Longtime readers know that we are a fan of intermarket analysis. The movement of certain markets influences other markets so it is always wise to analyze a handful of markets rather than just a single market by itself. Several years ago we learned from others before us how intermarket analysis can help us get a handle on the margins of gold (and silver) miners. Generally, Oil (energy) represents about 25% of the cost of mining while industrial metals prices can be a proxy for the costs of trucks, chemicals and blasting agents (like cyanide). It has been a while since we’ve looked at these charts but with the gold stocks having put in a major bottom it is time to analyze whether it is sustainable or not.

Simply put, we look at Gold relative to oil (bottom) and Gold relative to industrial metals (top). These ratios were quite low in 2007 when share prices were driven more so by positive sentiment and high valuations then by positive fundamentals. As you can see, the financial crisis was a major catalyst for the gold mining industry. Gold surged against oil and industrial metals. During the weak recovery these ratios held their ground and are reaching higher levels once again.

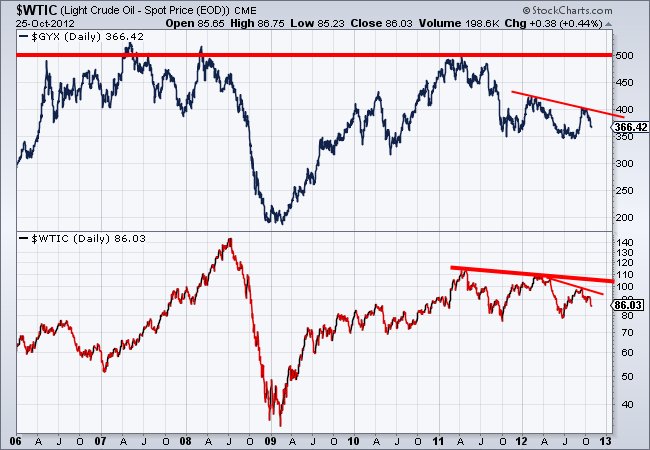

Next, we want to look at these markets by themselves. Industrial metals prices are on top while oil is on the bottom. Do these markets appear to be any threat to move much higher? Industrial metals have substantial resistance at 500 and have made obvious lower highs and lower highs in the past year. GYX is threatening a move below 350. Oil has also made lower lows and appears far more likely to test $78-$80 then to rebound above $95.

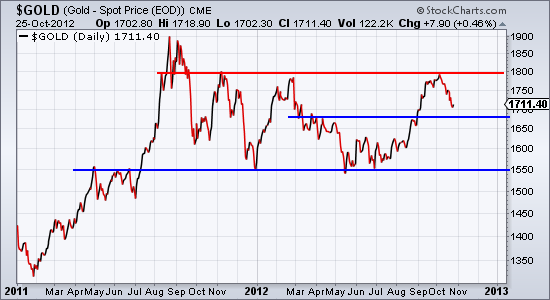

Meanwhile, Gold continues to hold up quite well within a consolidation. Predictably, its rebound ended at $1800. Yet, the market has a very strong bottom in place and has good support just below $1700.

As you can see, according to this simple straightforward analysis, Gold mining margins should continue to expand. The commodities that represent mining cost inputs are not only trending bearish but are little threat to move much higher anytime soon. Meanwhile, Gold is trading in a healthy range and once it breaks $1800 will be within a month or two of breaking to a new all time high.

In the early years of the boom, gold stocks performed quite well even as cost inputs surged. The reason was the market was willing to pay more and more for gold stocks. Presently we have a very different situation. The fundamentals for gold producers are improving yet the market is attaching low valuations to these companies. Our view is that if Gold breaks to and sustains a new high then the current valuations of these companies will increase materially.

All this being said, it is important to understand that gold mining is an extremely difficult industry. Despite this positive analysis, a fair portion of the industry will struggle. It is geologically and mathematically impossible for major producers to grow consistently. Small miners often lack the expertise and manpower to be successful. Most are aware of the 80-20 rule. We just returned from a tour of one of the best producer’s projects. We heard that this management team believes in the 95-5 rule. In other words, in the gold mining industry, 5% of the people produce 95% of the profits. You should keep this in mind when evaluating producers and potential producers. This is also why we focus on stock selection. In this sector, it is crucial to achieving great returns.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Mining Margins Will Expand Further

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.