The gold rally we predicted to happen in late 2018 took place, almost perfectly, based on our ADL predictive modeling systems results. This rally took place in May through September 2019 and pushed gold up to levels near $1600. The rest of the year, gold consolidated near $1500 as a strong US Stock Market rally took hold in Q4 of 2019. Our original prediction was that gold would rally to levels near $1750 before the end of 2019 based on our Adaptive Dynamic Learning predictive modeling system (ADL). This did not happen in 2019 but it appears gold is setting up for another upside rally in 2020.

Taking a look at our ADL predictive modeling systems on Monthly charts for gold and silver, we see two very interesting suggestions setting up:

First, Gold may attempt a rally to a level above $1700 before March/April 2020 and potentially extend this rally to well above $1850 by August/September 2020.

Second, Silver appears to lag behind this gold rally by about 7 to 8 months. Silver does not appear to want to start a rally will well after July or August 2020.

If we consider what happened in 2008/09 with the global credit market crisis, both gold and silver contracted lower near the start of this crisis (in late 2008). Eventually, gold began to move higher in August/September 2009 (well into the crisis event). Silver didn't really start to accelerate higher will August 2010 – a full 12 months after the gold rally started.

Our ADL system is suggesting that the silver rally will lag behind the gold rally by about 10 to 14 months given the ADL predictions for price activity in 2020. Thus, gold may continue to rally much higher fairly early in 2020, yet we won't see much upside movement in Silver till after July 2020.

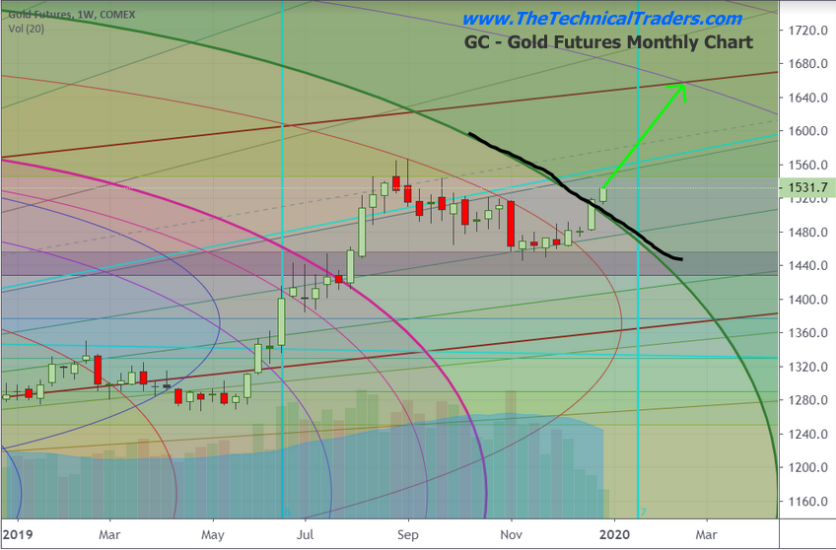

Monthly Gold

This first Monthly gold ADL chart highlights the ADL predictive modeling systems suggestion related to future price targets. We can see the upside move in Gold should begin with an upside target near $1600~1625 over the next 60+ days. After that, the rally should accelerate higher in April/May 2020 with another move higher towards $1700~1725. By August/September 2020, gold should attempt a rally to levels above $1800~1850 and then begin to consolidate above $1800 for a few months.Monthly Silver

This silver chart suggests that metals will react very similar in 2020 to what happened in 2008-09. While gold began to rally in August 2009, silver did not begin to accelerate higher till August/September 2010. This delay in the understanding that silver presents valid protection against risk may take place in this current upside rally in gold. If the ADL predictions are accurate, then silver will continue to provide buying opportunities for many months near $17.50~$18 before a major upside price advance begin.

By July 2020, Our system is suggesting that silver will advance to levels above $18.25, then begin a major price advance to levels above $19~20 fairly quickly. Please keep in mind the scope of these predictions related to the global markets and the US Presidential elections. We read into this that a lot of chaos/turmoil may be taking place in the US/World after June/July 2020.

Weekly Gold

This last chart is a weekly gold chart highlighting our Fibonacci Price Amplitude Arcs and the major resistance level that has just been broken in gold. The heavy GREEN arc and the BLACKLINE that we've drawn on this chart represent massive resistance originating from the lows near August 2018 in gold. We believe this resistance level, once broken, will prompt a major upside price move in gold to levels closer to or above $1700. If this price advance in gold aligns well with our ADL predictions, then we believe fear will continue to drive future a future price advance in gold and that fear may be related to continued Global stock market concerns and the US elections.

2020 may be a very good year for precious metals traders who are able to identify solid entry trades for these moves. If our ADL predictions are accurate, Gold should rally over 25% before the end of 2020. Silver may rally as much as 15% before the end of 2020. The timing of these moves suggests Gold traders will have opportunities for bigger price advanced early in 2020 and will begin a larger upside price move after February/March 2020. Silver will begin an upside price move after basing near the March/April 2020.