Gold prices plunged on Tuesday. Does it mean the end of the bull market?

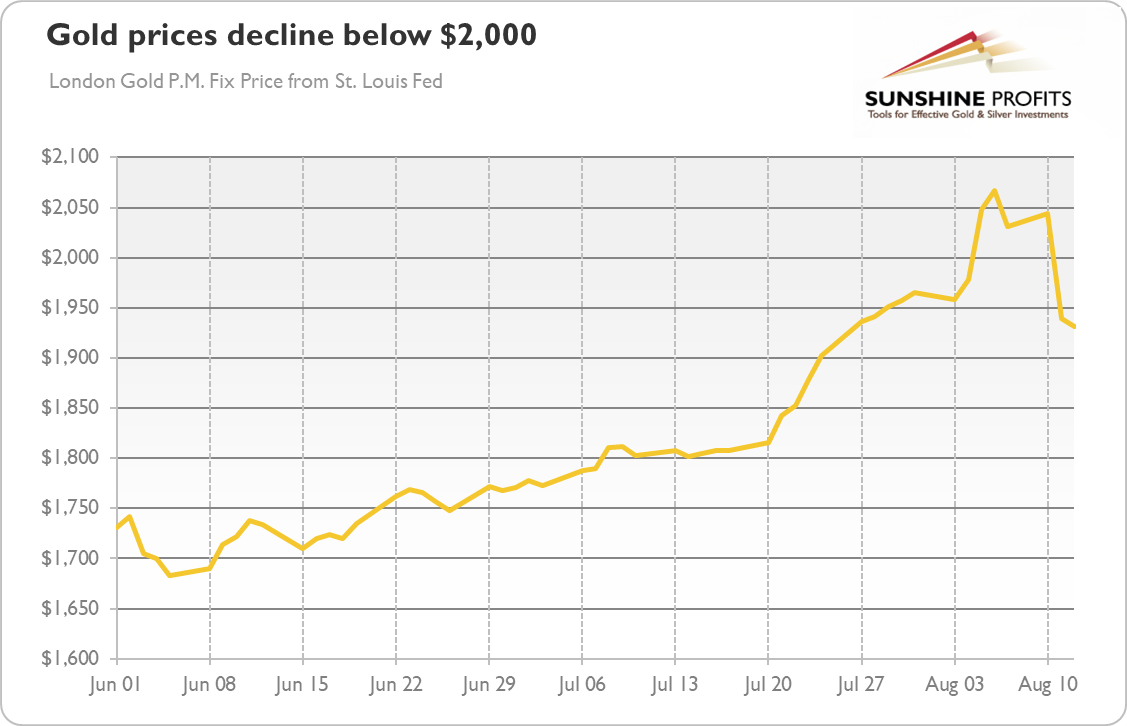

Tuesday was hot! And I don’t mean the weather. I mean that it was a remarkable day for the precious metals. The price of gold plunged more than $100 two days ago and it even dove below the key $1,900 level at one point on Wednesday. As the chart below shows, the London Gold Fix dropped from $2,044.50 to $1,939.65, or more than 5%, the worst fall in one session during the past several years. The price of silver plunged even more, from $29 to $24.40, which is more than 15%.

Are you disappointed? Why should you be? Are you disappointed when the sun goes down after sunrise? Are you disappointed when there is a cold and rainy day during the summer? You see, one day neither confirms nor falsifies the longer-term bull or bear market. The bull market does mean that gold has to rise constantly, day after day, in a straight line. There are always corrections on the way. Nothing goes straight up forever. There are ups and down, as in our daily lives.

Actually, you have been warned about the correction in the gold market in the last edition of the Fundamental Gold Report (and both in the Gold & Silver Trading Alerts and Stock Trading Alerts as well). I wrote that “correction in the short run would be totally normal, or even desirable” and that “until July, the rally in gold has been very gradual and steady. So, after the recent amazing acceleration, correction would not be something strange.” And voilà, it happened! So I hope that you were not surprised – the pace of the recent rally was simply too fast to be not followed by the correction. Gold was like Icarus – it flew too close to sun, and it had to fall.

What’s Next For Gold?

