Gold Today –New York closed at $1,262.70 yesterday after closing at$1,275.60 Tuesday.London opened at $1,260.00 today.

Overall the US dollar was stronger against global currencies, early today. Before London’s opening:

- The USD/EUR was stronger at $1.1164 after yesterday’s$1.1217: €1.

- The Dollar Index was stronger at 97.28 after yesterday’s 96.92.

- The yen was stronger at 109.65 after yesterday’s 110.14:$1.

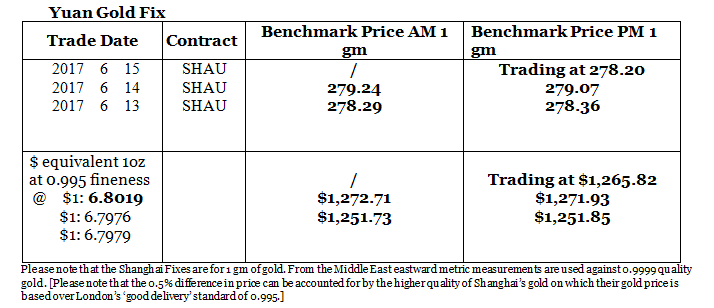

- The yuan was weaker at 6.8019after yesterday’s 6.7976: $1.

- The pound sterling was weaker at $1.2696 after yesterday’s $1.2785: £1.

Yesterday global gold markets saw volatility in all three markets ahead of the Fed. Once the statement was out global gold markets settled and steadied around $1,260, with London $5 lower than Shanghai.

We expect today will see a digestion of Mrs Yellen’s statement followed by gold’s reaction.

Silver Today –Silver closed at $17.13 yesterday after $16.76 at New York’s close Tuesday.

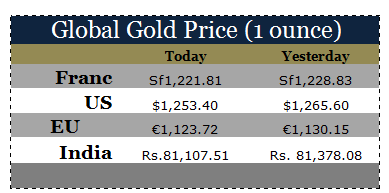

LBMA price setting: The LBMA gold price was set today at $1,260.25 from yesterday’s $1,268.25. The gold price in the euro was set at €1,128.75 after yesterday’s €1,131.71.

Ahead of the opening of New York the gold price was trading at $1,253.40 and in the euro at €1,123.72. At the same time, the silver price was trading at $16.69.

Gold (very short-term) The gold price should consolidate with a positive bias, in New York this week.

Silver (very short-term) The silver price should consolidate with a positive bias, in New York this week.

Price Drivers

The Fed

In essence, Janet Yellen’s statement showed that the Fed sees a moderately growing U.S. economy that will continue to grow at a moderate pace. No accommodation of President Trumps intended policies was made. The Fed Funds rate after the rise is lower than inflation levels and look like remaining there as the Fed Funds rate, if the economy remains on the path they expect it will.

If the economy remains on this path, then by the end of the year, the Fed will begin to reduce its Balance Sheet. It will be a very slow process intended to give markets no stress. As a result equity markets may rise more ignoring institutional worries that they are already too high. It is clear that hopes of a robust economy in the near future are unrealistic. For gold this was overall positive because of low inflation levels.

The dollar strengthened overnight on the back of her statement.

Technical picture

With yesterday’s huge sale of over 12 tonnes the gold price fell back from the day’s high in New York over $1,276 to $1,260 before London opened where it moved down further. But the move higher in the day followed the previous day’s close as you can see above over $1,262. So it did not have that big an effect on prices. We expect gold prices to move higher in the next week as the impact of the Fed’s move was no surprise, so gold markets can get on with the trend they were moving in before the statement.

It looks like whoever sold was either trying to knock the price back [likely protected by short positions on COMEX] or had positioned themselves for a postponement of the rate hike. Either way, gold remains in consolidation mode today. It has not affected gold overall positive Technical position with its bottom level of support at $1,240 now.

Gold ETFs – Yesterday, saw sales from the SPDR Gold ETF(NYSE:GLD) 0f 12.13 tonnes a huge amount but no change in the holdings of the Gold Trust.

Their holdings are now at 854.868 tonnes and, at 207.06 tonnes respectively.

Since January 4th 2016, 250.18 tonnes of gold have been added to the SPDR gold ETF and to the Gold Trust. Since January 6th 2017 50.13 tonnes have been added to the SPDR gold ETF and the Gold Trust.