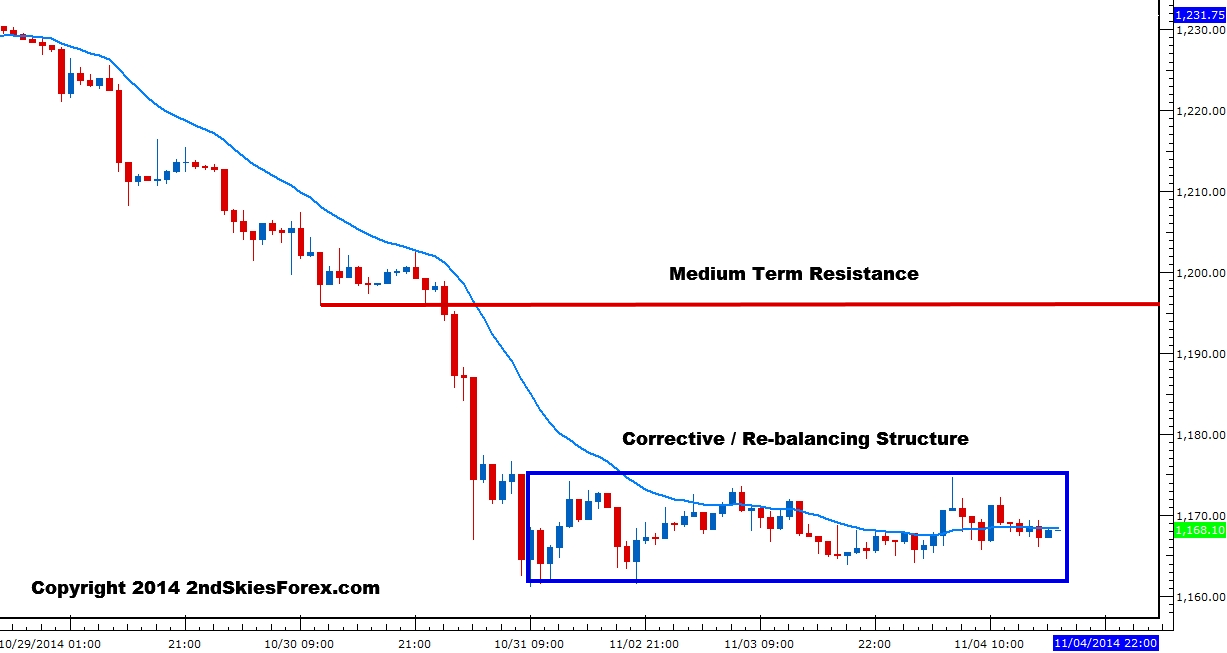

Gold – Corrective Structure On Lows (1hr chart)

Also a recipient of the recent volatility, Gold has lost a tremendous amount of ground in October, ending the month breaking the multi-year support at 1180. Since then, the price action for the precious metal has been consolidating in a corrective structure, re-balacing on the lows between 1162 and 1176.

Medium term and short term, we are still in a bear trend, so a leg down is favored to trade with the trend. If the PM breaks out of the consolidation higher, I suspect sellers will be waiting either at 1180 (former multi-year support) or 1196.

Only some massive gains would spook the bears short term. Downside targets would potentially be a move back down to $1000 as there is not below here, with 1077 and 1030 the only major support levels between here and the 1K figure.

Today in the members trade setups commentary, we cover setups on the GBPJPY, USDCHF, EURJPY, GBPJPY, CAC 40 and the GBPUSD. Click here to become a member.