- Gold prices set new records, but mining stocks lag.

- Should you consider investing in gold mining stocks now, and if so, which ones are the best?

- Is there a better alternative for investors looking for stability?

- Identify the best stocks and find the market's hidden gems for less than $10 with InvestingPro!

While gold is racking up record highs, gold mining stocks are struggling to take advantage. At its record high of $2323 an ounce on Thursday, the yellow metal was up +11.58% YTD, while the VanEck Gold Miners ETF (NYSE:GDX) was up just 6.9% over the same period.

There could be several factors behind this: competition from Gold-indexed ETFs and crypto-currencies, or the AI frenzy that has redirected many funds from this sector.

Buying opportunity in gold mining shares as the yellow metal breaks records?

This suggests that an opportunity could present itself, especially given the tense geopolitical situation, including the war in Ukraine and Gaza, which means that it's likely that the price of gold could continue to rise as safe-haven demand spikes.

Furthermore, central banks have been buying large amounts of gold in recent months, especially in China and other developing nations. These countries are adding gold to their reserves to diversify them, worried that their assets could be frozen if they clash with the United States, similar to what happened with Russia.

However, gold mining stocks are not just a way of profiting from rising gold prices. They also tend to be strong dividend-paying stocks and are globally connected to other equities, making them good diversification tools.

Gold miner stocks act as leveraged bets on the price of gold. These companies boost their production by building new mines, exploring new deposits and areas, and expanding their current operations. As they do this, their revenues and earnings increase.

3 gold miners to consider

Against this backdrop, we took a look at the biggest gold miner stocks listed in the US, to determine which might be the best investment opportunity.

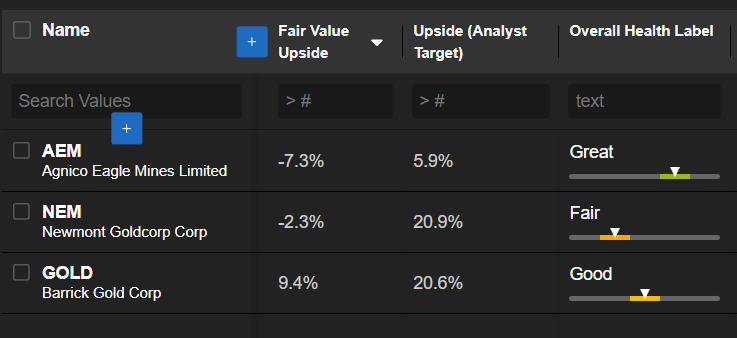

To do this, we turned to the InvestingPro stock analysis and strategy platform, to compare 3 of the most popular gold miner stocks: Newmont Goldcorp (NYSE:NEM), Barrick Gold Corp (NYSE:GOLD), and Agnico Eagle Mines Limited (NYSE:AEM).

To do this, we began by assembling them into a watchlist, displaying their bullish potential according to Fair Value, bullish potential according to analysts, and overall financial health label.

First of all, we note that Fair Value, which synthesizes several recognized financial models, assigns a negative potential to Agnico Eagle and Newmont, and a rather weak bullish potential to Barrick Gold.

On the other hand, it is important to note that the valuation models do not take into account the potential future evolution of the gold price.

Analysts, on the other hand, take the outlook for the metal more into account in their valuation of mining stocks. They give Newmont and Barrick Gold an upside potential of over 20%, and Agnico Eagle almost 6%.

As for the financial health scores, Agnico Eagle Mines' is the highest of the 3, rated "very good", while Newmont's is "fair" and Barrick Gold's "good".

Is there a better option for investors trying to play it safe?

None of these three stocks ticks all the boxes of a perfect stock market bet, but that doesn't mean they won't turn out to be good bets if gold continues to rise, as many analysts expect it to, and this is reflected in their targets for mining stocks, which are well above model valuations.

So, investors looking for exposure to gold would do well to keep these stocks on their radar. Nevertheless, if it's security and stability that interest you most in gold stocks, other options are at least as interesting.

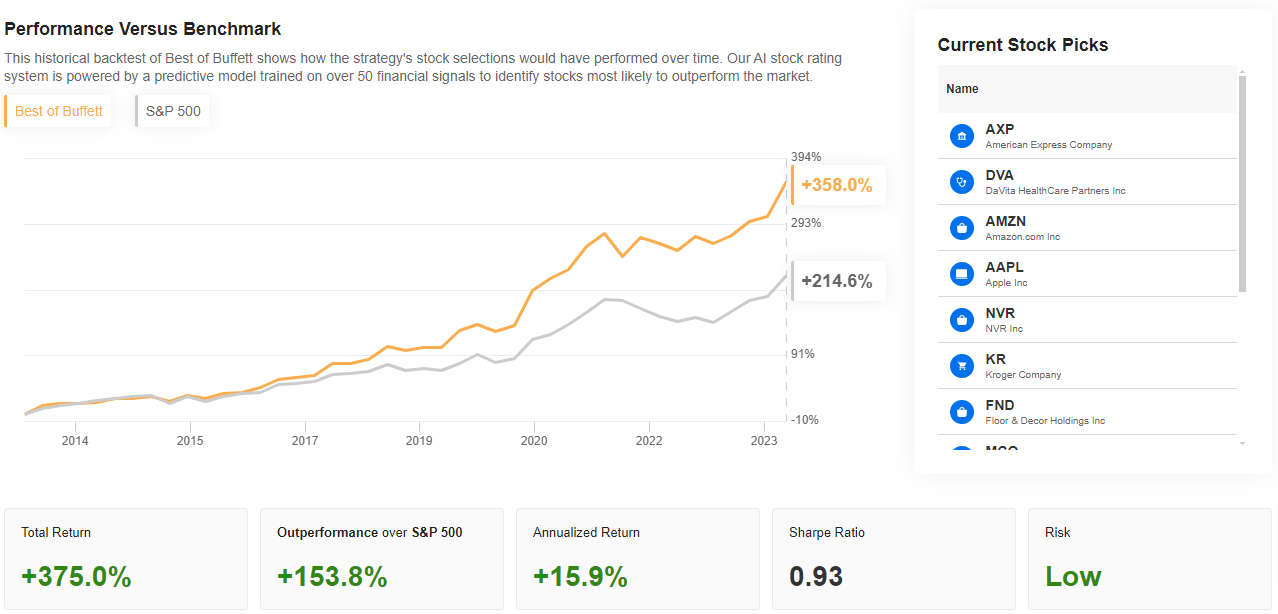

One such option is InvestingPro's ProPicks "Best of Buffett" strategy, an AI-managed portfolio which, as the name suggests, selects the crème de la crème of stocks in which the legendary investor invests.

Warren Buffett is renowned for his focus on safety and long-term performance, and artificial intelligence is used to refine the Omaha-based Oracle (NYSE:ORCL)'s picks to their quintessence, with results that speak for themselves: the strategy has posted a total gain of 358% since the start of its backtest in January 2013, representing an annualized performance of almost 16%.

Note that the ProPicks the Best of Buffett strategy is offered alongside 5 other thematic portfolios with varied profiles and impressive performances (Tech Titans strategy, for example, has returned almost 1800% over 10 years).

InvestingPro subscribers can discover these strategies and consult the list of shares in each of them by clicking here.

If you haven't already subscribed to InvestingPro, now is the perfect time to do so, as we are offering a limited-time discount of -10% on 1 and 2-year subscriptions, using the promo code ACTUPRO, to be entered on the payment page.

Disclaimer:This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.