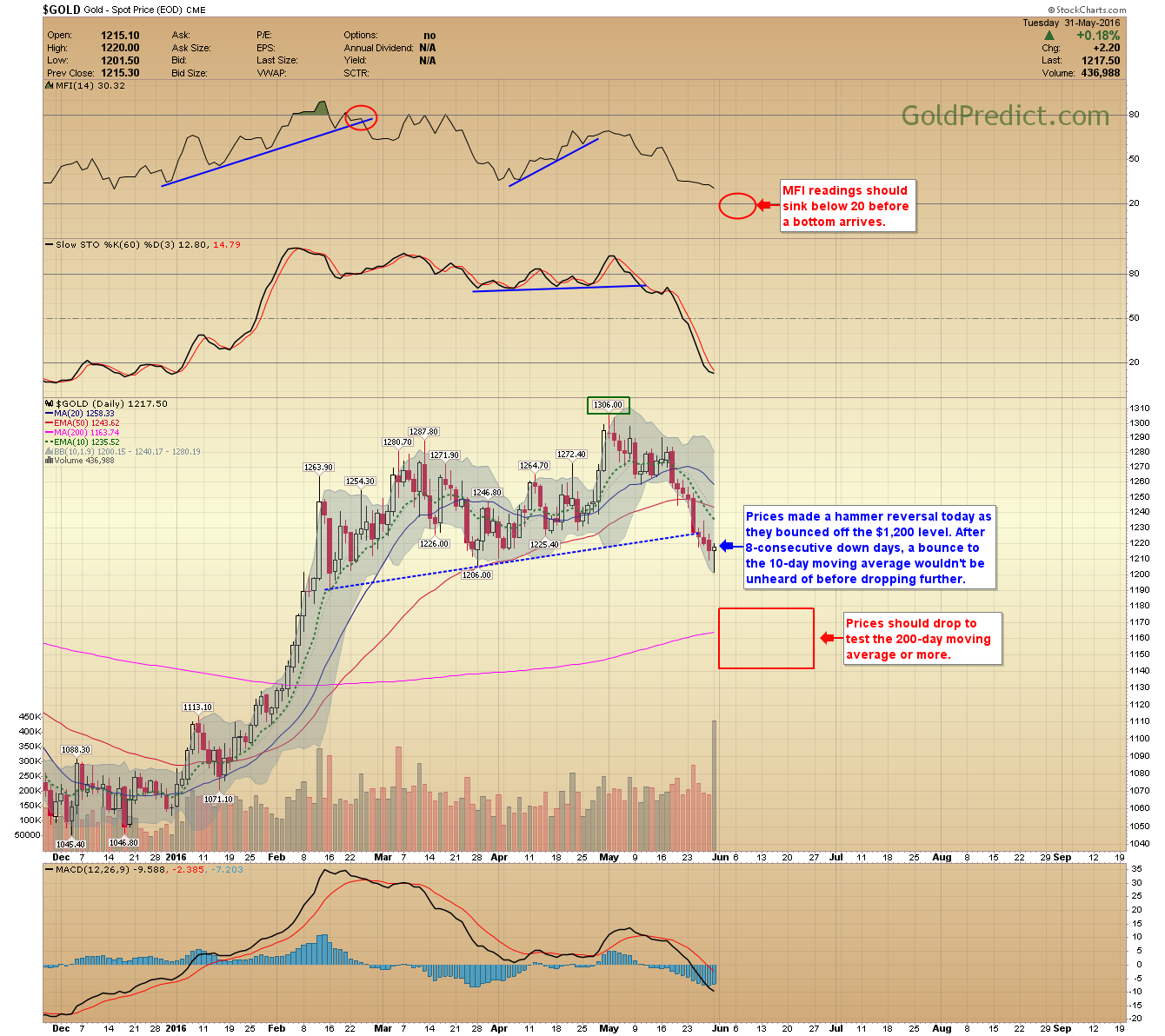

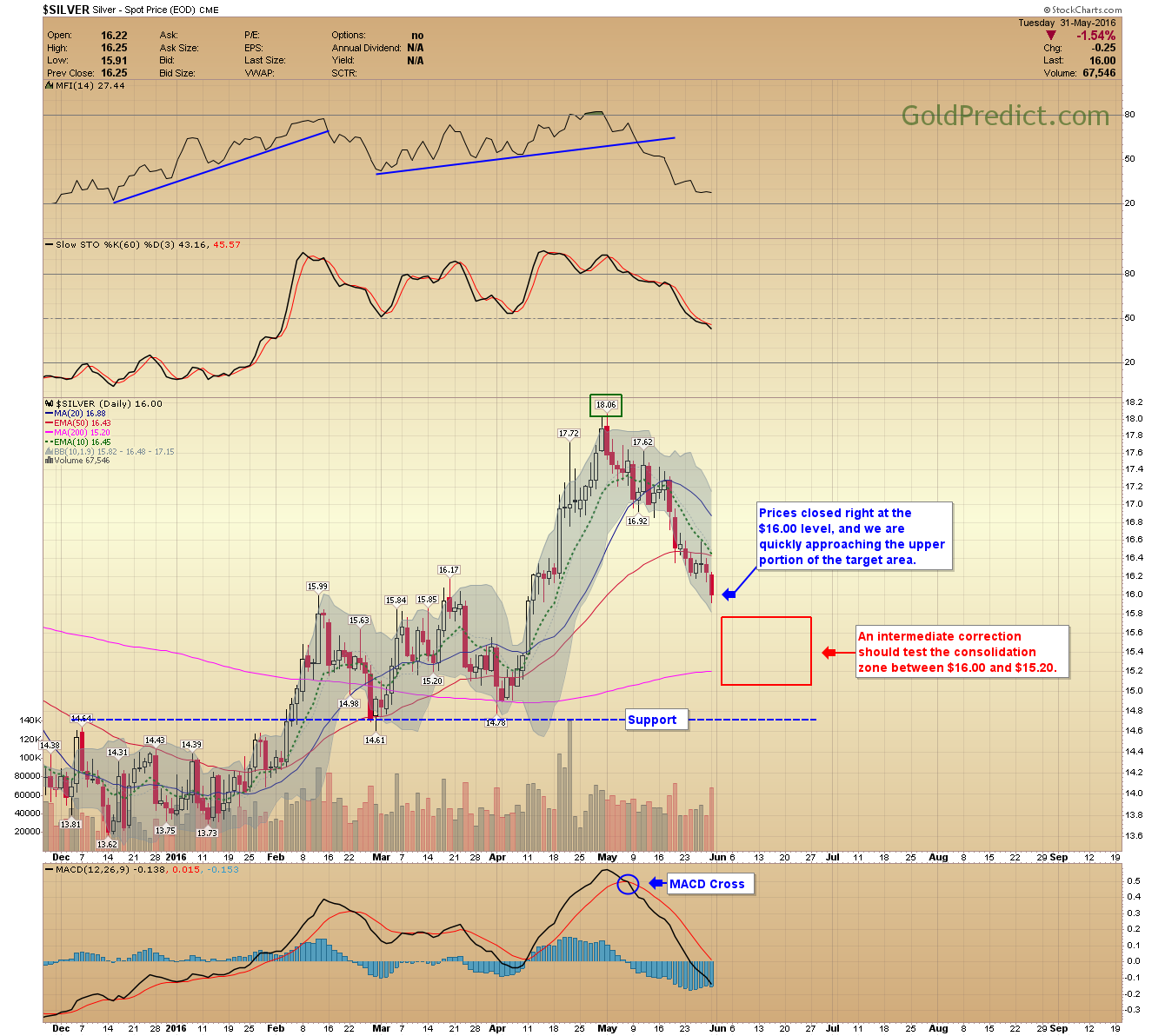

Gold prices bounced off the $1,200 level today, and silver closed right at the $16.00 support. We could see a bounce higher for a few days here or there, but ultimately prices are right on track to meeting their respective target areas later in June.

US DOLLAR - Prices continue higher toward the 200-day moving average which should be the next target.

GOLD - Prices made a hammer reversal today as they bounced off the $1,200 level. After 8-consecutive down days, a bounce to the 10-day moving average wouldn't be unheard of before dropping further.

