At McDonald’s (NYSE:MCD) restaurant, customers can “supersize” their food orders. Can gold supersize its awesome 2019 price action?

The technical action on this gold chart is spectacular!

Gold has formed a massive pennant formation. There’s no guarantee that it plays out, but if it does the technical target is in the $1560 area.

A $1560 gold price would turn most gold producers into gargantuan cash cows, and the near-vertical rally already in play in silver would likely become a textbook barn burner.

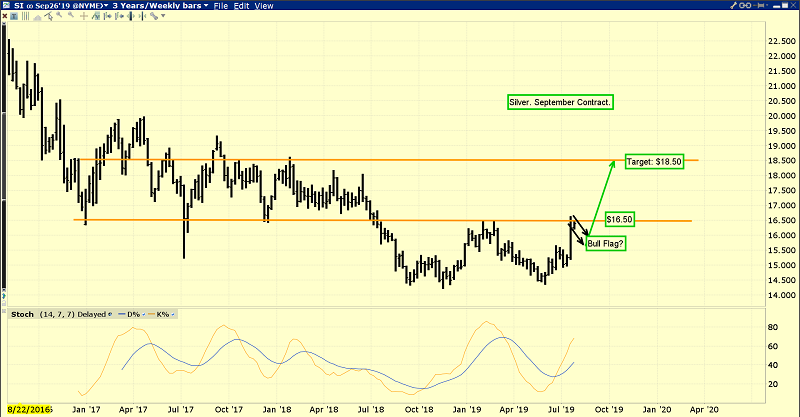

A pattern like a double bottom is now in play on the weekly Silver chart.

This pattern suggests the silver rally is just getting started and a breakout over the neckline would target the $18.50 area.

The Western fear trade for gold is now the “price driver in play” for all the precious metals upside action, but the love trade is also providing solid and consistent support for the market.

Interestingly, the Indian government tariff taxes of 12.5% have effectively revalued the price of the vast hoards of gold held by Indian citizens by 12.5%.

In America, real interest rates continue to decline as the business cycle peaks. Any uptick in inflation could create an institutional “feeding frenzy” in gold stocks and silver stocks.

Many bond market analysts believe that rate cuts from the Fed could accelerate the issuance of negative-rate bonds… dramatically!

Some gold analysts worry about the “large” commercial short position in gold on the COMEX, but I predicted years ago that when gold broke out of the bull continuation pattern… the commercial short position could rise to millions of contracts, with the price still going higher!

That’s because there are so many institutional money managers getting involved with gold now. The bottom line: Cash pays nothing and has no upside, and a surge in inflation would destroy the bond market and potentially topple the US government.

In this environment, institutional stock market investors are embracing gold and gold stocks. They are beginning to embrace silver too. Because silver is such a small market, even modest institutional buying is producing vertical price action!

Another positive aspect to the arrival of institutional investors in gold, silver, and the miners may be of interest to conspiracy buffs who believe in price manipulation.

I say that because institutional investors have in-house investigators who monitor the market action. They are quick to alert regulators when market trades don’t make sense.

Whether serious gold price manipulation existed in the past is probably unknowable, but there’s no question that the current market feels “cleaner” and more stable than it did when hedge funds dominated the market.

The SPDR fund (NYSE:GLD) is now at 825 tons, and the SLV silver fund is now at 11,070 tons. Institutions are buying steadily.

What happens if the Fed disappoints at next week’s key meeting? What happens if there’s no rate cut? Well, since 2014 I’ve talked about all Fed actions being positive for gold.

Gold rallied on QT and rate hikes and the stock market tanked because of the safe-haven bid. Gold also rallied on the recent Fed pause… much more than the stock market did!

The bottom line: If the Fed doesn’t cut rates at next week’s key meeting the stock market will crash and gold will cash a huge safe-haven bid. Everything the Fed does is now win-win for gold.

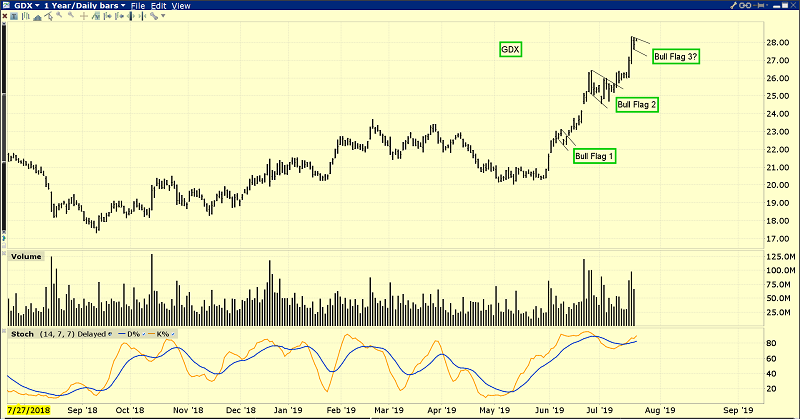

This is the fabulous GDX chart. I coined the term “flagification” to describe a market so powerful that numerous bull flags appear in succession. That’s happening with GDX and many gold miners now.

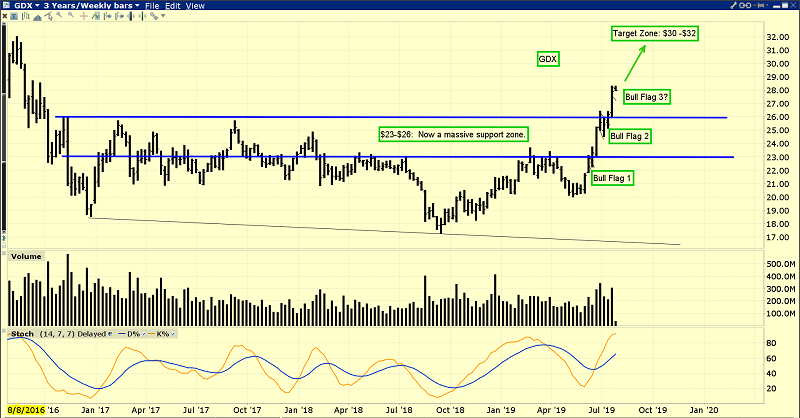

A look at the important weekly chart for GDX. If the bull flag on the daily chart plays out, GDX is going to my $30-$32 target zone, and to $37-$40 if the “supersize” bull pennant on the gold bullion chart activates.

The breakout above $26 on the weekly chart has turned the entire $23-$26 area into a massive support zone, so any failure or churning in the flag/pennant formations is little more than an annoying bearish fly that should soon be swatted away by a growing army of excited institutional buyers!