The gold miners will soon report what will almost certainly prove their best quarter ever. Mostly due to Q2’s record-shattering gold prices, gold miners’ earnings should soar off the charts. Those will be further boosted by slightly-lower mining costs many of these companies are predicting. With such incredibly-strong fundamentals, more professional fund managers should soon start investing in this high-potential sector.

Four times a year, publicly-traded companies report quarterly results. These earnings seasons are very important, illuminating how gold miners are actually faring fundamentally. That really cuts through the obscuring sentiment fogs often shrouding this sector. I enjoy learning about companies’ fundamentals, so for 32 quarters in a row I’ve analyzed the latest quarterlies from the top 25 gold stocks in both their leading ETFs.

Those are of course the GDX VanEck Gold Miners ETF (NYSE:GDX) dominated by super-major and major gold miners, and its little-brother VanEck Junior Gold Miners ETF (NYSE:GDXJ) which is actually overwhelmingly weighted to mid-tier gold miners despite its name. Those categories are defined by annual production levels, with super-majors exceeding 2,000k ounces, majors above 1,000k, mid-tiers over 300k, and juniors under that.

While gold-stock quarterlies are often interesting, my primary motivation in studying them every quarter is trading. The more I grow my knowledge on leading gold miners, the better I get at picking fundamentally-superior ones to fill our newsletter trading books. This better subset of gold miners is constantly evolving, with individual companies gradually migrating in and out depending on their current production and cost profiles.

We gather lots of data from those quarterly results, and have grown massive spreadsheets over the years to track it all. Most leading gold miners publish full-year production and cost guidances, and explain how their output is trending. In this industry, unit all-in sustaining costs are highly inversely correlated with production levels. The more ounces mined, the more ounces to spread gold mining’s big fixed costs across.

In their latest Q1’24 results, the majority of GDX-top-25 gold miners forecast improving output and lower costs as this year marches on. You’d think global gold mine production is linear and steady throughout calendar years, but it isn’t. The World Gold Council publishes the best-available global gold supply-and-demand data in its excellent quarterly Gold Demand Trends reports, which reveal production seasonality.

Since 2010, quarter-on-quarter global mined gold has averaged changes of -8.4% in Q1s, +4.8% in Q2s, +6.7% in Q3s, and +0.2% in Q4s. Q1s are gold miners’ weakest quarter of the year, which is followed by big production surges in both Q2s and Q3s. So Q2s average considerably-better output and proportionally-lower costs than Q1s. Northern-hemisphere winters and calendar fiscal years are the primary reasons.

Over 2/3rds of the world’s land masses are in the top half of the globe, along with similar proportions of global gold mines. So the worst of winter weather hits in Q1s, ranging from bitter cold and snow up north to heavy rains down south. Both reduce operational efficiencies, slowing excavating and hauling ores and more importantly slowing necessary chemical reactions that dissolve gold from ores on heap-leach pads.

Gold-mining managers often schedule processing-plant maintenance in these winter-impeded months, as well as expansions to upgrade throughputs. Capital allocated is often budgeted late in preceding years, then made available in Q1s. Much of that work requires temporarily shutting down plants, retarding output. But as that is completed and better spring and summer weather improves operations, production surges.

In Q1’24, the GDX-top-25 gold miners averaged $1,277 all-in sustaining costs. But one was an extreme outlier reporting -$121 due to enormous byproduct credits, and didn’t give guidance. Excluding that, the rest of those major gold miners averaged $1,370 AISCs. But their average full-year-2024 guidances were lower at $1,324. And those numbers included Q1’s higher costs before production ramps in subsequent quarters.

Run the math on that, and GDX-top-25 AISCs would have to average $1,310 in Q2 to Q4 this year to achieve that midpoint guidance. But Q3’s mining costs will likely be the lowest due to another big output surge, so $1,325 is a reasonable estimate for Q2. That equates to average AISCs retreating a modest 3.3% QoQ. This is conservative too, as that gold miner with negative AISCs should again drag down the average.

If it is lumped back in with the rest of the GDX top 25, Q2 average AISCs could fall as low as $1,235 or an eight-quarter low. That would further amplify sector unit profits, but for our purposes today let’s use that $1,325. Gold-mining earnings are essentially the difference between average prevailing gold prices and mining costs. Before Q2’s remarkable breakout surge, Q1’24 had the highest average gold ever at $2,072.

