Since the beginning of April, the dollar's continued weakening seems to be moving beyond monthly or quarterly rebalancing. US equity indices are rewriting all-time highs, and emerging market currencies are rising at an accelerated pace. These are all clear demonstrations of the recovery in demand for risky assets.

Markets are paying more attention to the recovery of activity in North America and several countries in Europe, where easing of restrictions and recovery of demand for commodities and energy are looming.

Although the world's third wave of coronavirus is already comparable to the second one by new daily cases, with India, Brazil, Turkey and several other major emerging economies taking the brunt of it, it remains outside the focus of markets, pushing commodity prices higher.

And throughout this week, this demand was actively manifested in investor interest in oil and gold.

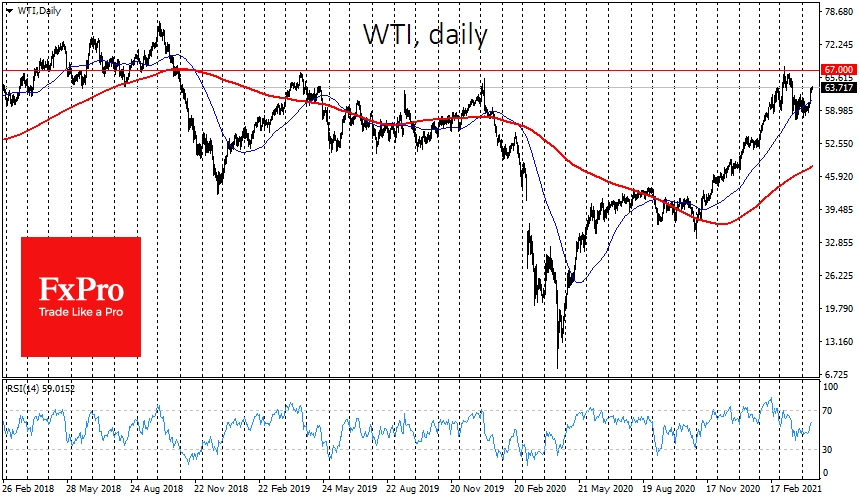

WTI crude oil is trading at $63.77 at the start of trading in Europe. Its price since the second half of March was hovering in the range of $57-62. This week it managed to break its upper boundary. The report on US oil inventories was a growth driver, noting the reduction in inventories to last week's level and the level of exactly one year ago. This was further evidence of a return to normalcy in the oil market, which triggered a 4% jump in prices and has supported buying since then.

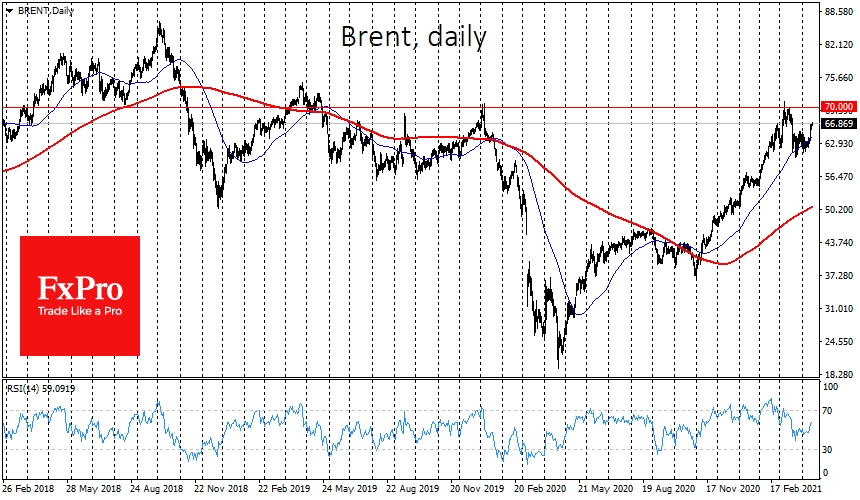

The next milestone on the upside is seen in the $66-67 area, where the price reversed to a correction in March. Having broken out of the $60-65 range, Brent can retest the $70 resistance in the following few trading sessions.

A weakening dollar dramatically increases the chances that the buyers will not stop there. The March pullback allowed liquidity to build up and recharge the bulls for an assault into the $68-77 area for WTI and $70-85 area for Brent.

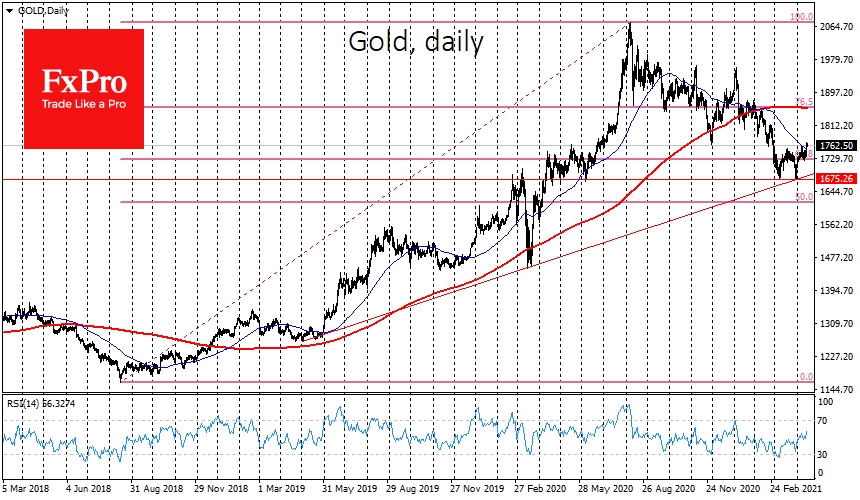

Gold also received support from buyers after an 8-month slide to the long-term trend line of support and a 38.2% retracement line from the rally since 2018. This trend has persisted and oversold gold is enjoying buying on the downside. It is also helped by a weak dollar and lower long-term Treasuries yields, making gold more attractive as a hedge against inflation.

The latest growth momentum has brought gold back above the 50-day average. It has lifted the price by $90 since the beginning of April to $1762, but it has yet to prove long-term growth by passing the test of the 200-day average (now at $1857).

If we look at the pullback from August 2020 to April as a correction from the growth impulse from August 2018, the next big step for the long-term buyers could be as high as above $2600.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold, Oil Return To Strong Gains

Published 04/16/2021, 05:13 AM

Updated 03/21/2024, 07:45 AM

Gold, Oil Return To Strong Gains

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.