SILVER - Prices closed right at the $16.00 level, and we are quickly approaching the upper portion of the target area.

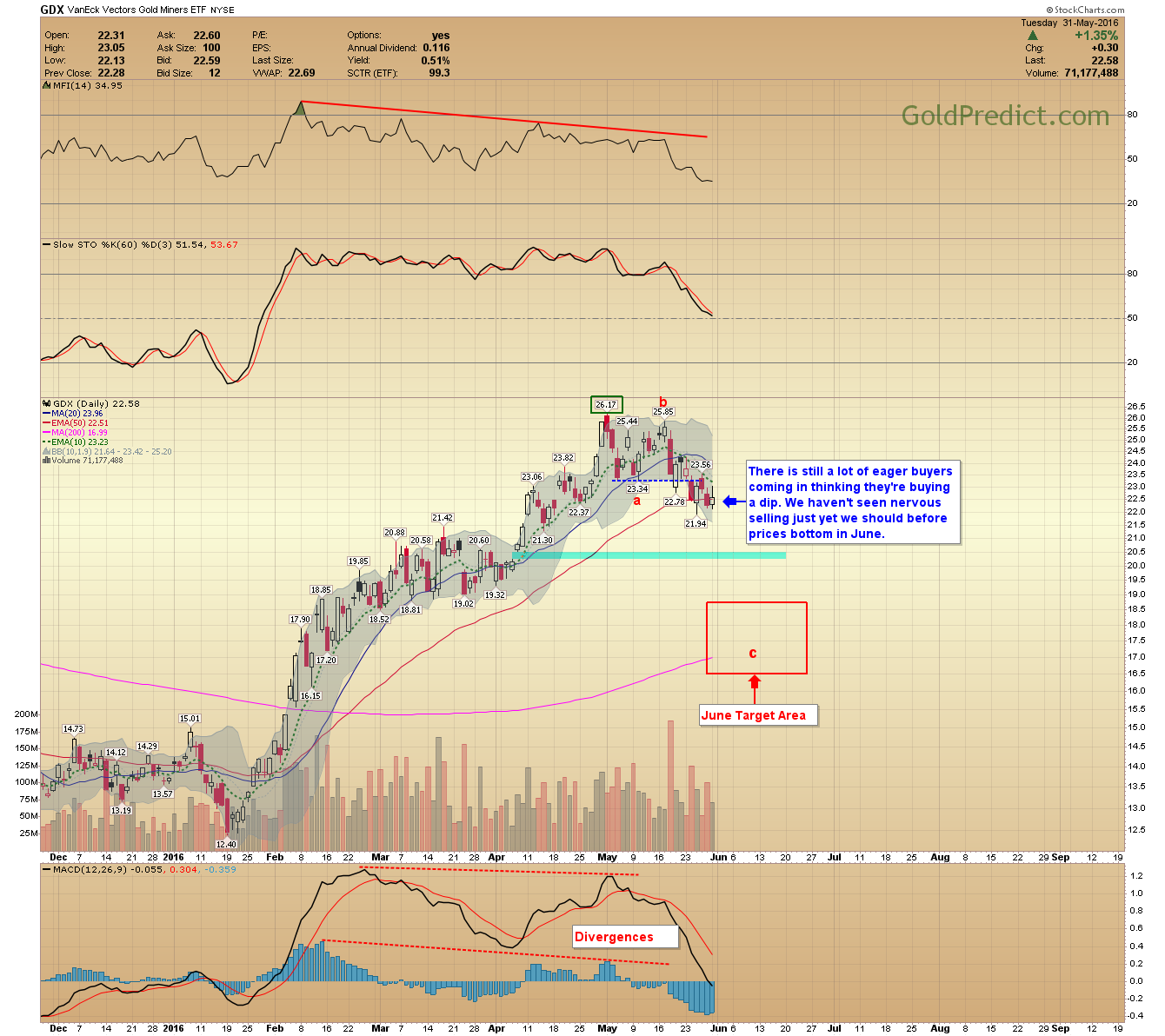

VanEck Vectors Gold Miners (NYSE:GDX) - There is still a lot of eager buyers coming in to buy what they believe is a dip. We haven't seen nervous selling just yet; we should before prices bottom in June.