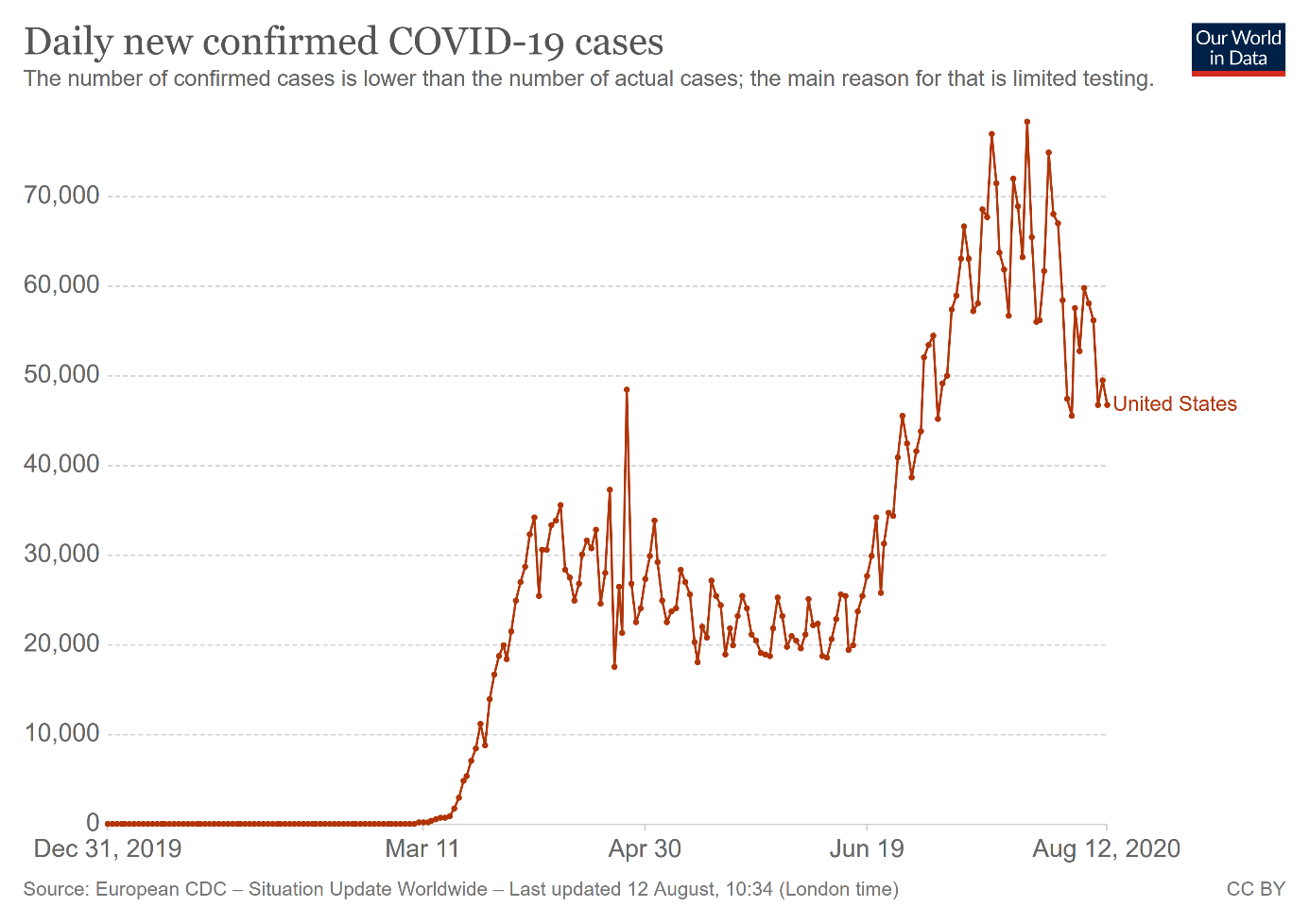

Some people believe that the recent plunge means the end of the bull market and that gold should go lower now. One of the major arguments behind this opinion is the improving epidemiological situation in America. Indeed, as the chart below shows, the U.S. daily infection rate is dropping slightly, which creates also better economic prospects.

Well, the improving epidemiological situation and followed better economic prospects are definitely the headwinds for gold. It might be the case that most of the worst news related to the coronavirus pandemic is already priced in. And that the American economy will now only strengthen.

However, the yellow metal is not strictly linked to the number of new cases of COVID-19. Actually, its recent rally occurred at the turn of July and August, when the epidemiological situation already started improving. And gold did not enter the bear market when the U.S. seemed to strengthen after the first wave of infections.

There are also other risks present. The dollar may rebound, while the real interest rates can go up. But these risks are always with us and we monitor them closely. However, the truth is that – from the long-term point of view – nothing changed this week in the fundamental outlook for gold. The Fed will remain dovish for an extended period of time, which means that the interest rates will remain at ultra low levels for years (as Fed Chair Jerome Powell has admitted recently: hikes are not likely to happen for a very long time). So, we still have lax monetary policy, unsound fiscal policy with rising fiscal deficits and public debts, geopolitical concerns and risk that all the injected stimulus will translate one day into inflation – and that the central banks will allow it to rise above the target.

In other words, the marketplace became simply overcrowded and the correction could, thus, occur without any fundamental shifts. If true, when the correction – and consolidation – is over, gold could continue its march north (maybe in a calmer way), especially if the greenback remains soft. But, of course, investors should be – as always – cautious (and they should read our Gold & Silver Trading Alerts for more technical analyses); the upcoming days will be critical for the gold market.