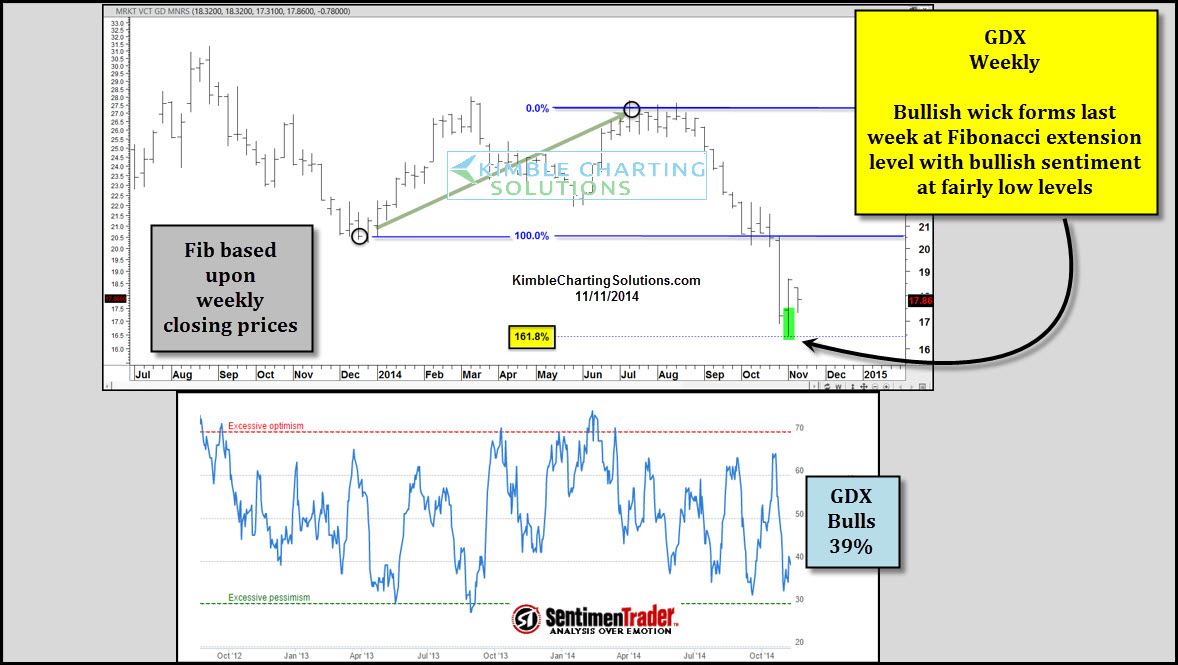

Gold Miners ETF (ARCA:GDX) broke below the lows of almost a year ago (Dec. 2013) and promptly lost nearly 20% of its value in less than two weeks.

That decline took it down to its Fibonacci 161% extension level (based upon the lows of a year ago and the highs this past summer).

The inset chart above from Sentiment Trader reflects that 39% of investors are bullish GDX at this time.

Needing this ratio to head higher (see below)

Quality rallies in the mining sector take place when Junior miners (ARCA:GDXJ) are stronger than seniors. The ratio above reflects how weak the Juniors have been the past couple of years, sending an overall bearish message to this sector.

Could a double bottom be taking place in this ratio right now? Humbly, it may be, yet I believe its too early to tell. I am watching the bullish wick in GDX and the level of this ratio very closely.

Premium and Metals Members took a position in this sector last week due to this ratio (see post).