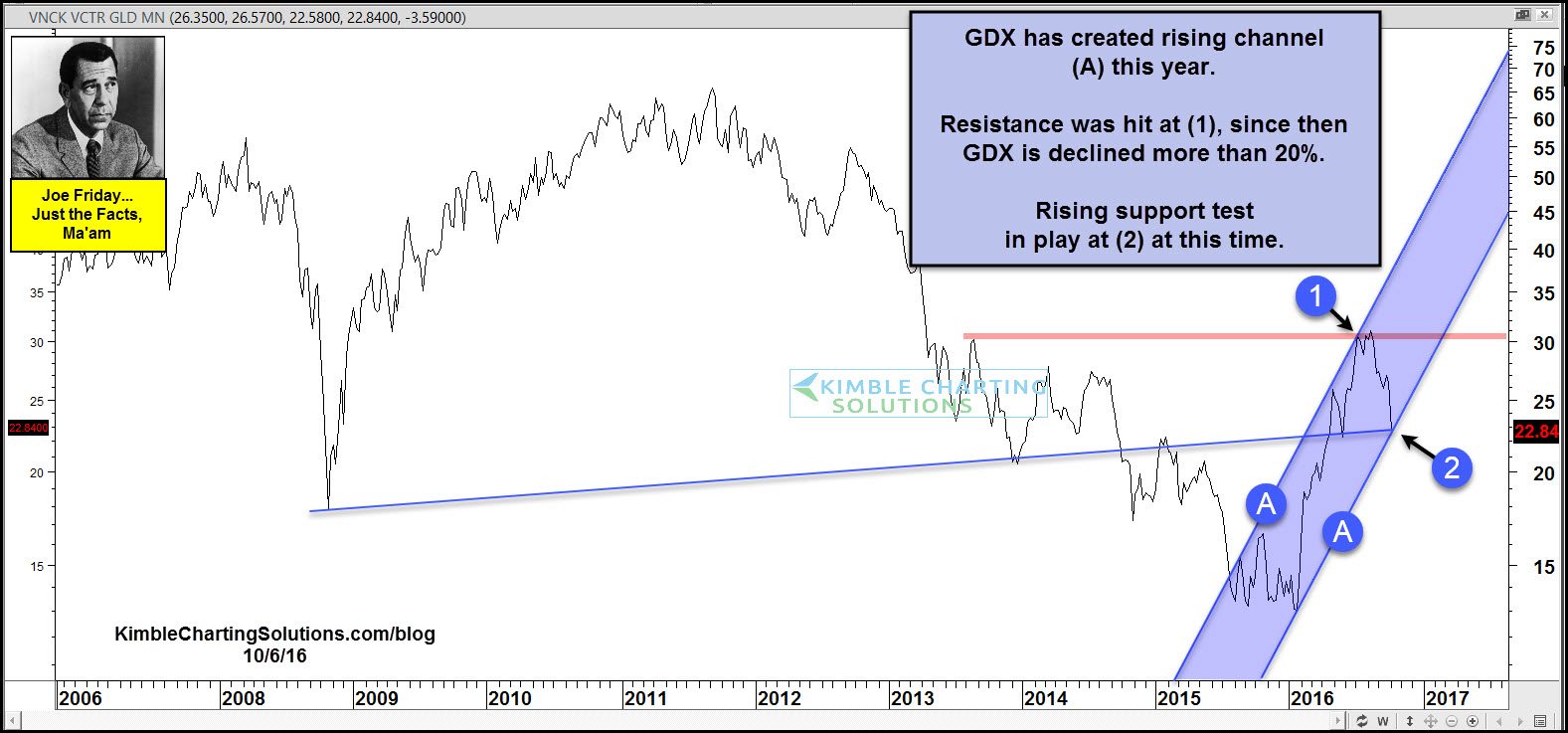

Gold- and silver-mining stocks rallied strongly during the first eight months of this year. Over the past two months, miners ETF GDX has declined over 20%. An important price test in is play right now.

This year's GDX rally has been contained within rising channel (A). In August, GDX hit 2013 highs and the top of rising channel (A) at (1). It then reversed quickly after failing to breakout on its second attempt.

Over the past 60 days, GDX has declined more than 20% after hitting resistance at (1).

GDX tested dual support at (2) this week. The short-term trend (8-months) remains up. This is the biggest test for miners since the lows that took place at the first of this year.

For the short-term trend to remain up, support has to hold at (2). If that support fails to hold here, selling pressure will intensify.