Key Points:

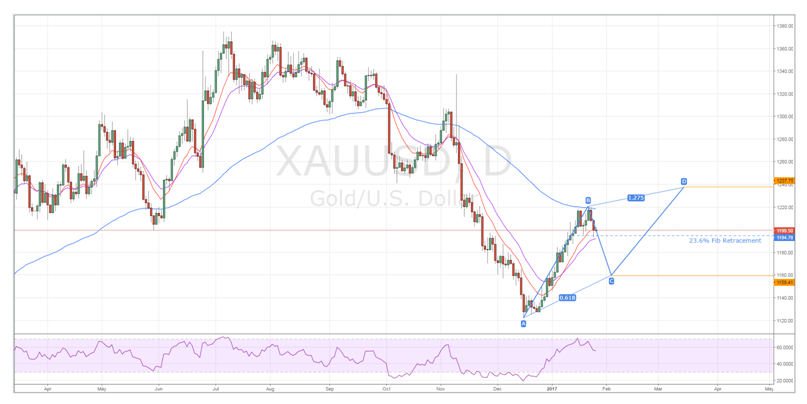

- Second leg of an ABCD wave is likely taking place.

- Resulting slump could see the metal move back to the 1159.41 mark.

- Fundamental factors currently propping up the weakening metal.

Selling pressure could return to the gold market with a vengeance this week as the next leg of a corrective wave takes place. If we do have an ABCD wave in our midst, a retracement as low as the 1159.41 mark could be seen within the fortnight. However, given the recent performance of the yellow metal, it might be worth taking a closer look at some of the technical data to confirm if these downside risks are likely to materialise.

First and foremost, the daily chart makes it quite clear that, despite the momentum of the past few weeks, the 1220.00 handle is remaining firmly in place. This is, in large part, due to the influence of the 100 day moving average which has been supplying substantial dynamic resistance around this key level. As a result, we are already seeing the beginnings of a proper reversal take place and these early losses could be about to extend impressively in the coming weeks.

Indeed, if we zoom to a shorter timeframe we can see some other technical forces at work which are highly suggestive of serious downside risks moving forward. Firstly, on the H4 chart, a relatively obvious double top structure has formed which further demonstrates the difficulty the metal is having in breaching resistance. Secondly, taking a look at the Bollinger bands, gold’s recent foray below the lower band would tend to indicate some real underlying weakness in the commodity’s position.

In fact, the only real technical impediment to further losses seems to be the coincidence of the 23.6% Fibonacci retracement and the neckline of the double top structure. However, from a fundamental perspective, this reluctance to surge lower could be understandable. Specifically, given the whirlwind of a week that it has been in the US with respect to political news, traders are likely attempting to shield themselves from some of the expected headline risks by moving back to gold.

Ultimately, this underlying market fear could necessitate a rather impressive slew of US results to be posted in the coming days to really kick start the forecasted tumble. This being said, there is no shortage of economic news as the week begins to wind down which provides ample opportunities for a downside breakout. As a result of this, the trek back to the 1159.41 mark could be seen very shortly.