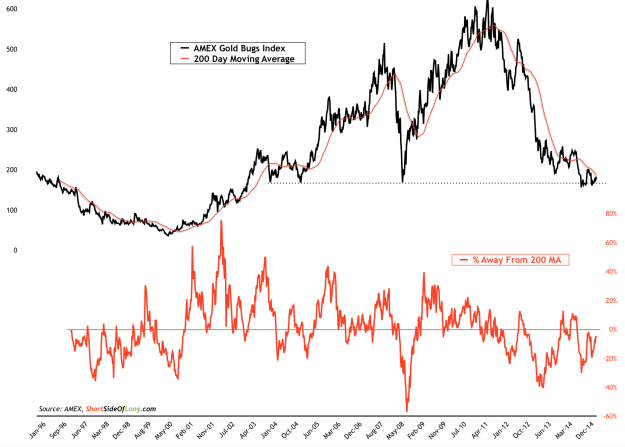

Second chart of the day focuses on the beaten down and very depressed gold-mining sector. The bear market that started in September 2011 is slowly closing in on its four-year anniversary (we have only three months left).

Gold miners are holding the important support level

So far the gold-mining sector has failed to stage a strong rebound from the very important support level at around 160 on in the HUI Gold Bugs Index (refer to chart above). While the price still remains above support, it has not yet moved above the 200-day moving average (red line on the chart).

While I am not some great technical analyst, it should be totally clear to all market participants that major rallies usually occur when price is above -- not below -- this trending line. Therefore, keep a close eye on the miners in coming weeks as they flirt with this important resistance level.