Today’s US CPI report will be released with Chinese markets closed for a “Golden Week” holiday.

The lack of liquidity means wild price action is likely when the report is released, but the big picture is unchanged and is of course best defined as

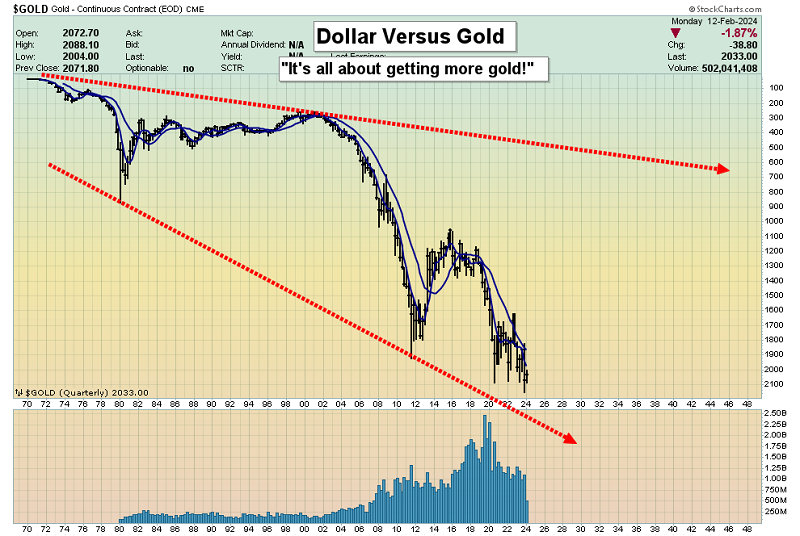

Fiat and debt versus ultimate money gold!

The disturbing chart of the relentless US fiat meltdown versus gold. While it’s the world’s most esteemed fiat, when compared to gold, American fiat money looks like rotting compost.

As fiat and debt-oriented empires fade into the sunset (or begin to burn), their interest rates start to rise and that rise tends to be sustained.

Government and bank managers of the empire promise that “big growth” and higher taxes are solutions to the problem of fiat.

Sadly, there can be some temporary relief with this approach, but then the march into the abyss resumes and does so with even more aggressiveness than before.

In India, interest rates are above 6%, but no citizen spouts the “gold pays no interest and fiat does!” mantra (gibberish) that is so common in the West.

This silly mantra is widely proclaimed as a reason not to buy gold when of course the only real reason not to buy gold is because it is not on sale.

The good news, the great news, is that gold is currently on sale, but the big questions are these: Is it on enough of a sale for savvy gold bugs to buy more of it today?

If not, what price zone should they buy? When it is time to buy, can they buy silver and mining stocks too?

For some insight into these vital matters. The weekly gold chart. Gamblers should buy an array of metals-oriented items right now, using small size or stoplosses to manage their risk.

With Stochastics and RSI both in the 50 zone (a zone that is associated with the launch of momentum-themed rallies), a surprise surge that takes gold hundreds of dollars higher is a realistic scenario from here.

Investors with core positions will of course benefit in this scenario. For fresh buys, the big zone of focus for investors must be $1973, which is a key previous low.

The spectacular weekly silver price chart. Note the position of the 14,5,5 Stochastics series oscillator. Whatever happens with this CPI report doesn’t really matter, because a massive rally looks imminent.

The enormous inverse head and shouldering action suggests this rally will only be the opening act of a much bigger move that sees silver reach at least $35.

In India, gold dealers have started charging premiums again because of growing demand. Indian citizens are the world’s most savvy investors. Land is their favourite asset and gold is the currency of choice. It doesn’t get better than this!

I’ve dubbed Indian citizens as the world’s “Titans of Ton”, and if they are nibbling at gold at the current price, it’s a “must buy” zone for gamblers in the West.

What about the American government’s endless wars, how will they affect the price of gold?

Well, as expected, the Ukraine war has killed, maimed, and ruined an outrageous number of citizens in both Ukraine and Russia who were ordered to “fight for their Gmen”.

Gaza looks like a bombed concentration camp and that’s exactly what it could become.

Because the US stock market has rallied a bit, governments in the West can use the rally as supposed proof that everything is fine, which it isn’t.

These wars showcase the disgraceful actions and meddling mindset of the US government, but it’s the debt that funds the carnage that is the big driver for gold.

Wars can create intermediate-trend rallies and price sales for gold, but they don’t define gold itself.

All citizens of “Gold Nation” need to focus on getting more gold rather than trying to predict the next minor move higher or lower in the price.

The bottom line is that gold is so fantastic that doing anything except trying to get more of it is a waste of investor time.

The miners? Gold bugs in the West are as obsessed with gold stocks as Indians are with gold jewelry, and the great news is that there is suddenly some very positive technical action occurring in a lot of these stocks.

The GDX weekly chart. The 14,5,5 series Stochastics oscillator has reached oversold status with the key BPGDM sentiment indicator sitting below 30.

There’s a positive divergence between both Stochastics and RSI with the price. It’s an extremely positive set-up.

There’s also inverse H&S action in play that suggests a surge to the $40 is likely. That would be a 50% rally in fiat terms.

Many individual miners would quickly rally hundreds of percent higher. If it happens, and it likely will, eager investors can look to parlay those big fiat profits into a lot more gold!