Goldis trading around 2,910 USD per troy ounce on Wednesday, pausing after the previous day's growth. The temporary slowdown comes as rising US Treasury bond yields exert pressure on prices.

Key Drivers Influencing Gold Prices

Despite this pause, gold remains near its record highs, supported by strong safe-haven demand amid escalating trade tensions. On Tuesday, the US implemented 25% tariffs on Canada and Mexico and a 10% tariff on China, worsening the global trade climate and triggering retaliatory measures.

US Commerce Secretary Howard Lutnick suggested that tariff reductions for Canada and Mexico may be possible in the future, which has slightly calmed market fears but has not eliminated concerns entirely.

Further bolstering gold’s appeal as a safe-haven asset is the broader geopolitical landscape. The US suspended military aid to Ukraine, while reports emerged suggesting a potential easing of sanctions against Russia. These developments increase uncertainty in global markets, enhancing gold’s attractiveness.

In the near term, market participants are awaiting key US economic reports, including the ISM services PMI and employment data. These indicators will provide further clues about the Federal Reserve’s monetary policy direction. Recent data suggests growing economic strains, strengthening the argument for additional rate cuts, which would further support gold prices.

Technical Analysis of XAU/USD

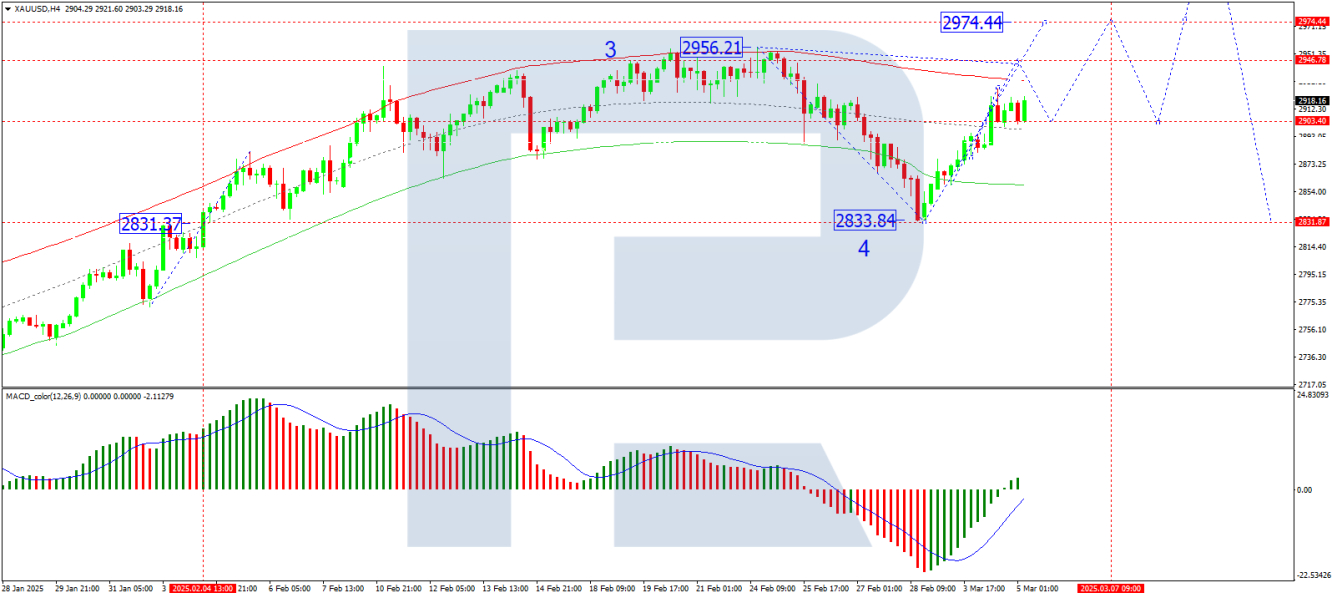

On the H4 chart, XAU/USD has formed a growth wave to 2,900. Currently, the market is consolidating around this level. A breakout to the upside is expected, with a target of 2,974 as the next local resistance level. After reaching this target, a correction towards 2,900 could follow. The MACD indicator confirms this scenario, with its signal line positioned below zero but trending upwards, indicating strong bullish momentum.

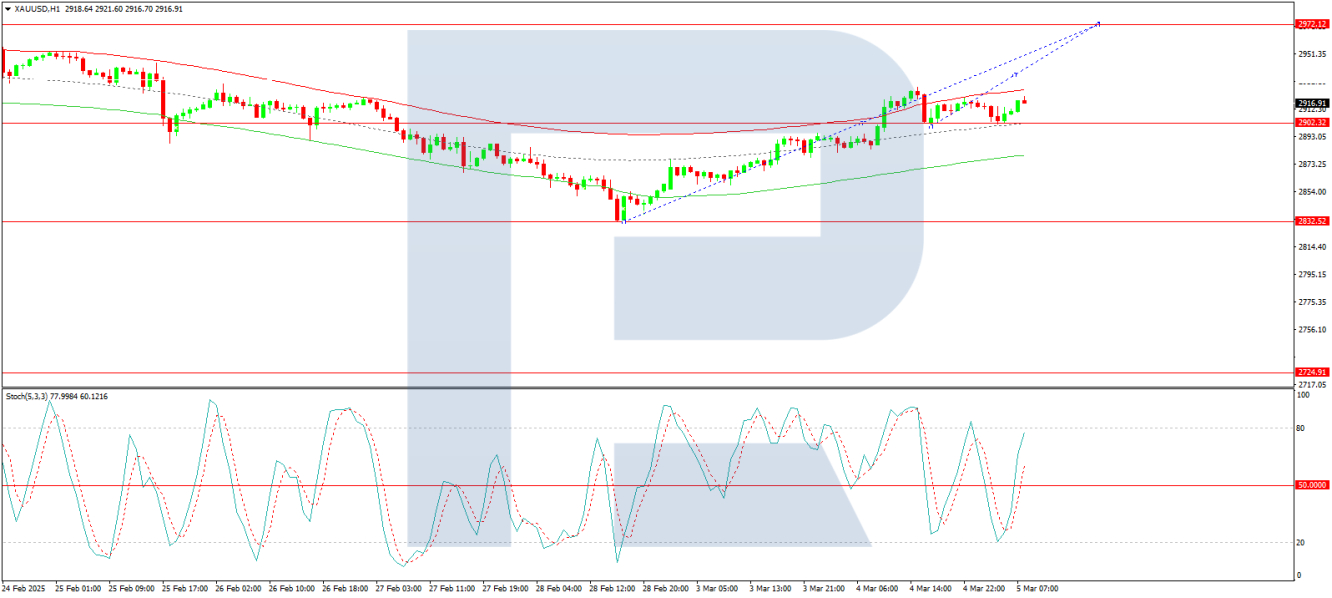

On the H1 chart, gold has already executed a growth wave to 2,900, forming a consolidation range at this level. If the price breaks downward, a correction to 2,880 is possible before another upward impulse begins. A bullish breakout from the consolidation range would open the potential for a direct rally towards 2,974. The Stochastic oscillator supports this view, with its signal line above 50 and pointing towards 80, indicating a continuation of upward momentum.

Conclusion

Gold remains well-supported by trade tensions, geopolitical uncertainties, and expectations of Federal Reserve rate cuts. While a temporary pullback could occur, the broader trend suggests further upside towards 2,974. Market participants should watch upcoming US economic data releases for additional confirmation of gold’s next move.

By RoboForex Analytical Department

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.