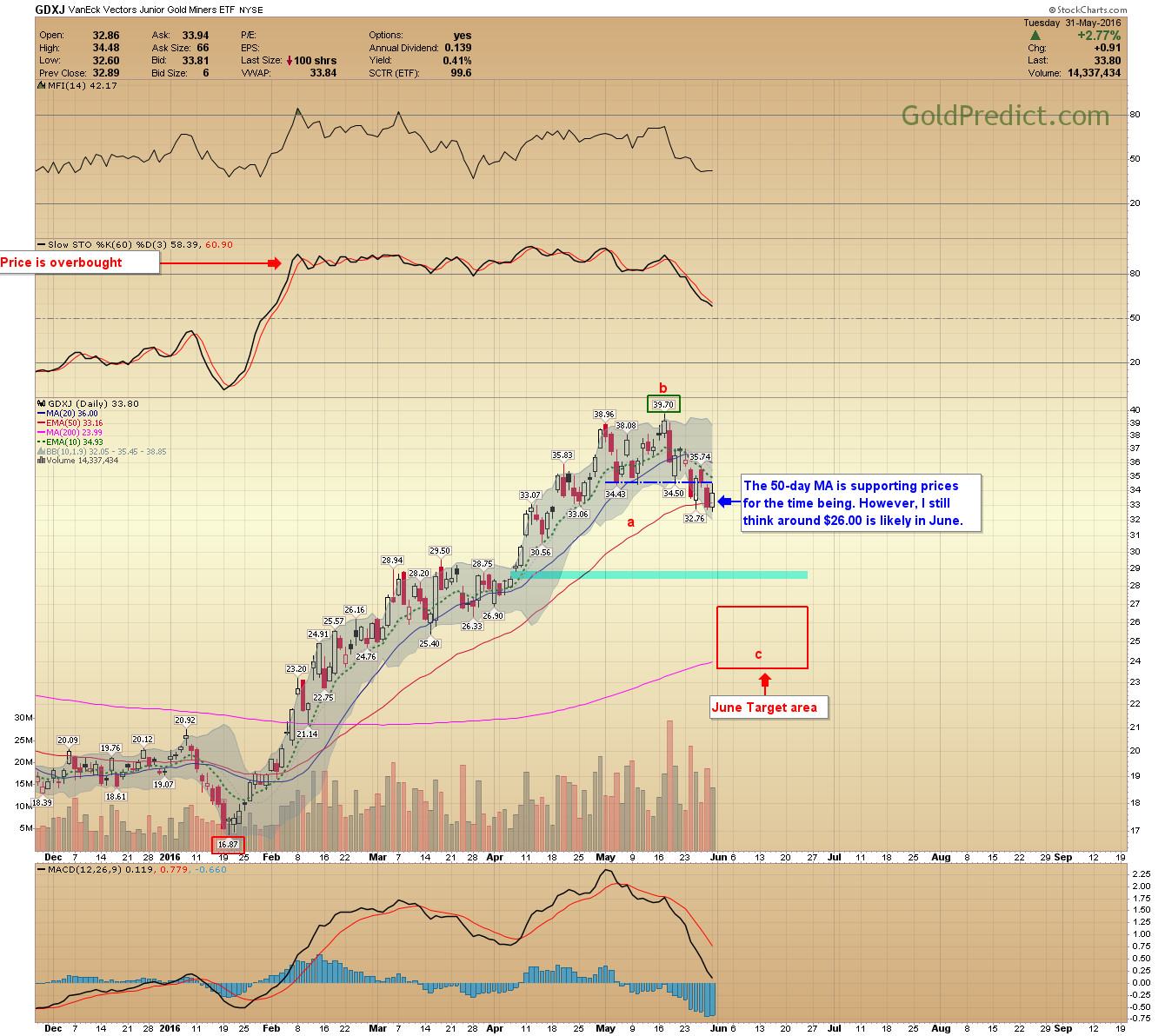

VanEck Vectors Junior Gold Miners (NYSE:GDXJ) - The 50-day MA is supporting prices for the time being. However, I still think around $26.00 is likely in June.

