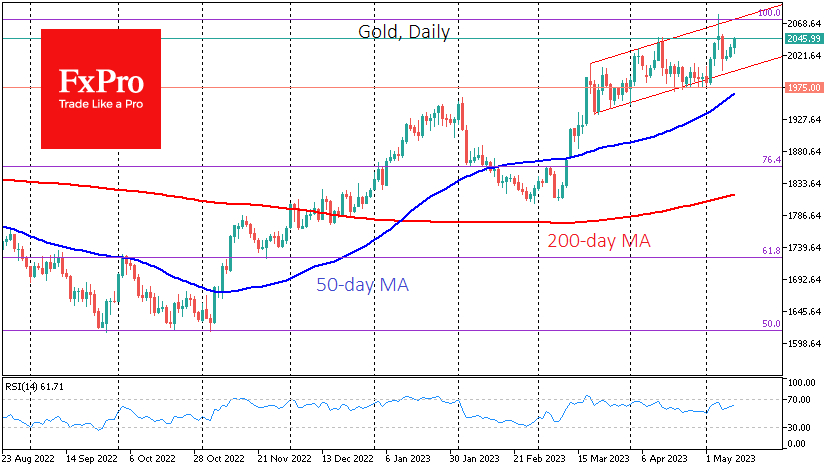

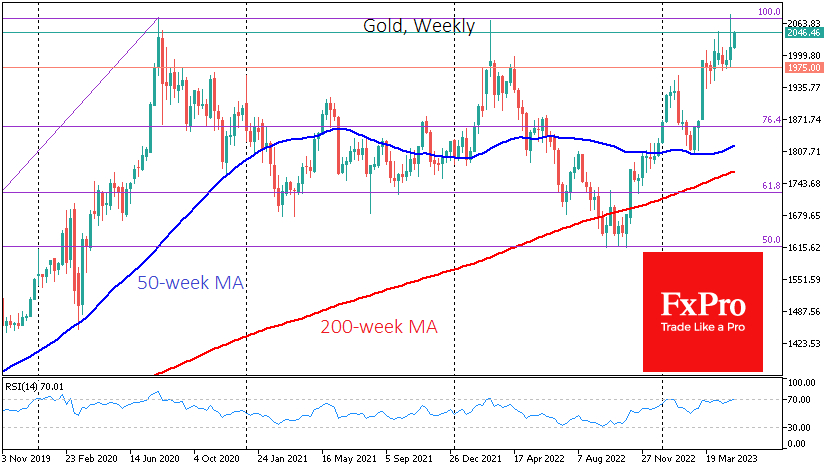

Gold showed very high volatility on Thursday and Friday, rising to $2081 and falling below $2000 in less than 48 hours. However, the price remained within the uptrend that has been in place since the second half of March.

The sharp rise and fall in gold at the end of last week had a close inverse correlation with US regional banks. Their problems triggered a short squeeze after the close of the regular session on Wednesday. However, the rapid recovery of the banks on Friday caused a sharp pullback.

Banks, by their very nature, are vulnerable to public sentiment. And from that point of view, the outflow of deposits from regional banks will likely stop with outside intervention, so the list of bankruptcies is still being determined.

The much more difficult question is whether gold will continue to be in demand of bad news about banks. The gold rallies on the convulsions of regional credit institutions were more about a liquidity crisis, and gradually capital may flow back into dollar-denominated debt assets, which are currently offering impressive yields.

However, it is worth taking a step back to realise that the banks' problems are not the only driver for gold. Investors should also bear in mind the trend towards increasing purchases of gold as a reserve by emerging market central banks, which are also exposed to the risk of being hit by US or EU sanctions that block settlement in dollars and euros.

We also noted earlier a strong technical disposition in gold, whose price is approaching historical highs much more smoothly than in 2020 or 2022, leaving more strength for a breakout.

An important bullish signal for gold could be a weekly close above $2035, the highest close in history. However, a much smoother ride with a touch of the lower end of the uptrend range around $2000 is seen as a more likely scenario before the uptrend resumes.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Needs to Correct Before Another Leg Up

Published 05/10/2023, 09:47 AM

Updated 03/21/2024, 07:45 AM

Gold Needs to Correct Before Another Leg Up

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.