Analysis of the movements of the Gold Futures indicates a steeper slide could continue as the gold bulls feel it is scary to hold this non-yield asset at such a high level.

No doubt gold futures have seen a sharp downfall after testing the highs of $2801.80 on October 30th, 2024 since the interest rate cuts by the Fed were widely expected, finally came true on Thursday which fueled this selling spree in gold.

Secondly, Donald Trump’s victory in the 2024 US presidential elections has added more fuel to this free fall in gold prices, as investors are likely to shift their money from gold to crypto.

Undoubtedly, the world’s largest cryptocurrency rallied to record highs this week amid optimism over the friendlier U.S. regulations during a second Trump presidency.

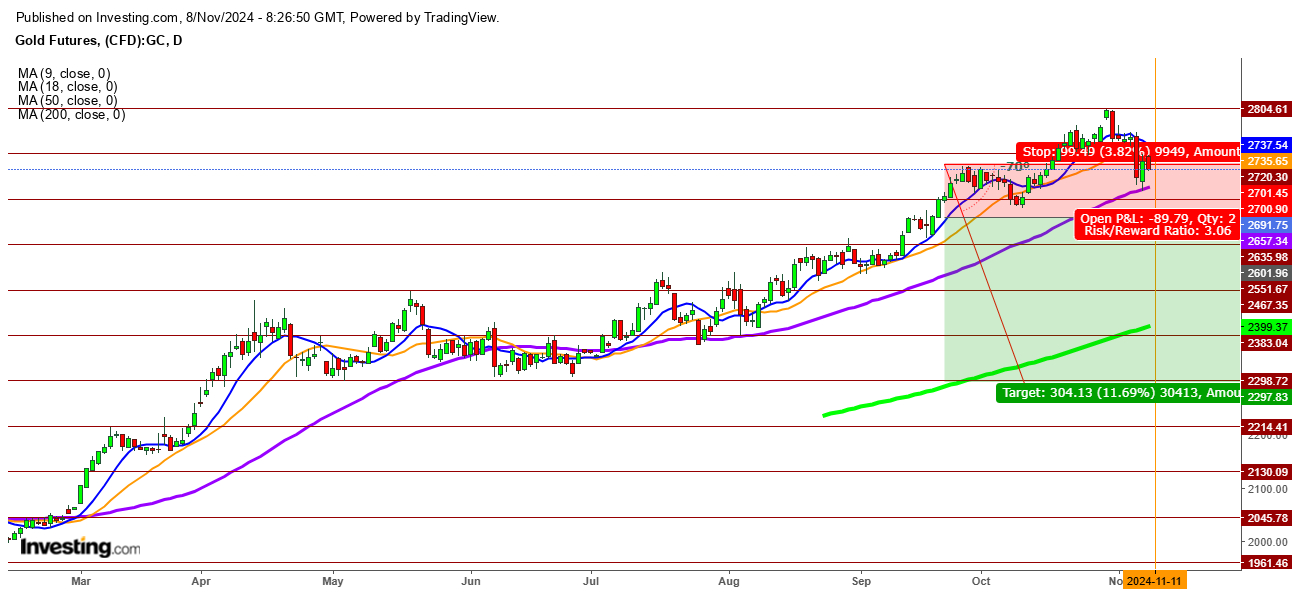

In a daily chart, gold futures indicate signification support for the gold futures at $2656 and a breakdown of gold prices below this support could push the prices to test the next support at $2525.

In the daily chart, 9 DMA is trying to break the 18 DMA, indicating a short-term weakness in the gold prices.

In a weekly chart, gold futures have formed a bearish formation that could continue to push the price downward during the coming weeks. Currently, the gold futures are taking support at the 9 DMA which is at $2683. The second support level is at 18 DMA which is currently at $2588, and the third level would be at 50 DMA which is currently at $2351.

Finally, I conclude that the quantum of money shifting from non-yielding assets like gold will map the further fall in gold futures. The point to be noted is the level, the gold futures will close this month.