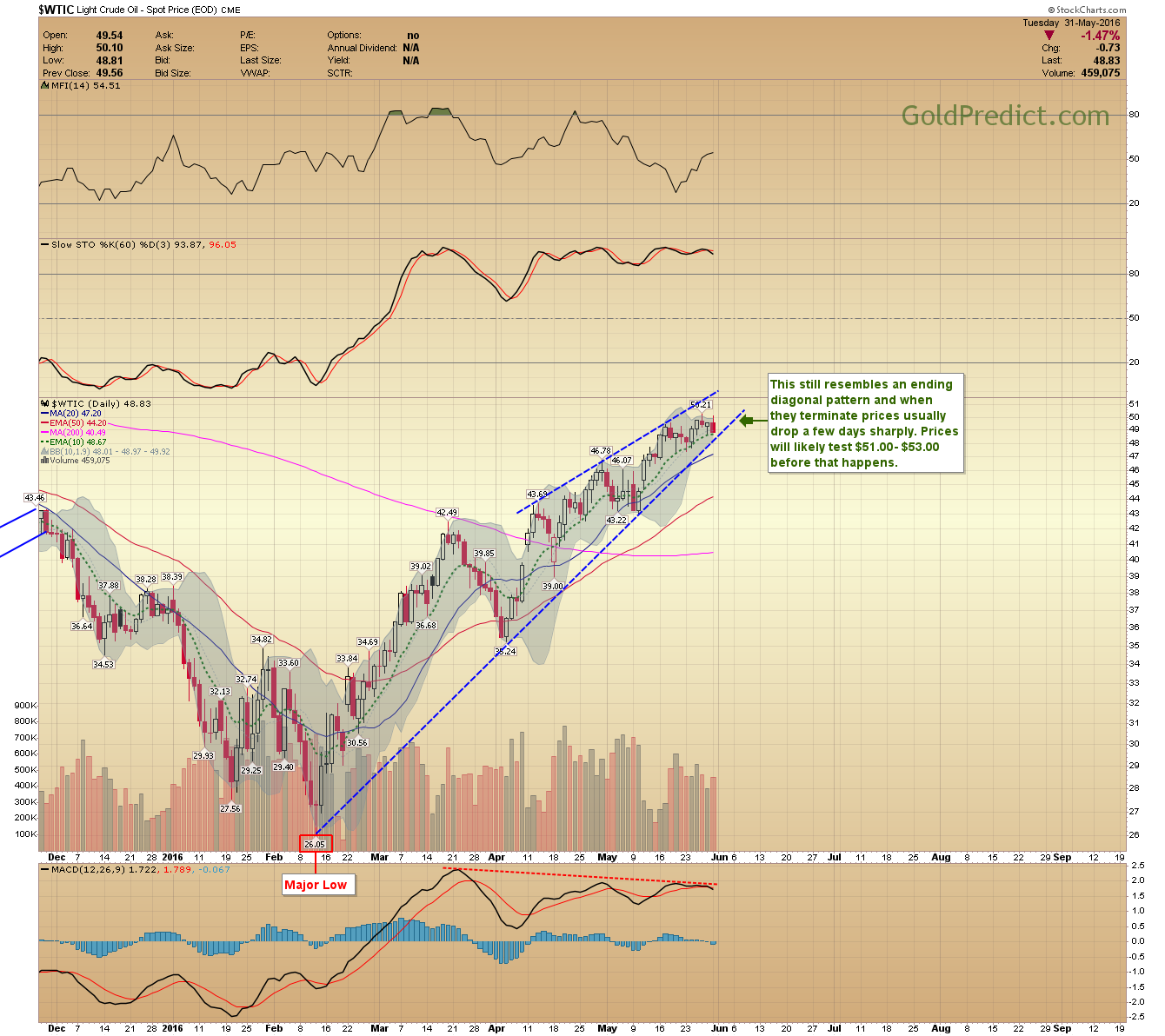

WTIC - This still resembles an ending diagonal pattern and when they terminate prices usually drop a few days sharply. Prices will likely test $51.00 before that happens.