And that truly was fantastic, as gold had never even closed that high before late December 2023. But Q2 proved exceptional, utterly trouncing that earlier record. With Q2’24 fully 97% completed mid-week, gold has averaged a stupendous $2,338. That soared a mammoth 12.8% QoQ and 18.2% YoY. As gold has mostly consolidated high in recent months, such lofty prevailing price levels are gradually being normalized.

With $2,338 average gold prices less $1,325 average all-in sustaining costs, the major gold miners of GDX are tracking to average awesome unit profits of $1,013 per ounce. And they could soar as high as $1,103 if that negative-AISC gold miner comes through again. Either way, $1,000+ per-ounce earnings would be the highest by far this sector has ever reported. We’ve amassed extensive data on this profits proxy.

During the last 32 quarters which include gold miners’ most-profitable ever, the top five unit profits were $884 in Q3’20, $838 in Q4’20, $795 in Q1’24, $744 in Q2’21, and $730 in Q2’20. The average across that entire span was $562. So soaring over $1,000 in Q2’24 is a big deal, utterly unprecedented. That estimate of $1,013 would make for huge year-over-year growth too, soaring 69% from the comparable Q2’23’s $598.

Colossal sector unit earnings growth is nothing new for gold miners either. In Q3’23, Q4’23, and Q1’24 respectively, GDX-top-25 per-ounce profits blasted up 94%, 42%, and 35% YoY. No other sector in the stock markets is seeing earnings rocket higher so fast. Some value-oriented fund managers will have to take notice sooner or later here, and start deploying capital in gold stocks from essentially-zero allocations.

And even before these blockbuster Q2 results are released, plenty of gold miners already have fantastic fundamentals. Last week I wrote an essay on gold stocks reloading, readying for another strong surge higher after working off serious overboughtness and excessive greed in recent months. I mentioned that sideways-to-lower grind stopped us out of about 1/4th of our newsletter trades at big realized gains.

I wrote “We’re probably going to refill our trading books over the next couple weeks, bringing our weekly back up to twenty positions and our monthly to ten.” We indeed started doing that this week, and one of our new trades illustrates the incredible gold-stock bargains out there. This gold miner is projecting about 288k ounces of output this year, near $1,325 AISCs. But it is building a new flagship mine going live in Q2’25.

That is forecast to add another 195k ounces of annual production, around much-more-profitable $1,007 AISCs that will drag down overall company-wide ones. This is huge coming growth, catapulting this gold miner well into mid-tier-dom producing around 500k ounces annually. Since late January alone, this stock has already rocketed up 91% at best, and is still 48% higher midweek. We rode a good chunk of that surge.

We were last stopped out of this stock in early June at nice 55% realized gains, and have been waiting to reload it. With a sterling profile like that, you’d think this fundamentally-superior gold miner has to be trading at 30x+ earnings. Yet the kicker is its trailing-twelve-month price-to-earnings ratio this week is merely 9.9x. That’s an epic bargain, dirt-cheap by any stock-market measure. Other gold stocks look similar.

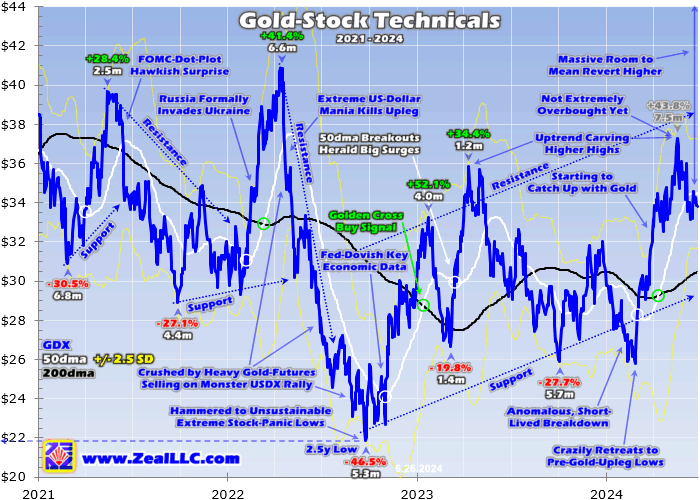

With gold miners all but printing money with gold consolidating high near record territory, speculators and investors alike should be flocking to gold stocks. Traders don’t need to do any of this analysis to see how massively profitable they’ve been, a simple P/E stock screen will reveal that. Yet with gold miners’ best quarter ever about to be reported, sector apathy remains widespread as this lackluster GDX chart reveals.

