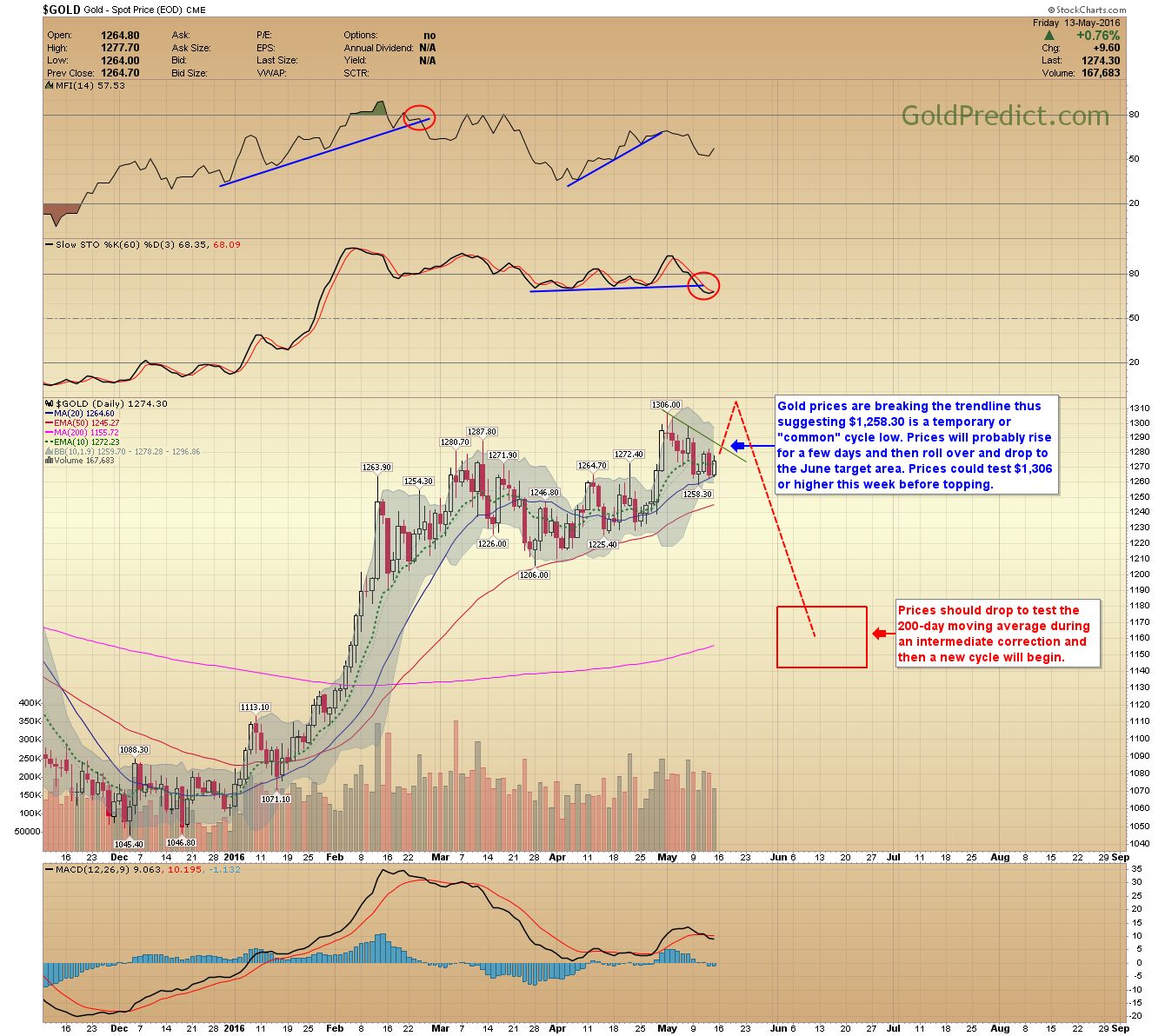

I wanted to update as prices are breaking short-term downtrend lines, suggesting a temporary or common cycle low may be in for precious metals.

If this is the case, prices will rise for a few days, maybe until Wednesday or Thursday, perhaps around the time the Fed minutes are released, then things should roll over.

Also, I wanted to point out a situation I've been watching in the weekly gold chart concerning significant underlying weakness.

Gold prices are breaking the short-term trendline, therefore suggesting $1,258.30 may be a temporary or "common" cycle low. Prices will probably rise for a few days and then roll over to the June target area.

Prices could test $1,306 or higher this week before topping.

Same situation in silver - prices will rally a few days and then they should roll over and drop to the June low.

There is a big problem with the weekly On Balance Volume (OBV) in gold. Prices rallied sharply, but the OBV didn't move higher as prices made their run to $1,306.

The OBV has now rolled over and is threatening to make a new low, a major non-confirmation. OBV is not confirming this move in gold, and there is no logical reason prices haven't dropped.