According to Weinstein Stage Analysis, the ideal buy-point for gold is the breakout above the 30-week moving average on heavy volume after a Stage 1 base. The next, best buy-point is a retest of this breakout if it occurs. In terms of foreign currencies (anything except US dollars) gold has crashed through the 30-week moving average to the upside and has passed its ideal buy-point.

There have been a lot of fake breakouts for gold in the past year which is why I think this current breakout isn't getting the proper attention. 2014 was a full year of basing and faking bulls out, especially with the late fall plunge in gold due to a parabolic U.S. dollar.

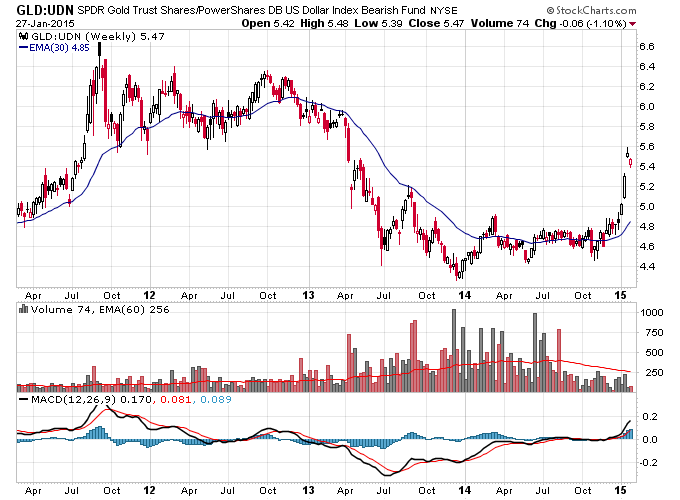

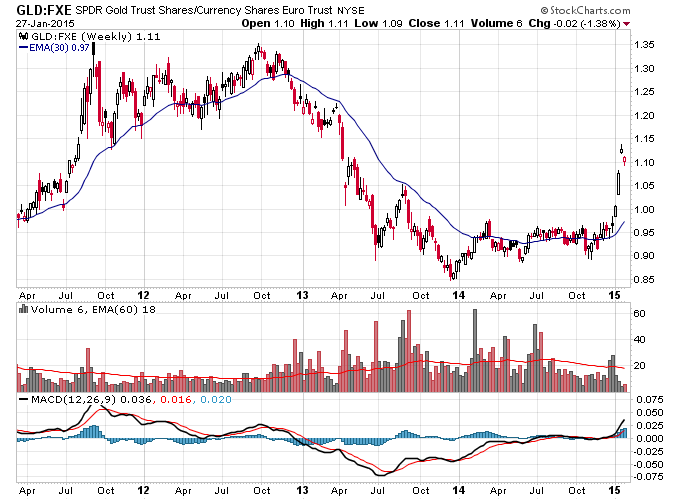

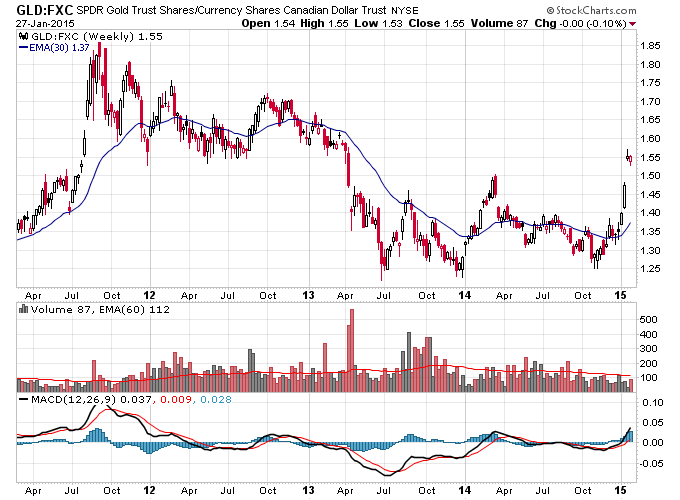

But even though there is a lot of apathy towards gold, the fact is, in foreign currencies gold is on the cusp of a legitimate bull market. (Pictured in the charts below, SPDR Gold Trust (ARCA:GLD) vs PowerShares DB USD Index Bearish ETF (NYSE:UDN), Rydex CurrencyShares Euro Currency ETF (NYSE:FXE) and Rydex CurrencyShares CAD Trust (NYSE:FXC).

If gold can get above $1350 in dollar terms, then gold will be in position to produce an ideal buy-point in a gold bull market in U.S. dollars.