The Coronavirus continues to run amuck and is creating havoc on human lives and the markets. So rather than focus on opinions about whether or not it will become a worldwide pandemic, let’s look at the immediate impact. First and foremost, Apple (NASDAQ:AAPL) was hit hard this week and ended down over -2.5% on Friday and is now off -5% from its recent highs. Considering Apple is the biggest component in our key benchmark indexes, it’s not something to dismiss.

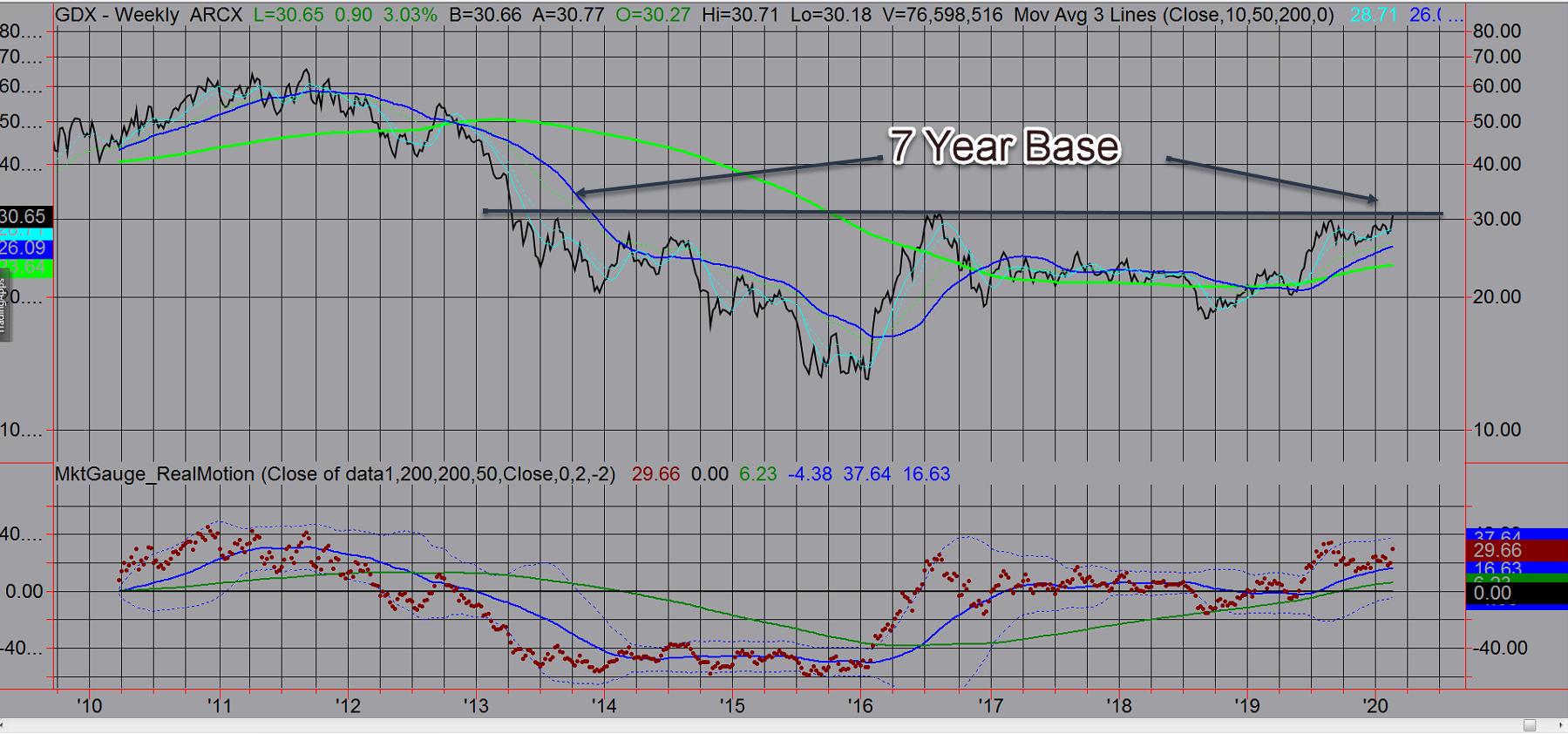

China’s central bank has pumped in almost $500 billion dollars of liquidity to try to offset the impact of the virus. The question is will this huge injection will be enough to get people out of isolation and maybe risk their lives to go out and buy products (like a new iPhone). The pressure worldwide on rates trickled down to US long bonds which hit all-time lows in yield. Meanwhile Gold, hit seven-year highs and Gold Miners are looking to break out of a 7-year basing pattern. Volatility jumped and soft commodities (helped by a spreading locust) look poised to join the rally in metals. Switzerland stock market firmed, not surprising considering the flight to gold.

This week’s highlights are:

- Risk Gauges backed off to full Risk Off

- Safety plays such as Utilities and Consumer Staples firmed

- Brother Biotech acted well on a relative basis and closed positive for last five days, while Retail firmed

- Market Internals went negative along with Sentiment

- Volume patterns reversed from last week and now showing Institutional selling across all key benchmarks

- Volatility jumped, confirming this week’s permission

- Bonds, Gold & Gold Miners (NYSE:GDX) +8.23% on the week) all rallied to new multi-year highs

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.