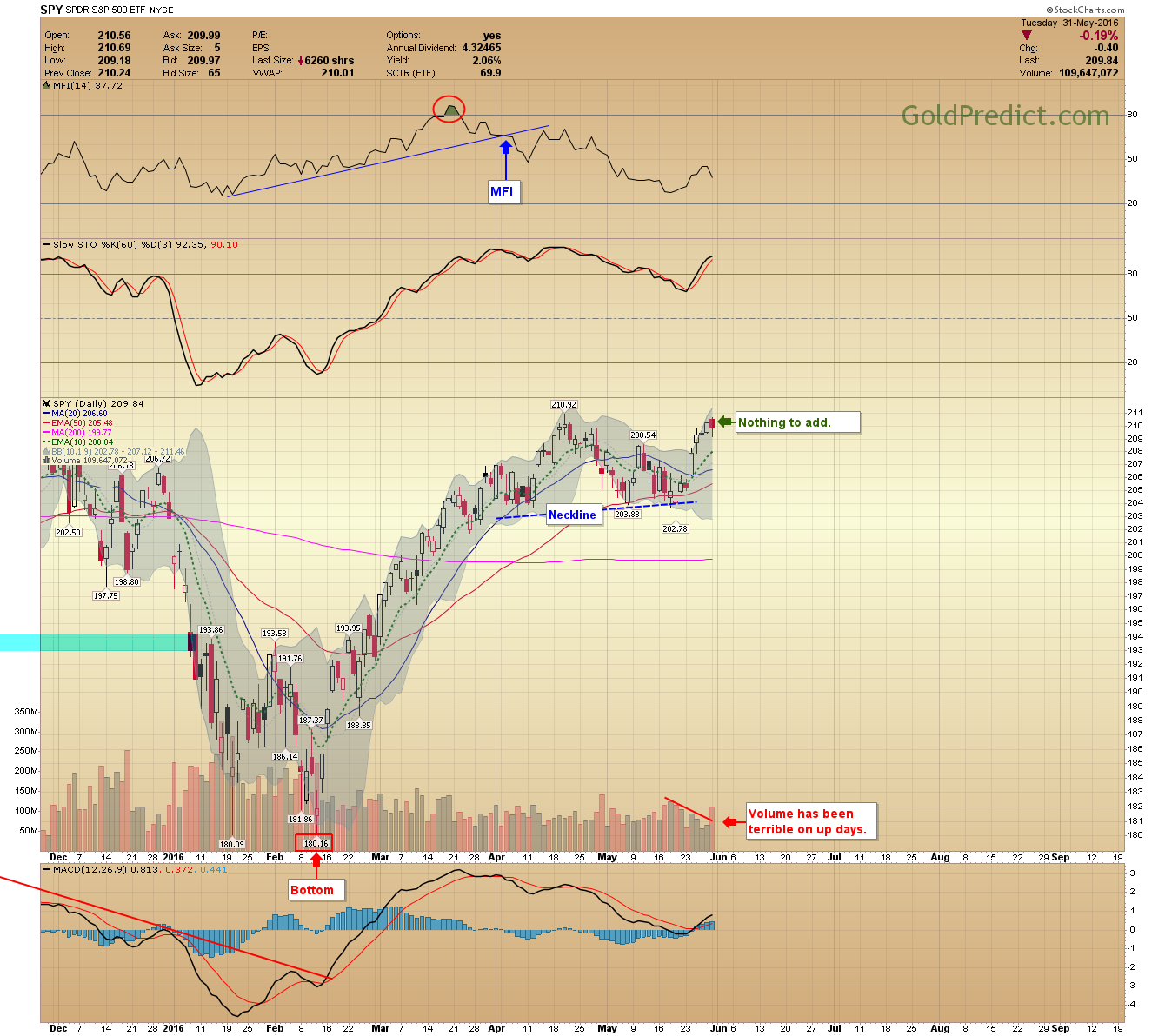

SPDR S&P 500 (NYSE:SPY) - Nothing to add from the weekend newsletter. Volume on up days is anemic.