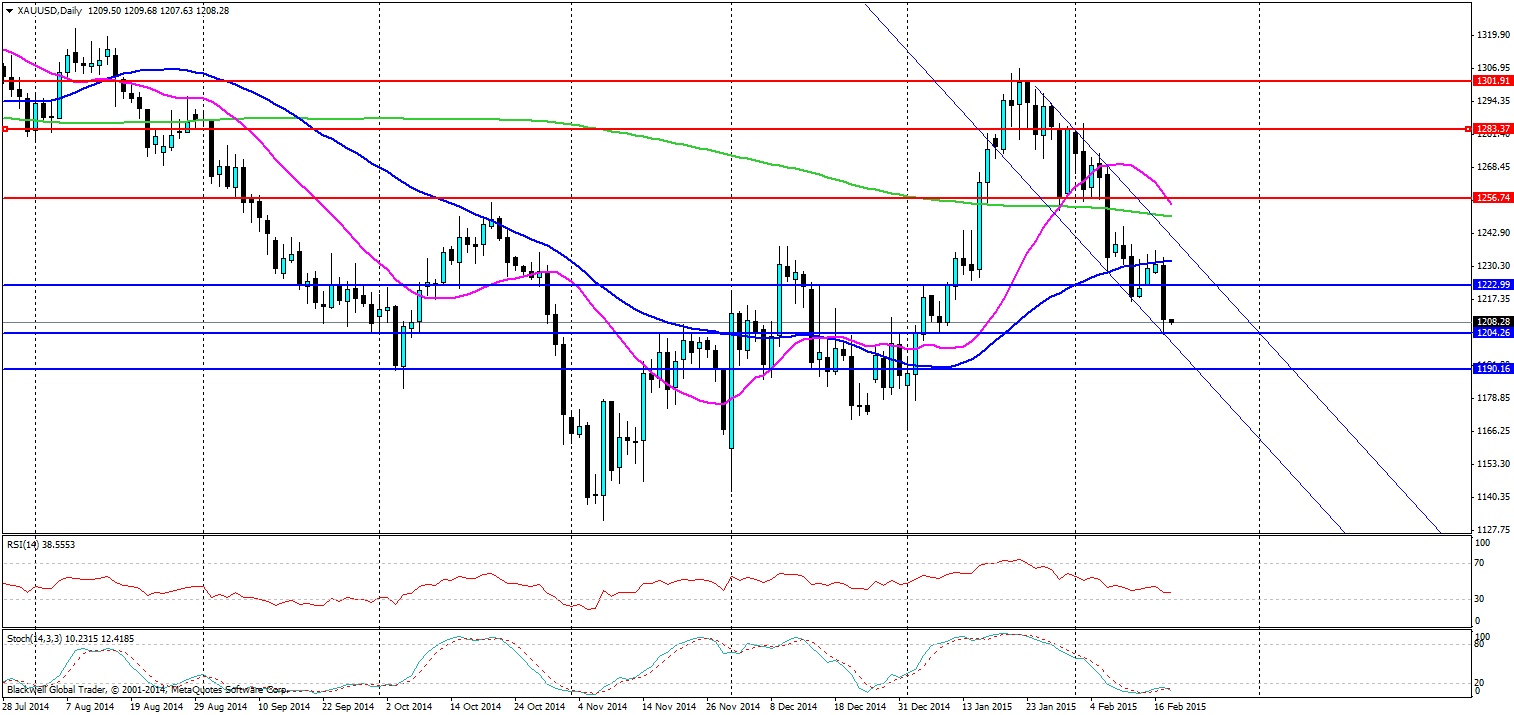

The gold market has been looking like its edging lower for some time now, and the market has been somewhat bearish as of late.

Over the previous few days gold has been tempting to push through the 50 MA and in previous articles I discussed how gold was respecting this level for the most part. Well with a positive outlook on the Greek tragedy going down gold finally pushed lower overnight.