GDX isn’t faring poorly, it recently surged 44.5% higher from late February to mid-May. But gold stocks are ultimately leveraged plays on gold, and their metal’s underlying mighty upleg powered up 33.2% at best since early October. Major gold stocks only amplified gold by 1.3x, which is really weak compared to historical precedent. GDX tends to leverage material gold moves by 2x to 3x, it should’ve rallied 66% to 100%.

This is improving, as during that latest surge GDX amplified gold’s gains by 2.3x. Yet this sector remains massively undervalued relative to these high prevailing gold prices fueling huge earnings growth. That’s mostly because traders aren’t interested yet, they’ve been distracted by the seductive AI stock bubble stealing market limelight. Shockingly American stock investors haven’t even started chasing this gold upleg yet.

And if gold isn’t even on their radars yet, they certainly aren’t aware of gold stocks. The past few months as gold broke out to many new records on Chinese investors and central banks buying, market news was all-NVIDIA-all-the-time. Gold won some financial-media coverage, but nothing compared to the AI stock bubble. Skyrocketing parabolic in a colossal gamma squeeze, NVDA’s moonshot overshadowed everything.

At last week’s latest record high, NVIDIA (NASDAQ:NVDA) briefly became the world’s largest company worth $3,340b. It had skyrocketed 173.8% year-to-date, nearly doubled its 200-day moving average at 1.976x, and traded at a dangerous 79.3x TTM P/E. Drenched in popular greed and absurdly overbought, this epic anomaly can’t and won’t last. NVIDIA rolling over is a serious problem for these stock markets heavily reliant on its gains.

As this latest stock bubble inevitably decisively bursts, euphoric scales will fall from traders’ eyes. They will look to prudently diversify their mega-cap-tech-dominated portfolios, and some will notice gold and add modest gold-stock allocations. This contrarian sector is so small it won’t take much buying to catapult it way higher. With American stock investors actually selling gold during it, today’s gold upleg isn’t over.

This is gold’s first record-achieving upleg since a pair both cresting in 2020. They averaged monster 41.4% gains largely fueled by American stock investors buying major-gold-ETF shares. Like usual GDX amplified those, averaging its own 105.4% gains. Again Q3’20 was also the last time major gold miners’ unit earnings soared to records. Professional fund investors noticed that, and bid gold stocks way higher.

With Q2’24 tracking to see the fattest gold-mining profits ever by far, and the first new record since Q3’20, gold stocks’ setup here is wildly bullish. As gold finishes its own high consolidation here in the summer doldrums to rebalance sentiment and technicals, it will resume powering higher. As traders’ awareness of gold grows, they will increasingly chase it and leverage its upside by deploying some capital in gold stocks.

Recent months’ gold-stock drift lower is a good mid-upleg buying opportunity to add trades. The biggest gains will be won by contrarians buying in early before the herd figures this out. Even GDX’s upside will be handily bested by the fundamentally-superior mid-tiers and juniors we specialize in. They’re not just better able to consistently grow their production with lower-cost mines, their smaller stocks are easier to bid higher.

The bottom line is gold miners will soon report a record quarter. Mostly thanks to record-shattering gold prices, Q2’24’s sector unit earnings will almost certainly prove the highest ever by far. They will be further boosted by projected lower mining costs as production ramps. Amazingly major gold miners’ average Q2 profits are now tracking over an unprecedented $1,000 per ounce. Their quarterly results should prove epic.

With gold stocks already deeply undervalued even before this windfall, their strong fundamentals should start attracting fund investors. Their capital inflows ought to drive gold stocks much higher. And Q2 results are coming out as gold readies to rally out of recent months’ high consolidation rebalancing sentiment and technicals. As always the biggest gold-stock gains will be won by traders buying in early before the herd.