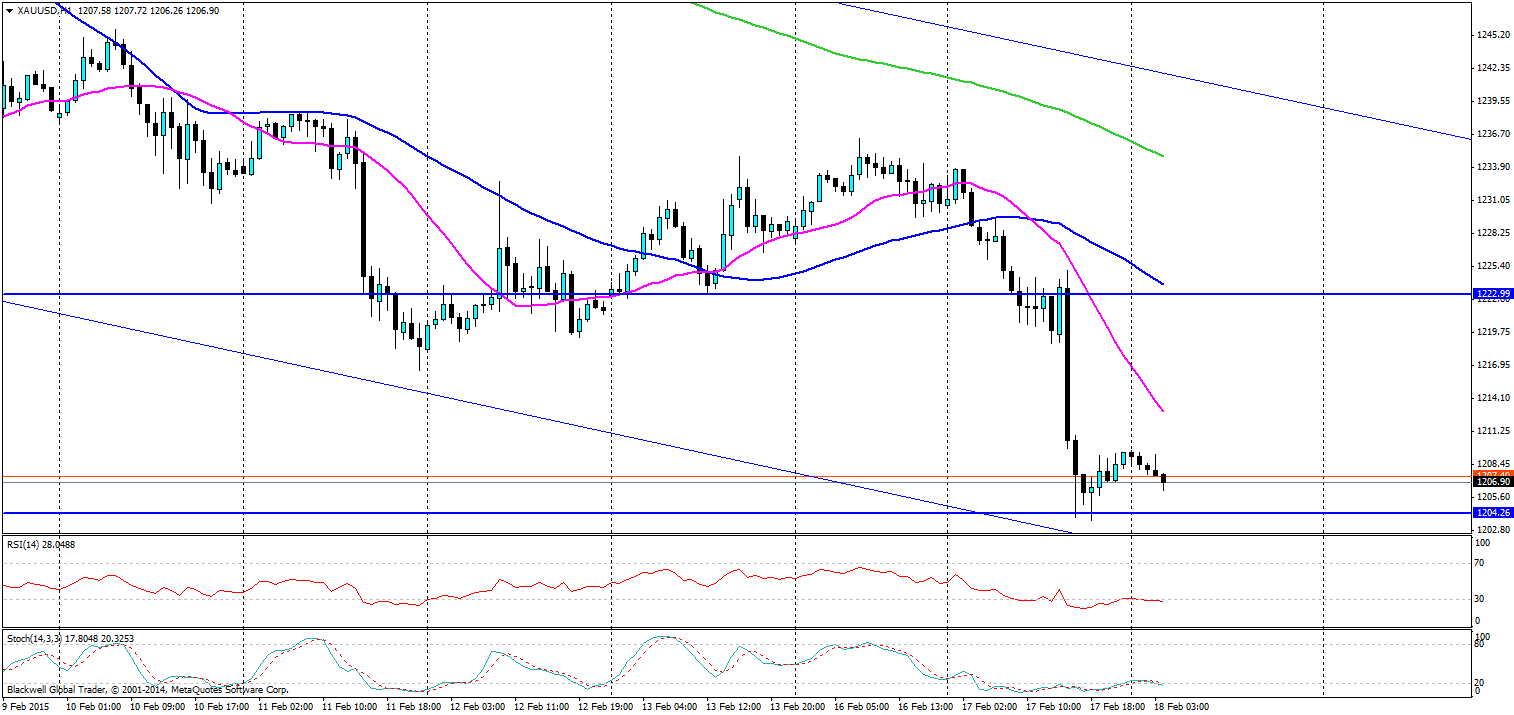

The bottom was easily found as gold found support in the market around 1204.26 and this level could be further tested tonight. Markets may also look for a shorter time frame double bottom here on the support charts

As can be seen on the H1 it’s not unlikely to see a double bottom and a few quick points taken here in this scenario as the markets will be acutely aware of this level from last night.

But looking at the long term picture there is another key level lower on the charts that can be found at 1190.16 and the market will look to drive down to this level if 1204 fails, it will be interesting to see how much it respects the current channel though. Hence why I am looking for the double bottom play before the market looks to drift lower.

Either way, with the Greek tragedy, precious metal markets are quick to swing either way in order to hedge out risk or play of an increase in risk appetite. The market believes that common ground will be found, but maybe not the 11th hour. I’m a little more cautious, but technicals reflect fundamentals and in this case they are bearish on the gold market.